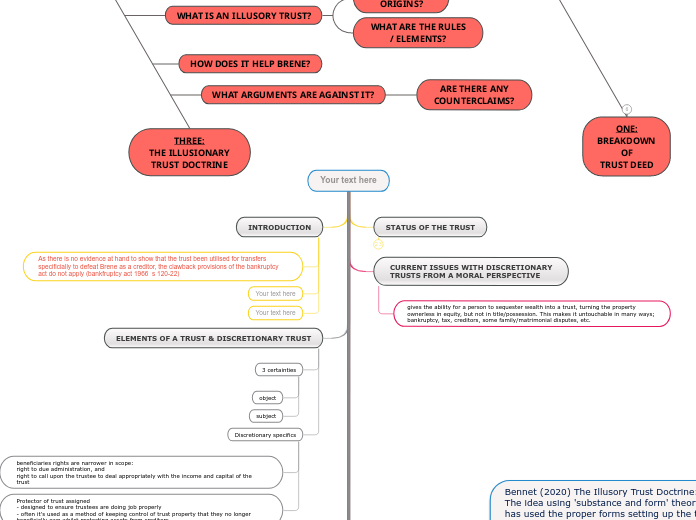

ONE:

BREAKDOWN

OF

TRUST DEED

Asset Distribution

Trust Assets

WHAT DOES THIS MEAN

FOR THE

SIGMUND JUNG TRUST?

POWERS OF

APPOINTMENT

SETTLOR

&

TRUSTEES

THREE:

THE ILLUSIONARY

TRUST DOCTRINE

WHAT ARGUMENTS ARE AGAINST IT?

ARE THERE ANY

COUNTERCLAIMS?

HOW DOES IT HELP BRENE?

WHAT IS AN ILLUSORY TRUST?

WHAT ARE THE RULES

/ ELEMENTS?

WHAT ARE ITS

ORIGINS?

FOUR:

CONCLUSION

TWO:

DISCRETIONARY

TRUST

DOCTRINE

WHAT HAS FAILED IN

SIMILAR SITUATIONS BEFORE

OVERVIEW OF

DISCRETIONARY TRUSTS

Your text here

title here

RESULT OF ILLUSORY TRUST BEING PROVEN?

In the end, you can't have your cake and eat it too

B: TRUST IS VOID, AND ALL PROEPRTY REVERTS BACK TO HIM

A: HE IS DESIGNATED AS HAVING PROPERTY RIGHTS

ACCESS TO DOCUMENTATION

Schnidt v rosewood:

the right to seek a courts intervention and due administration of the trust does not depend on entitlement to a fixed and transmissble beneficial interest.

additionally, the mere existence of a power of addition having the ability to block a beneficiaries right to due administration of a trust is contrary to the ratio in schmidt

The ability of beneficiaries of a discretionary trust to require trustees to terminate a trust and distribute the trust property, even in circumstances where a breoad power to add further (unspecified) beneficiaries exist.

ILLUSORY TRUST

CASES

Cases of Note:

Armitage v Nurse [1998] Ch 241

Millett LJ, 713:

. . . there is an irreducible core of obligations owed by

the trustees to the beneficiaries and enforceable by them which is fundamental to the concept of a trust. If the beneficiaries have no rights enforceable against the trustees there are no trusts.

Harrison v Harrison [2008] NZHC 2580

discussed in russell and graham

- husband and wife move assets into discretionary trusts

- trustee was company which they controlled

- had power to change shareholdings in existing trustee

- additionall power of appointment and removal of trustees

HELD: the intention of couple was to retain complete control over the use and joyment of the assets. @[22]

There is no doubt that the terms of the deed appear on their face to separate the legal title from the beneficial interests. But that may not be the substantial effect of the arrangement. As a matter of substance the only significant change which appears to be effected by the deed in this case is that the husband’s shares in HWL, which he originally held personally, have fallen into the joint control of himself and his wife. The husband and wife are otherwise in the same position as they were before entering into the deed, inasmuch as they have postponed to the future whether or not the house or the shares or any other assets will pass to the benefit of their children or any other persons.

TSMF -

Tasarruf Mevduati Sigorta Fonu v Merrill Lynch Bank

[2011] UKPC 17, [2012] 1 WLR 1721 [TMSF]

in clayton , discussing TMSF: @ [125]

In TMSF, the Privy Council found that

the settlor’s powers to revoke the trust were such that

the settlor could be regarded as having rights tantamount

to ownership. It made no finding about the

status of the trust in the period before the revocation

powers were exercised, because it was not required to

do so in order to resolve the issue before it. However,

there was nothing in the judgment to indicate that the

trust was invalid in the period before the power to

revoke it was exercised . . .

bennet 2020 discussinog 217 @[68]

the Privy Council considered whether a power of revocation retained by a settlor could be regarded as a right that the settlor should be required to transfer to receivers. In effect the trust did not protect the settlor from claims against the property they had transferred

to it, but the Board did not find that the trust was invalid.

- Mezhprom Bank v Pugachev 2017 EWCH 2426 (ch)

- Wealthy Russian businessman

- English assets held in NZ trusts

- Owned Russian bank which became insolvent & collapsed, and was accused of misappropriating large $$ from it. Freezing orders were made on his assets worldwide

- Pugachev and his family had assets settled in discretionary trusts (pugachv and family members as discretionary beneficiaries)

- NZ trusts had companies as trustees.

- significant feature across the trusts was Pugachevs powers as trust protector. Asserted he had so much power over the trusts and assets that it was in effect his rather than assets being held for beneficiaries (bennet (2020)

Bennet 2020:

Case focuses more on whether a protectors powers MUST be fiduciary, or can be non-fiduciary in nature.

The term "taking into account all relevant circumstances" is to be interpreted as not including the subjective intentions of the settlor, but DO include the role of the protector as settlor, trustee, and/or discretionary beneficiary and the powers conferred on the protector.

Birss J found that when taking these relevant circumstances into account, the trust deeds true effect was to make Pugachev the beneficial owner

MY POV:

it's interpreted as if a protector must have a fiduciary role, yet a beneficiary should have the right to act in their own interests, the two are at odds with each other; how can you be both at the same time?

Pugachev had powers to

- add discretionary beneficiaries

- add a new protector

- add or remove trustees "with or without cause"

- trustees needed his written consent before exercising a number of their powers and discretions: distribution of any income/capital, investment, removal of beneficiaries, variation of the deed, etc

- pugachev had the right to reside in property

- direct sale of regisdential property to some extent (Bennet 2020)

Webb v Webb [2017] CKCA4; [2020] UKPC 22

bennet pg218, @ [87]

MR webb argued in his defence that:

Mr Webb argued that exercising these powers for his own benefit would be a breach of his fiduciary duties as the trustee, 17 3 and that interpreting the deed in a way that would allow him to so benefit would be contrary to the trial court's finding that he intended to create valid trusts. 17 4 To this, the Board responded that "[a]cceptance that Mr Webb intended to create trusts does not in any way preclude a finding that he reserved such broad powers to himself as settlor and beneficiary that he failed to make an effective disposition of the relevant property."

It also observed that Mr Webb's power to remove other beneficiaries was held as settlor, and not in his capacity as trustee or consultant of the trust, which meant they were: 176

... amply sufficient for Mr Webb to arrange matters in such a way that he alone would hold the trust property on trust for himself and no-one else, with the consequence that the legal and beneficial interest in all of that property would vest in him.

i.e., they bound his "bundle of rights" indistinguishable from ownership

Bennet 2020

- Case from the Cook Islands

- Nature of dispute very similar to Clayton

- Married couple separated, mr Webb claimed he held no matrimonial property as much of it was settled into trusts

- Mrs webb argued the trusts were invalid and the assests in the trusts were matrimonial property, claiming limitation on beneficiary rights to information, and Mr Webss intention to retain control/ownership of trust property.

- Lower court disregarded arguments, interpreting that Mrs webb asserting sham. Overturned by court of appeal, applying ratio from Clayton and Pugachev

COURT OF APPEAL HELD THAT: after applying the beneficial ownership test, there was no trust

stated that the key question to ask was "whether, on an objective analysis of the powers reserved to Mr Webb in the trust deeds, Mr Webb had evinced an intention to irrevocably to relinquish his beneficial interest in the trust property.

@216

the test is wehether, despite the creation of the arrangement, the settlor can recover the property without the exercise of a power by a "truly independent person"

Mr webb as appointor, had the powers to:

- remove beneficiaries

- remove or replace trustees

- could appoint himself to the office of 'consultant' (and did) giving capacity over investment, acceleration of vesting date, variation of trust deed

- was trustee as well , and had powers of distribution at his absolute discretion

Bennet 2020 pg 215, discussing Webb [53]

"[t]he key issue is whether, on an objective analysis of the powers reserved to the respondent in that deed, the settlor has evinced an intention to irrevocably relinquish a beneficial interest."

@[56]:

The matter is best tested by asking what would have occurred if the respondent had attempted to recover the property which he ostensibly settled on the trust. If a critical step in such an attempt would have required the assent of a truly independent person, or would have been subject to an enforceable fiduciary duty on his part, it could not be said that the purported settlement on the trust was ineffective. Conversely if, on an objective view of the deed, the respondent had retained for himself the uncontrolled power to recover the property it could not be said that he had divested himself of his beneficial ownership of the property.

Clayton v Clayton [2013] NZHC 309 (and related cases)

Probert 2017, calls it "the raison detre of problematic, contemporary trust usage"

Probert 2019 discussing HC judgement @[90]

As Hansen J established in the High Court, the deed empowered Mr Clayton to use and

invest the property in any way he wished.1 81 Mr Clayton could exercise any of his broad powers or discretions for his own benefit. 182 The trust is not illusory on this basis alone. If Mr Clayton appointed property to himself as beneficiary, he would be exercising a fiduciary power and would be subject to the traditional mechanisms used to control the exercise of that power. 183 However, the VRPT deed provided that Mr Clayton could exercise any of his broad powers or discretions for his own benefit, without regard for the other beneficiaries' interests, and notwithstanding any conflict of interest with the VRPT or other beneficiaries. 184 At this point, the trust deed in substance omits a fiduciary relationship in which the trustee holds or deals with trust property for the benefit of the beneficiaries. Mr Clayton can completely disregard all other interests in relation to the trust

It was argued in Clayton that a purported trust’s terms provided so much control of property to the trustee that no trust actually existed.

Disagreement ensued.

Two lower courts accepted this proposition, but the Court of Appeal rejected it. The Supreme Court decided the case on other grounds, but indicated that its members could not agree on the illusory trust issue.

high court agreed with the illusory trust concept though

[2013] 3 NZLR 236 [78]–[80] (Clayton (High

Court)).

@ {51}

Mr Clayton thus ‘effectively retained all

the powers of ownership’27 and could use the trust property ‘just as he would

if the trust had never been created’.28 The trust was illusory.

WHATEVS>>> WHAT YOU SHOULD REMEMBER IS

Clayton is the authority for the proposition that property which is ostensible held on the trusts of a NZ discretionary trust may nevertheless be regarded as being in substance the property of a particular individual holding wide powers over the trust

Power to remove all other beneficiaries except for default benefeiciaries

- change any term relationg th management and administration of trust

- deed authorised a trustee who was also a beneficiary to exercise powers in his own favour, without considering the interests of all the beneficiaries.

@ [118]

. . . the provisions of the [VRPT] give Mr Clayton unfettered power to distribute the income and the capital of the trust to himself if he wishes and to bring the trust to an end at any time he pleases. Mr Clayton effectively retained all the powers of ownership.

What he has in fact done is neither here nor there, although it appears that, through his delegates, Mr Clayton exercises, in a practical sense, the powers of ownership. It is what he has the legal power to do that is important and that is basically to do whatever he wants with the trust property. Within a largely conventional framework the trust deed provides an appearance of separation. The reality is, however, that if he chooses to, Mr Clayton is able to deal with trust property just as he would if the trust had never been created.

HELD: mr Claytong was able to appoint the whole property to himself without being constrained in any practical sense by any fiduciary duty

Mr/mrs clayton undergo divorce proceedings.

- mr clayton has large amount of property in discretionary trusts

- sole settlor and trustee, as well as discretionary beneficiary

- principal family member

Barkleys draft textbook excerpt:

There is one key example in Aotearoa of a trust where the trustees’ duties were too weak to prevent someone having a property interest. This is the famous case of Clayton v Clayton [2015] NZCA 30. Mr Clayton was the settlor of a trust, but also made himself the only trustee as well as a discretionary beneficiary alongside his children. This meant that he undertook to hold the property on trust until he decided whether to give it back to himself or to his children.

In the Court of Appeal, the Court accepted that Mr Clayton was bound by the mandatory duties to make distributions honestly and in good faith. The Court understood that these duties meant that Mr Clayton, as trustee, could not be recognised as free to distribute the property to himself because he owed distribution duties to his children. Mr Clayton’s duties of honesty and good faith meant that his trustee powers could not be recognised as a property interest, and neither could his status as discretionary beneficiary.

The assessment changed in the Supreme Court. Here the Court found that while Mr Clayton might be a trustee, he did not owe duties to the beneficiaries that would in any way hinder his freedom to benefit himself. Therefore, because the other beneficiaries did not have rights that limited Mr Clayton’s powers, he had the power and freedom to take the trust property for himself. This power could be recognised as a beneficial property interest that he had to share with his ex-wife.

Clayton is a rare case because it is unusual for a discretionary beneficiary to be the only trustee and authorised to exercise powers for his own benefit, which the trust deed explicitly stated. If Mr Clayton had a co-trustee it would have been much more difficult for the Supreme Court to say that the co-trustee’s duties were not strong enough to prevent Mr Clayton having a right to the property. Only if beneficiaries’ rights are so weak they are basically non-existent are the Aotearoa courts willing accept that anyone has a property interest in a discretionary trust.

barkley 2019

argument that the trust itself isn't valid

settlor as trustee with power to distribute to class of discretionary beneficiaries including himself isn't a valid trust - equivalent to the clayton tr ust with included the express clause that he could act in his own best intrests at all times - he has therefore failed to create a valid trust and has retained absolute ownership of trust assets at all times. reasoning is that there is no objective intention to irrevocably relinquish his beneficial interest in the assets because the deet provided no impediment to the settlor recovering the entire trust fund.

web v webb (cook islands case heard in nz) found this in particular because the deeds exclusion clause removed the fiduciary duties that the trustee would otherwise owe to the beneficiearies

NZ court of appeal found that a fiduciary restriction on self benefit was essential for the creation of a trust (not no-benefit, just some sort of restriction rather than a free for all)

this is particular to when the settlor is the trustee, and has the power to add/remove beneficiaries at discretion

clause "any trusdt wehich includes any beneficiary

1NZLR551 @[55]

The VRPT deed also contains a very broad resettlement power. Under cl 8.1, the Trustee may resettle the Trust Fund upon the Trustees of any trust which includes any one or more of the Discretionary Beneficiaries (in this case, that class includes Mr Clayton himself). On the face of it, this would allow Mr Clayton to resettle the trust capital on the Trustee of a trust of which he was a (or the) beneficiary.

Bennet 2020 - pugachevs [162] case discussing Clayton v Clayton [119]:

He observed that the Supreme Court's decision "illuminates some important principles" relevant to the illusory trust claim:

The case shows that when considering what powers a person actually has as a result of a trust deed, the court is entitled to construe the powers and duties as a whole and work out what is going on, as a matter of substance. Even though the VRPT deed in that case named more than one Discretionary Beneficiary and named Final Beneficiaries which did not include Mr Clayton, when the deed is examined with care, what emerged is that in fact Mr Clayton had effectively retained the powers of ownership.

Thus, the test for illusory trusts Birss J discerns from Clayton v Clayton is whether the rights and duties in the deed mean that in substance the settlor retains the powers of ownership.

Bennet, cvc@[133] discussing protectors:

... the unscrupulous person can prevent the trustees from distributing the money to anyone but himself (or herself) and can remove recalcitrant trustees who fail to do his or her bidding and replace them with trustees willing to do what the unscrupulous person wants. Viewed in that way, perhaps the discretionary trust is not really a discretionary trust at all; the unscrupulous person has retained effective control of the assets or at least can recover that control whenever they like.

Unsuccessful third party claims to

discretionary trusts in Australia

Saunders v Vautier HIGHLY UNLIKELY ARGUMENT

Termination of trust by court order if all beneficiaries agree they can override the trust terms and demand the assets

Schnidt v rosewood:

the right to seek a courts intervention and due administration of the trust does not depend on entitlement to a fixed and transmissble beneficial interest.

additionally, the mere existence of a power of addition having the ability to block a beneficiaries right to due administration of a trust is contrary to the ratio in schmidt

the fact that the beneficiaries of a discretionary trust do not have absolute/indefeasible intrerests makes no difference; it is enough that they are currently the only persons entitled to due administration of the trust

~CPT custodian pty ltd v commissioner of state revenue 2005 hca 54 @ 44

the fact that the beneficiaries of a discretionary trust do not have absolute/indefeasible intrerests makes no difference; it is enough that they are currently the only persons entitled to due administration of the trust

~CPT custodian pty ltd v commissioner of state revenue 2005 hca 54 @ 44

kennon v spry

the family court system

a lonesome success story: the richstar decision

para 36 (french J) "where a discretionary trust is controlled by a trustee who is in truth the alter ego of a beneficiary, then at the fvery least a contingent interest may be indentified because... itis as good as certain that the beneficiary will receiv the benefits of distributions either of income or captial or both.

Para 33 9French J) ref Craig v fed com taxaation [1945] HCA 1 (McTiernan J)

... contingent interest was defined as "merely the prospect or possibility of a future estate" to be contrasted with "the category of bare possibilities and expectations"

beneficiary had a degree of influence over the trustees power to select whom payments from the trust would go towards. This degree of influence is indicative of aproprietary interest

Para 29 (French J) "I distringuish the 'ordinary case' from the case in which the beneficiary effectively controls the trustees power of selection. Then there is something which is akin to a proprietary interest in the beneficiary.

Para 20 (French J) "A trust will not be purely discretionar... where the donee of the power of selection has a discretion only as to the time or method of making payments to the beneficiaries

potential remedies that don't hold to specifics of deed

Moving forward the vesting date forward so property must be distributed

sham trust

a declaration of a trust that is a facade hiding arrangments actually intended between the settlor and trustee, bennet 2017

right to assign as properietary interest

can only be a sham when the trust set up is different from the owners intent. There are cases whereCan it can technically happen

ELEMENTS OF A TRUST & DISCRETIONARY TRUST

Discretionary specifics

Protector of trust assigned

- designed to ensure trustees are doing job properly

- often it's used as a method of keeping control of trust property that they no longer beneficially own whilst protecting assets from creditors

beneficiaries rights are narrower in scope:

right to due administration, and

right to call upon the trustee to deal appropriately with the income and capital of the trust

3 certainties

subject

object

INTRODUCTION

As there is no evidence at hand to show that the trust been utilised for transfers specificially to defeat Brene as a creditor, the clawback provisions of the bankruptcy act do not apply (bankfruptcy act 1966 s 120-22)

SIGMUNDS ARGUMENTS AGAINST

ILLUSIONARY TRUST DOCTRINE

NITIKMAN ARTICLE - "A STEP TOO FAR"

quotes trusts that have a right to be revoked? that's not a damn trust

states that that the decision in Mardo case preferable:

holding that a power to ask for the poroperty is not the same as owning the property

to me, this is not a discretionary trust; it is a normal trust with a contingent remainder, which is different. The legal rights to property aren't teh same DISREGARD

REBUTTAL: The difference being the ownership of the property in the first place, and keeping the beneficial and legal ownership - the two never seems to stop coinciding in reality (if not on paper)

most of his arguments are in his footnotes

he does not beleive that it is an irrevocable fact that a trustee must have a fiduciary duty; noting bartlett clauses re: trustee obligations in overseeing performance of shares in trustee corporations

"if one fiduciary duty can be eliminated by the trust deed because the settlor has chose that arrangement, why can the settlor not eliminate all such duties?"

Birss J in pugachev states that no clause is wide enough to completeley waive a trustees obligations to a beneficiary. if the trustee has no duty, are they a trustee? can you TRUST them?

property definition used in Clayton was for matrimonial law, and does not meet the definition for common law (fn6)

SIGMUND-SPECIFIC

WHAT IF SIGMUND WASN'T THE SETTLOR?

but was appointed as the trustee, in particular at a later point in time (just as he has the power to do currently)? Does the trust become illusory?

he probably wasn't however, UK court in Webb v Webb [2020] UKPC 22 (lord kitchin) states rights over trust property retained by a trust creator were inconsistent with stellemnt of the property on trust, and it "did not make any material difference", when the trust was created by a nominal settlor.

this was because the person providing the trust assts plainly intended that the trust would 'operate as a vehicle into which he would at a later stage transfer matrimonial property'. In an equitable sense, the settlor and any person adding substantial property into a trust must be extended to mean the same role.

i.e., if sigmund wasn't the settlor, it doesn't matter, he could still be seen as the beneficial owner of the trust.

Durrhurr,, but this was already rejected in all the non-conforming decisions following richstar

Probert (2019) states that:

Illusory trusts are also conceptually distinct from "alter ego trusts". The alter-ego concept involves viewing the trust as the alter ego of an external controller such as the settlor. 90 It is similar to a finding of a sham, in that the level of control relinquished by the trustee, to the controller, indicates that the trust structure is a fagade that can be disregarded. 9 1 Alter ego trusts are not considered in this article

French J had a different approach to Richstar. rather than seeing the trust as illusory almost to the point of void ab initio, he dtermined that where "the beneficiar effectively controls the trustees power of selection, then there is something akin to a proprietary interest in the beneficiary

this idea being that the trust was an 'alter ego' for the beneficiary (wait... isn't this the Salomon argument all over again?)

Discretionary trusts are meant to have an unknown scope of distribution (within the defined corners of the deed) seen as an "expectancy or mere possibility of distribution". in comparison, the beneficiary had a "contingent interest... a right of a proprietary character [that] will come into existence at a future time [if some event occurs].... because "it is good as certain that the beneficiary will receive the benefits of distributions of either income or capital or both"

The argument is being motivated on the basis of current policy, not on the basis of solid doctrine, and "the conceptual beasts ... attack the very existence of the apparent trust"

~ bewnnet 2020 quoting Jesse Wall "Taking the Bundle of Rights Seriously" (2019) 50 VUWLR 733 at 749-750

REBUTTAL:

proponents of the illusory trust accept this notion, and that this is one of the substantive reasons underpinning the decision, but it shouldn't be criticised; what should be criticised is that the courts are to focused on their current lines of reasoning rather than morality and policy

~ Bennet, discussin "Form, Substance and Recharacterisation" in Andrew Robertson and James Goudkamp (eds) Form and Substance in the Law of Obligations (Hart Publishing, Oxford, 2019) 71

PRECEDENT

a lack of common law rationale:

the decisions made did not have a lot of case law backing, and none had a clear rationale to base off much of the decisions were based off the fundamental principles of trust law

bringing back the concept that there must be fiduciary obligations on the trustee in relation to the nominated beneficiaries. If someone holds non-fiduciary powers yet has the ability to make or prevent key decisions, it contradicts the very requirement of the doctrine.

REBUTTAL:

The Justices in the cases have simply uses substantive instead of formative reasons to create a new rule in a divisive area of law that has only come to play in the last 75 years

~ Bennet 227

aren't the fundamental princples of something such as trust law formed from years upon years of common law doctrine compounded into rules though?

How else do we get our snail in a bottle? Salomon and Salomon? Agreement, acceptance, and Consideration...., equity doesn't assist a volunteer,

that it's not settled law, and that illusory trusts are a different thing altogether

Many textbooks do not show suppoert for it, arguing

- exclusiong of liability,

- no right ot interference by third parties / trustee usurpation hesitancy

- insuffiecient accountability

-

HECK, OUR TEXTBOOK DOESNT EVEN DISCUSS DISCRETIONARY TRUSTS AT ALL!!

where it's not a form and substance issue, but another transaction alltogether, such as trust for creditors for debt payments, or maybe quistclose style trusts

[56] Counsel for the VRPT Trustee said Mr Clayton’s fiduciary obligations to the Final Beneficiaries constrained Mr Clayton’s ability to exercise these powers in his own favour. That submission has to be evaluated against a background of a number of provisions of the VRPT deed that modify the duties imposed on the Trustee. In particular:

(a)Clause 14.1 of the VRPT deed, which authorises a Trustee who is also a Beneficiary (as Mr Clayton is) to exercise any power or discretion vested in the Trustee in his own favour;

(b)Clause 11.1, which authorises the Trustee to exercise a power or discretion conferred on the Trustee even though the interests of all beneficiaries are not considered by the Trustee (cl 11.1(a)), the exercise would or might be contrary to the interests of any present or future Beneficiary (cl 11.1(b)) and/or the exercise results in the whole of the trust capital or income being distributed to one Beneficiary to the exclusion of others (cl 11.1(c)); and

(c)Clause 19.1(c), which authorises the Trustee to exercise any power or discretion notwithstanding that the interests of the Trustee may conflict with the duty of the Trustee to the Beneficiaries or any of them.

[57] These provisions make it possible for Mr Clayton, even if he has not exercised the power conferred on him as Principal Family Member by cl 7.1, to resolve as Trustee to apply the trust capital and income to himself (to the exclusion of the Final Beneficiaries and any remaining Discretionary Beneficiaries). He could do this without considering the interests of other Discretionary Beneficiaries (if any) or those of the Final Beneficiaries even if it meant all the trust capital and income was distributed to him to the exclusion of other Beneficiaries. The position of the Final Beneficiaries is contingent on the trust capital not being distributed before the Vesting Day. The fact that the decision involved a conflict between his personal interest and the interests of other Beneficiaries would not matter.

[58] These provisions mean that Mr Clayton is not constrained by any fiduciary duty when exercising the VRPT powers in his own favour to the detriment of the Final Beneficiaries. The fact that he cannot remove the Final Beneficiaries does not alter the fact that he can, unrestrained by fiduciary obligations, exercise the VRPT powers to appoint the whole of the trust property to himself. That leads to the next question: are the VRPT powers of sufficiently similar effect to a general power of appointment that it is appropriate to treat them as property for the purposes of the PRA?

DETTAILS

OF AN

ILLUSORY

TRUST

probert 2019

"an illusory trust is an arrangemetn that is not a trust due to the rights and obligations coniained in teh trust deed" (or lack thereof)

requires checking that the two fundamental principles are met:

1)the fiduciary relationship of the trustee holding the trust property for the benefit of the beneficiaries and

2) trustee accountability - the enfoceable fiduciary obligations to the beneficiary

It does not meanthere can be a complete lack of conflict

Bennet 2017,

One such competing moral value might be that the trust is for the benefit of

the beneficiary, which explains the reason why the trust property is not

available to satisfy the trustee or settlor’s legal obligations. The mechanism of

the trust should not create a substantive position where the trustee or settlor

effectively has the benefit of the trust property, while that property is not

available to satisfy legal claims against them.

Either of these moral principles might be used to interpret the core principle

that a trust is an arrangement in which a trustee must act for the benefit of

others with respect to property. Where the legal principles do not provide an

answer, we could develop the law to better conform with the normative values

we perceive to underlie it. If such normative arguments become influential in

trusts law argument that interprets and develops the (non-moral) core

principles of trusts, this would chip away at Penner’s untheory.

a trustee may be empowered by deed to act in a way that provides them with a benefit, or places them in a conflict. Theyre is an argumetn to be had that they may act in their self interest, but only to the extent that there is still the benefit for the beneficiary

There needs to be SOME level of settlor control to be allowed:

Bennet 2017 Geraint Thomas observes that:

The obvious danger is that, by one means or another, the settlor has retained so much

control over the ‘trust’ assets that he will be held not to have created a trust at all ...

If a binding trust was genuinely intended by the settlor, but the intended trust fails

because he has inadvertently retained too much control over it and its assets, there

is a resulting trust for the settlor.157

VARIATIONS IN THEORY

reality of control constituting beneficial ownership: the extensive set of powers, when held by a discretionary beneficiary, are non-fiduciary and mean that the protector has beneficial ownership.

PUGACHEV

protector did not have power to make himself the legal owner of property, but could design it that he was either the only beneficiary AND/OR the trustees couldnt designate trust funds to anyone without his permission.

~ the ability to reverse/undo what had been done at his command basically

Subtopic

WEBB

Specified that the test only required he could make himself the legal owner at any time

THIS IS THE LOOSEST OF THE TESTS

CLAYTON

beneficiary/protector had the ability to assign himself property

OTHER KEY ASPECTS

A trust will also be illusory if the trustees

owe no enforceable duties to the beneficiaries so as to

eliminate the ‘irreducible core of obligations’ which is

fundamental to the concept of a trust.4

powers of disposition via settlor-trustee-beneficiary,

including a lack of prohibition on self-benefit

lack of fiduciary constraints within the clauses of the deed (express exclusion) is an option, but would be rarer to see

retention of beneficial ownership

THE RULES: (bennet 2020, 2017)

a trust could be seen as illusory where

FOUR: if they have certain specified powers [reality of control]

THREE if they can distribute all trust property to themselves [unlimited benefit] OR

TWO: can veto certain specified trustee decisions (trustee discretions are overborne by another) OR

ONE: the trustee is exonerated from all personal liability (no [meaningful] acountablility), OR

Bennet (2020) The Illusory Trust Doctrine:

The idea using 'substance and form' theory that even though a person has used the proper forms setting up the trust (proper language and clauses in the trust deed), in substance they have not formed an actual trust.

In the case of the Illusory Trust, it focuses on that the settlor/trustee (not always both, sometimes either) is allowed to (or in effect never loses) the beneficial ownership of the assets.

QUOTE: 'look through' the the 'form' of the trust as a property structure that divests the settlor of ownership to see the 'substance' of the settlors control

The arrangement in the end, contains the words, but not the essence of what a trust is.

THIS BEGS THE QUESTION....WHAT SHOULD BE DONE ABOUT IT?

Look for sham: the true intent behind the forming of the trust. if it was formed for a purpose inherently different to what is listed by word in the deed

Enable a 'piercing the veil' style approach to trusts, looking beyond the form of the deed to true attribution of ownership.

~bennet akins this to looking to the true essence of property ownership in family law/ relationship disputes, where courts look beyond the firm statutory definitions of 'property' or 'financial resources' to ensure fair distribution between spouses (pg 205)

QUOTE: pg 2020:

["General features of the trust is that] the settlor can retain powers to control the trustees such as the power to add and replace trustees and to veto trustee decisions. in substence they have control of the trust, but by orthodox legal rule, they are not the owner of the property and are therefore not subject to the piabilities of ownership.

The questions is, if the protector holds the poers for their own benefit and not as a fiduciary for the beneficiaries,, is it really a trust for the beneficiaries?

QUOTING birss J in pugachev [179]-[180] pg 202:

... if a person gives away their property to someone else then it is no longer theirs. But that is not what the unscrupulous person in the example wants to do at all. As far as they are concerned the property is theirs. The objective is not to lose control of it, the objective is to hide it and protect it from creditors.... The problem for the unscrupulous person is that in the kind of discretionary trust discussed so far, all the power is in the hands of the trustees.

The form over substance view instead allows for exploitation of trust law, such as tax avoidance, inheritance, property ownership liabilities

The overall idea of this theory comes from a basis that if courts allow only strict adherence to form, it is allowing its use for a function external to its actual purpose (e.g., tax avoidance rather than an actual trust).

CURRENT ISSUES WITH DISCRETIONARY

TRUSTS FROM A MORAL PERSPECTIVE

gives the ability for a person to sequester wealth into a trust, turning the property ownerless in equity, but not in title/possession. This makes it untouchable in many ways; bankruptcy, tax, creditors, some family/matrimonial disputes, etc.

STATUS OF THE TRUST

OTHER

TRUSTEE DISCRETION

2.2(b) the interpretation of this deed in cases of doubt is to favour the broadening of the powers and the restricting of the liabilities of the Trustees;

11.1. For the avoidance of doubt and notwithstanding anything in this deed or any rule of law which imposes upon the Trustees the duty to act impartially towards Beneficiaries, the Trustees shall have unfettered discretion as to the exercise of the powers and discretions conferred upon them by this deed

DISTRIBUTION OF TRUST ASSETS

Trustee has power of unfettered discretion to transfer all of the income and/or capital to any one or more beneficiaries in whatever proportion they deem fit.

CAPITAL (if before vesting day)

6.1. The Trustees may at any time:

(a) pay or apply all or any part of the capital of the Trust Fund to or for such one or more of the Discretionary Beneficiaries who are then living or in existence;

(b) appropriate all or any part of the capital of the Trust Fund for such one or more of the Discretionary Beneficiaries who are then living or in existence contingently upon the reaching of a specified age or the happening of a specified event.

INCOME

Trustees may " pay or apply all or any part of the income of the Trust Fund to or for such one or more of the Discretionary Beneficiaries who are then living or in existence;"

VESTING DATE

80 years from the date of the date of the deed

OR

any earlier day that the trustees appoint under deed

BENEFICIARIES

Final Beneficiaries

Child or Children of PRINCIPLE FAMILY MEMBER born or adopted before the vesting day

OR if a final beneficiary has died, any issue of said final beneficiary

general discretionary beneficiaries

(a) the Principal Family Member;

(b) the Final Beneficiaries;

(c) the issue of any Final Beneficiary;

(d) any wife, husband, widow, widower, former wife or former husband for the time being of any Beneficiary described in paragraphs (a) to (c) of this definition;

(e) any trust ... which includes ... any Beneficiary;

(f) any person appointed pursuant to cl 7.1(a), but does not include any person who has been removed from the class of Discretionary Beneficiaries pursuant to clause 7.1(b).

principal family member

Sigmund Jung

POWER TO APPOINT

~principal family member~

TRANSFER POWER OF APPOINTMENT

The Principal Family Member may transfer the powers of appointment and removal of Trustees to such person or persons as the Principal Family Member may nominate by deed or will.

additionally: holder of power of appointment of trustees may exercise that power in favour of themselves

TRUSTEES:

17.1power, from time to time, appoint and remove trustees

BENEFICIARIES:

appoint any person to become a member of the class of discretionary beneficiaries

remove any person from the class of discretionary beneficiaries

SETTLOR AND TRUSTEES

trustee: Principal Family Member

nominal settlor (unknown)