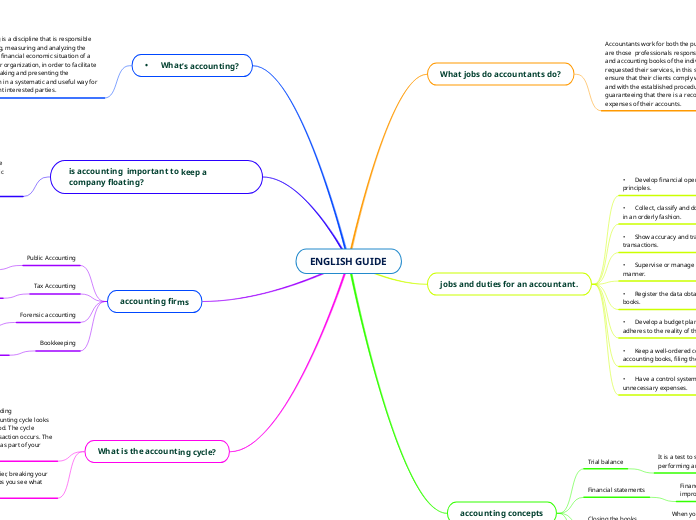

ENGLISH GUIDE

Autos = Self

Bios = Life

Graphy=Writing

An autobiography is the author's retelling of their life. This is written in first person and the author is the main character.

What is the accounting cycle?

The accounting cycle makes accounting easier, breaking your bookkeeping down into smaller tasks. It helps you see what you need to accomplish next.

The accounting cycle is the process of recording

your business’s financial activities. The accounting cycle looks back in time at the end of a designated period. The cycle includes several steps, starting when a transaction occurs. The cycle ends when you record the transaction as part of your financial statements.

Add the things you like and make you a happy person!

accounting firms

Bookkeeping

firms complete fundamental accounting tasks for small and medium-sized companies.

Forensic accounting

firms focus on tax preparation and planning for companies of all sizes, and also for individuals.

Tax Accounting

firms use accounting skills and legal policies to uncover fraudulent and illegal activities.

Public Accounting

firms typically employ Certified Public

Accountants (CPAs).

is accounting important to keep a company floating?

Add your personal information.

Yes, since it is a discipline that studies the accounts of the company and that gives information on what its economic situation is. Accounting is a fundamental pillar in the administration of a company.

• What’s accounting?

Add your vision for your future! You can choose to add your short term goal or long term goal!

Accounting is a discipline that is responsible for studying, measuring and analyzing the assets and financial economic situation of a company or organization, in order to facilitate decision-making and presenting the information in a systematic and useful way for the different interested parties.

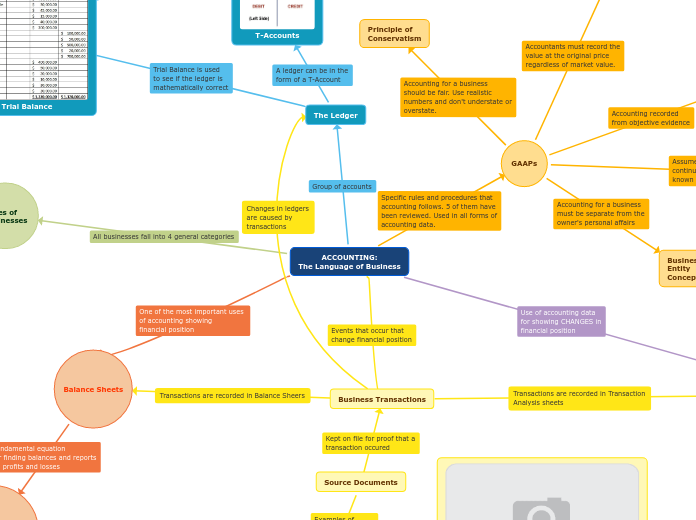

accounting concepts

Add the institutes where you got your degrees.

Transaction

When we talk about a transaction, we are talking about a different type of operation that is carried out between two or more parties and that involves the exchange of goods or services in exchange for the corresponding capital

Closing the books

When you close your books, you need to set up your accounting for the next period.

Financial statements

Financial statements are used to measure performance, make improvements, and set goals

Trial balance

It is a test to see if the debits and credits match after performing an input setting.

jobs and duties for an accountant.

What and who made you who you are today?

• Have a control system in the budget and avoid unnecessary expenses.

• Keep a well-ordered control and management of all accounting books, filing their corresponding auxiliaries.

• Develop a budget plan based on prior analysis that adheres to the reality of the client or business organization.

• Register the data obtained respectively in accounting books.

• Supervise or manage financial movements in a timely manner.

• Show accuracy and transparency in accounting transactions.

• Collect, classify and document the economic information in an orderly fashion.

• Develop financial operations based on accounting principles.

What jobs do accountants do?

Add information about your family. Usually, the mother's maiden name is written.

Additionally, you can add their age.

Accountants work for both the public and private sectors and are those professionals responsible for the financial status and accounting books of the individual or company that has requested their services, in this sense, their mission is to ensure that their clients comply with the applicable legislation and with the established procedures, in addition to guaranteeing that there is a record of the income and expenses of their accounts.