door Rawaidah Razikin 4 jaren geleden

460

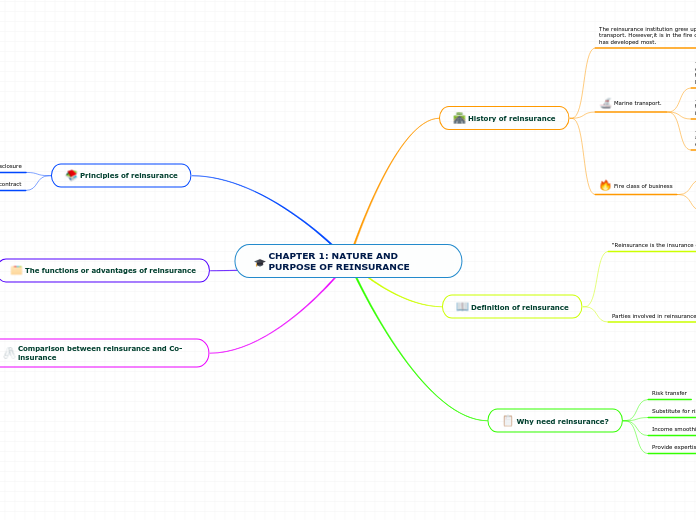

CHAPTER 1: NATURE AND PURPOSE OF REINSURANCE

Reinsurance is a mechanism by which insurers manage and mitigate the risks they underwrite by transferring portions of those risks to other insurance entities. This practice dates back to the 14th century, primarily initiated within the context of marine transport due to the perilous nature of sea voyages.