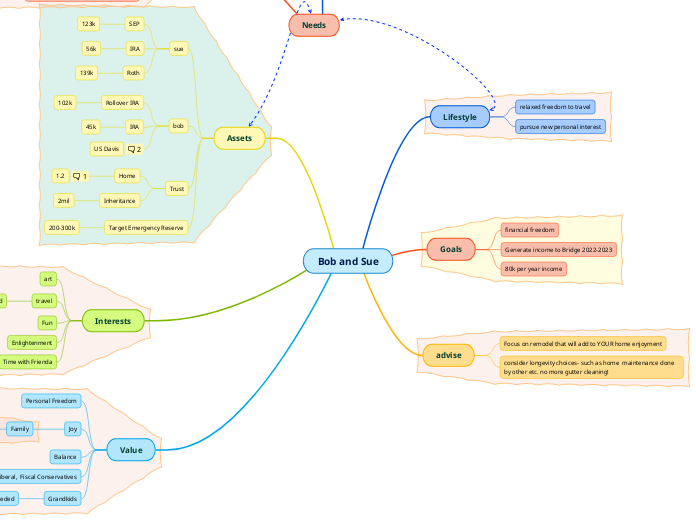

Needs

Income

Bob pension will be $1500 in Oct 2023

Earning for assets

Funds held out of plan for bridge goal

60k

$4000 per month from assets

Pension

currently $2000

Social Security

Nov 2023 - $3000

assumptions

30k travel need/ 20k annually

60k electric car

100k to remodel house- put in lift

100k crave out for SPCA

300k Emergency reserve

6k min- 8k desired

income need will go down in May 2023 by 2k and again in Nov 2023 by 2k. Assumptions made that inflation push expense enough to still require assets to subsidy income

Bob and Sue

Value

Grandkids

college funds needed

100k

Social Liberal, Fiscal Conservatives

Balance

Joy

Family

Son

Support

100k for house or ?

Personal Freedom

Interests

Time with Frienda

Enlightenment

Fun

travel

seven wonders of the Ancient World

art

Assets

Target Emergency Reserve

200-300k

Trust

Inheritance

2mil

Home

1.2

Plan to spend 100k +/- to rehab/remodel home. NOt major construction- more comfort items

Live in home until no longer comfortable

bob

US Davis

Franklin Funds and personal banking

This is where extra cash will live - rate decent at 1%

Hi, Nancy. We don't understand this bit. Thanks, Evy

45k

Rollover IRA

102k

sue

Roth

139k

IRA

56k

SEP

123k

advise

consider longevity choices- such as home maintenance done by other etc. no more gutter cleaning!

Focus on remodel that will add to YOUR home enjoyment

Goals

80k per year income

Generate income to Bridge 2022-2023

financial freedom

Lifestyle

pursue new personal interest

relaxed freedom to travel