by Luo Luo 6 years ago

120

DT Virtual Summit - Strategic Initiatives in FSI

The financial services industry is undergoing significant transformation driven by evolving market needs and technological advancements. Traditional banks and insurance companies face the imperative to adapt or risk obsolescence.

Open

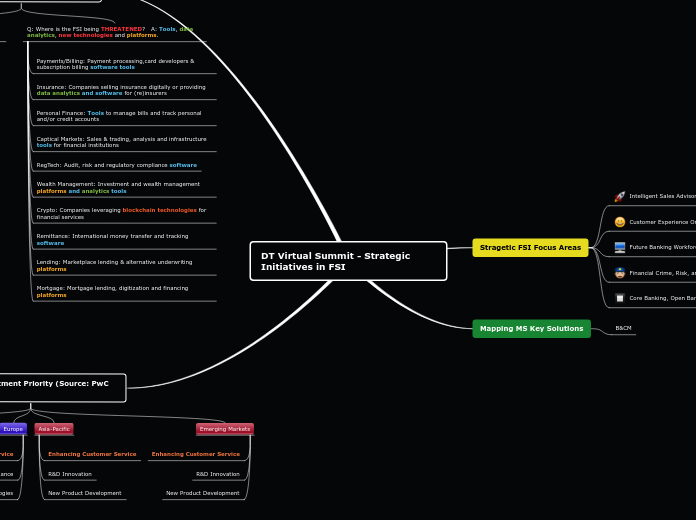

DT Virtual Summit - Strategic Initiatives in FSI Top FSI Investment Priority (Source: PwC 2020 Survey) Emerging Markets Asia-Pacific New Product Development R&D Innovation Europe The United States Implementing New Technologies Enhancing Customer Service Regulatory Compliance FSI at Risk and The Changing Market Q: Where is the FSI being THREATENED? A: Tools, data analytics, new technologies and platforms. Mortgage: Mortgage lending, digitization and financing platforms Lending: Marketplace lending & alternative underwriting platforms Remittance: International money transfer and tracking software Crypto: Companies leveraging blockchain technologies for financial services Wealth Management: Investment and wealth management platforms and analytics tools RegTech: Audit, risk and regulatory compliance software Captical Markets: Sales & trading, analysis and infrastructure tools for financial institutions Personal Finance: Tools to manage bills and track personal and/or credit accounts Insurance: Companies selling insurance digitally or providing data analytics and software for (re)insurers Payments/Billing: Payment processing,card developers & subscription billing software tools Because Banks and Insurance MUST change to meet the market needs or risk being replaced. Competitors are much more than 5 years ago Customers' needs are changing Mapping MS Key Solutions B&CM Stragetic FSI Focus Areas Core Banking, Open Banking and Payments Financial Crime, Risk, and Cybersecurity Future Banking Workforce Customer Experience Orchestration Intelligent Sales Advisors