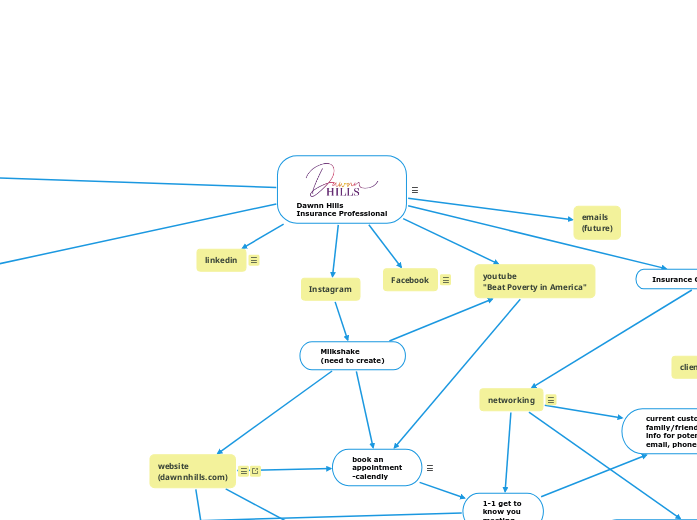

Dawnn Hills

Insurance Professional

National Agents Alliance

Avg times meet with a person is 3

emails

(future)

youtube

"Beat Poverty in America"

linkedin

- needs bio

- need to update title and roles

Facebook

@dmhinsurance

- mirrored posts from IG

- gets some private messages

- doesn't have very good reach

- book now button pops up a calendar to book appointment, then automatically sends message

Instagram

Milkshake

(need to create)

book an

appointment

-calendly

-needs clarity on the type of conversation/appointment to book

website

(dawnnhills.com)

https://dmhinsurancegroup.com/

Is the Alliance website editable?

Can we change the message to focus more on recruiting?

In the future:

dawnnhills.com

- (mission-driven) beat poverty in america

- book Dawnn as speaker

- insurance advisor

- personal story

Blog

Accountability Coaching

-pricing

TA: Business Owners/Entrepreneurs

client

non-client

Agent Recruiting Journey

referral

Referrals come from:

- The Fitz Group

- current clients

- associates

current customer/associates/

family/friends gives contact

info for agent lead via

email, phone call, text

Dawnn contacts agent

lead to introduce self

and set up a meeting

1st meeting with

Non-Licensed Broker Lead

1st meeting with

Licensed Broker Lead

-outline for getting started

-process for finding leads

-agent shares goals/why

-layout expectations

Dawnn goes through the

immersion process with Broker

-could take 1-3 months

Broker writes and installs

policy for 1st client

Commission

Carrier

Commission

-paid only after

policy is approved

Override

Commission

-13 Brokers

Broker begins bootcamp

-immersion process/daily coaching call

-training videos

-training on assessments

and writing applications

Insurance Customer Journey

leads from NAA

-log in to ARC

-choose a qualified lead

(2-5 per week)

(new agent needs 30-45 per week)

National Agent Alliance

-consistently send info to prospects on public lists

networking

Networking Events include:

- monthly educational sessions (last Wednesday of the month)

- workshops for strategic partners

- trainings for strategic partners

- Oakland Rotary #3

1-1 get to

know you

meeting

client referral

current customer/associates/

family/friends gives contact

info for potential client via

email, phone call, text

Dawnn contacts potential client to set up a meeting and expectations for the 1st meeting

1st meeting with potential client

-fact finder

-figure out numbers

-assessment

-emergency contact form (beneficiary and referrals)

-trust/advance health care directive/will

-setup next meeting

Dawnn identifies best carrier and product

Products

Indemnity

IUL

-pay monthly to build on

opportunity to have several IUL's

-create strategy for monthly and smaller lumps of money

-min. $100

-save 25% of income, subtract taxes, take 20% of the net income

-access to cash in real time

income protection

create a strategy over time to get to that number

gross annual income x 12 (no kids) (24 w/kids)

final expense

-for those who can't qualify for life insurance, but guaranteed $25k, must stay alive for 2 years

annuities

-put lump sums of money

Have money for retirement while you're young.

$5k, $10k, $15k - put it in an annuity in a lump sum

-it will grow faster

-4% to 8%

-access to cash in real time

2nd Meeting

-reviews carrier and products

-client chooses one

Dawnn fills out application and sends to carrier and follow up with carrier until application is issued

application is denied

submit to new carrier/product

application is approved

3rd meeting to review and install policy

-setup 4 90-day meetings

(or enough meetings for the client to be educated enough to understand their policy for their financial and medical needs and how Dawnn and team can meet those needs)

Dawnn and client

install the policy

90-day meetings for 1.5 to 2 years

meet annually

the insured passes

contact with beneficiary is made

Dawnn notifies the carrier

Dawnn creates a claim

Dawnn follows up with the claim every week until issued

-could take 1-3 months

check issued to beneficiary

sent to funeral home

remaining balance to

beneficiary after

funeral home expenses

sent to agent

delivers to beneficiary

client contacts

emergency form people

Dawnn reaches out to them

Training

Joe & Tawnee Walker

Team Call

The Fitz Group

The DCC call

President's Club

Building Tools &

Back office Support