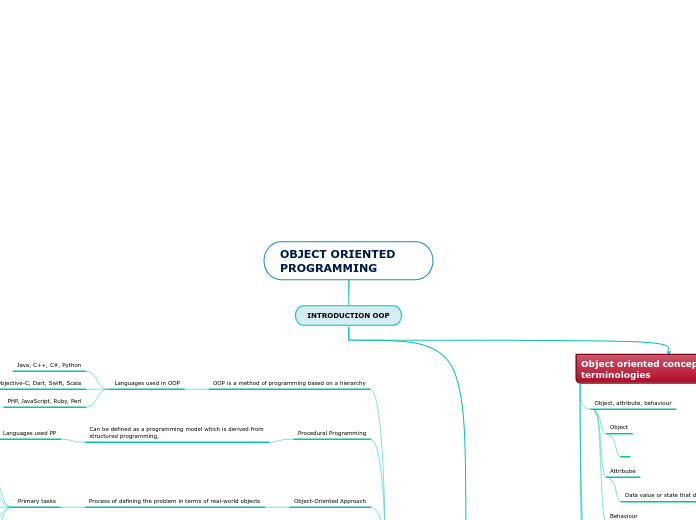

Monte Carlo Analysis

Outputs

What is it that we are interested in knowing the distribution of?

Understand shape of uncertainty

Summaries

Graphics

Excel Techniques

How to simulate ANY probability distribution

Voilà

3. Use the inverse of the cdf to find what variable value corresponds with that point

2. This picks a point in the cumulative distribution function (cdf)

1. Draw from a [0,1] uniform

Put all inputs in the same worksheet as the outputs

Inputs

Identify variables

These are the most important variables I want to study.

Reasons to choose

It is under our control

It is of concern to some actors, but not others

It is "systematic"

We want to price the risk associated with it

There are differences of opinion concerning that input

We want to determine required operational margins

We know something about the distribution

Relationship between variables

Correlation

Assumed as intrinsic characteristic of the distribution

Must be stable

Independence

Uncorrelateness does not always imply independence

Independence is not transitive among variables

Number of variables

Be very wary of the "curse of dimensionality". Models become intractable very quickly when as we add inputs to our analysis.

Large number of variables can distort the outcome

Number should be restricted (to relevant variables only)

Have known probability distributions

I must be able to guess or know, with some degree of accuracy, the distribution of the uncertainty in the input variables.

This point cannot be stressed enough. If I have no idea what the distribution function of the inputs is, the whole analysis is useless.

Sometimes it is better not to pick the obvious input (if we know nothing about its distribution), but some other driver for which we have a better estimate of its distribution.

Assuming a normal distribution without convincing ourselves it makes sense (can the variable have positive and negative values? is the distribution likely symmetric? ...) is a sure recipe for disaster.

Standard Deviation

Have an effect on output