door Kevin Liu 4 jaren geleden

524

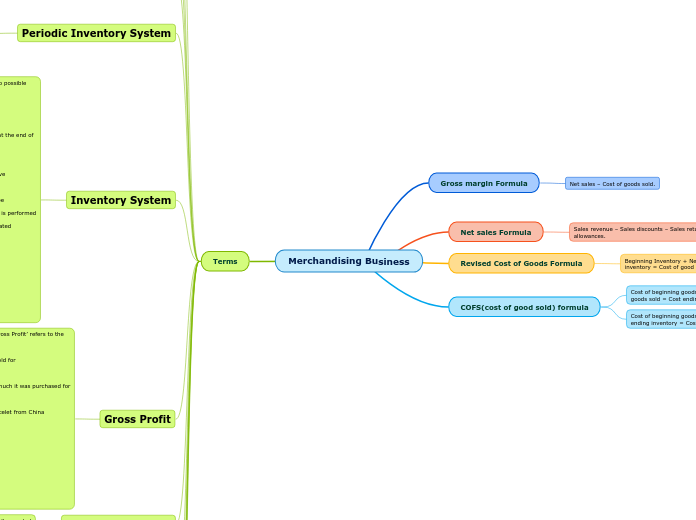

Merchandising Business

A merchandising business relies heavily on accurate inventory and cost accounting to determine profitability. The revised cost of goods sold formula takes into account the beginning inventory, net cost of purchases, and ending inventory.