door ELLA GREER 12 maanden geleden

73

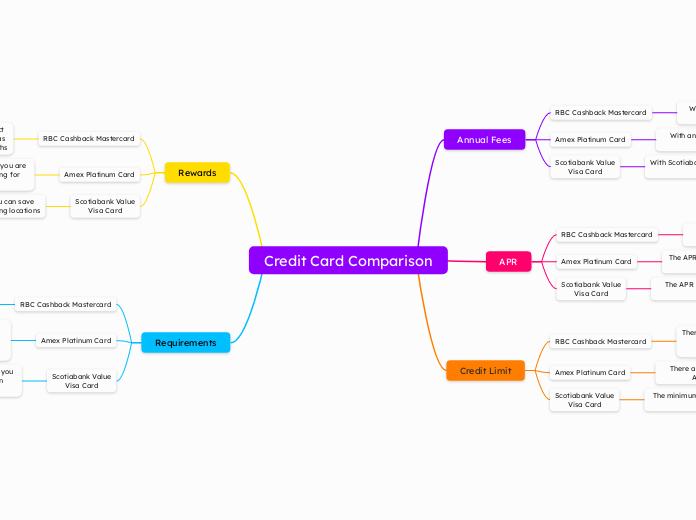

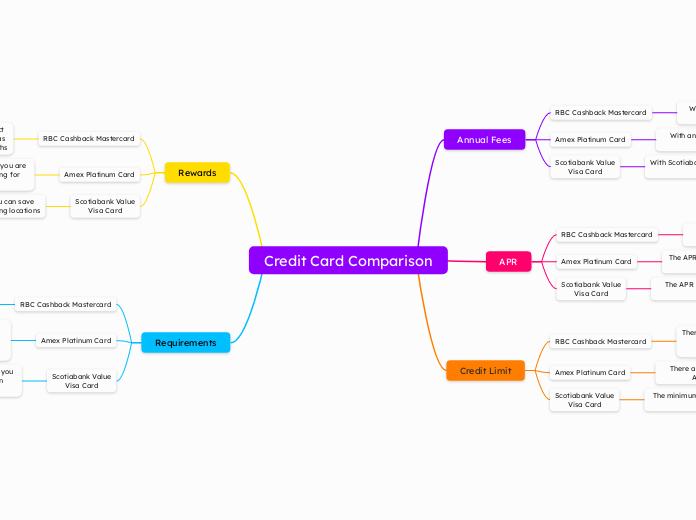

Credit Card Comparison

Comparing three different credit cards reveals distinct features and benefits. The Scotiabank Value Visa Card has a low annual fee of $29 and a minimum credit limit of $500, offering a 12.

door ELLA GREER 12 maanden geleden

73

Meer zoals dit