by Abhijeet Shinde 5 years ago

735

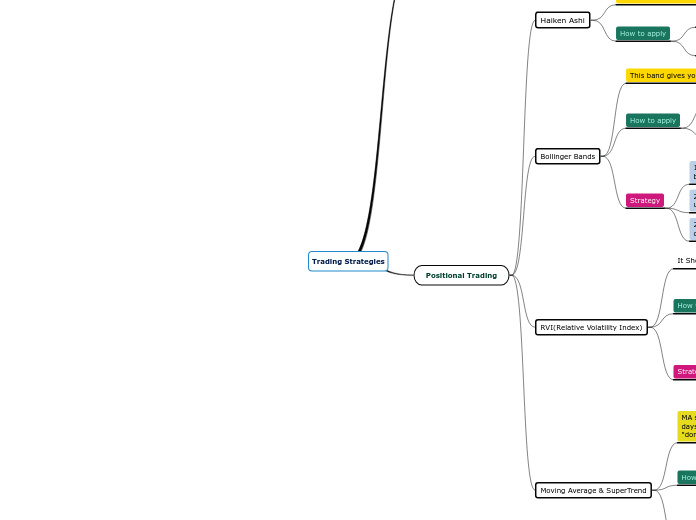

Trading Strategies

The document outlines various trading strategies and indicators useful for both positional and intraday trading. Haiken Ashi is explained as a method to average prices over time, assisting in trend analysis.