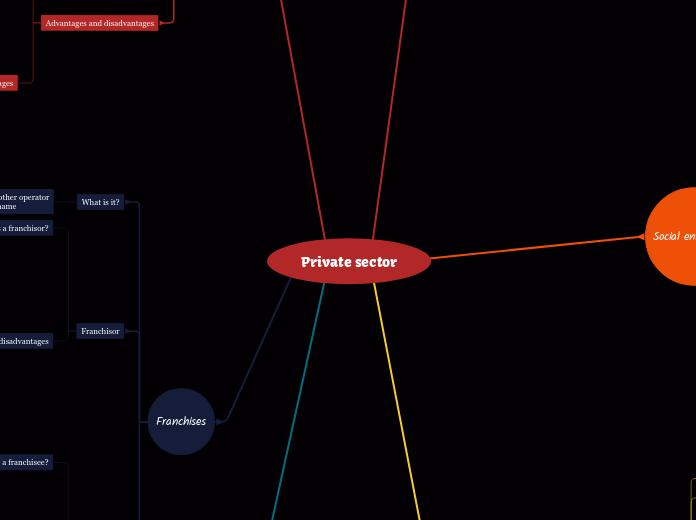

Private sector

Multinationals

Key features

Highly influential both economically and

politically

Highly advanced and up to date technology

Powerful advertising and marketing capability

Highly qualified and experienced

professional executives and managers

Huge assets

A large business with significant

production or service operations in

atleast 2 different countries

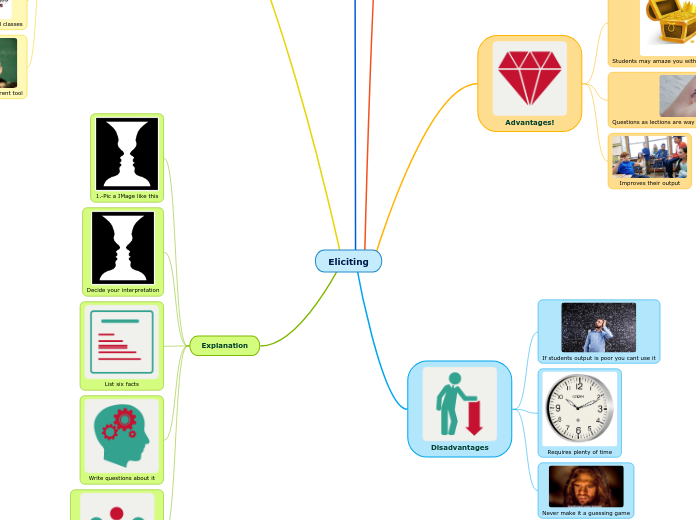

Franchises

Franchisee

Expensive way to start a business

Lack of independence

Strict contracts have to be signed

Profit is shared with the franchisor

National marketing may be

organised

Setup costs are predictable

Backup surport is given

Less risk

Who is a franchisee?

Operator who trades under

their name

Franchisor

Cost of support for franchisees may

be high

Franshisees may get merchandise

from elsewhere

Poor franchisees may damage

brand's reputation

Profit is shared with the franchisee

Franchisees are more motivated

that employees

Franchisees take some of the risk

Cheaper method of growth

Fast method of growth

Who is a franchisor?

Owner of business

A business allows another operator

to trade under their name

Partnerships

Partnersips still tend to be small

Any partner's decision is legally

binding on all

Partners may disagree

and fall out

Profit has to be shared

Have unlimited liability

Finanacial info is not published

Job of running the business

is shared

Partners can specialise in their

area of expertise

Easy setup

It is a legal document that states the

partner's rights

However, they can draw up a deed of

partnership

There are no leagal fomalities to

complete when forming a partnership

They also share the profits

Owners will share responsibilities

for running the business

A business owned by 2-20 people

Limited companies

Public limited

Advantages and disadvantes

Managers may take control rather

than owners

More regulatory control owing to

company acts

May be more remote from customers

More financial info has to be published

Outsiders can take control by buying shares

Setting up can be very expensive

May have high profile in the media

Shares can be bought and sold very easily

May be able to dominate the market

PLCs can exploit economies of scale

Large amounts of capital can be raised

Any person or organisation can buy shares

in a PLC

Their shares can be bought and sold by the

public on the stock exchange

Larger that private limited companies

Private limited

Advantages and disadvantages

Cannot raise huge amounts of money

Takes time to transfer shares to new owner

Profits are shared between more members

Costs money and time to setup

Financial information has to be published

Has more status

Business continues if a shareholder

dies

Control cannot be lost to outsiders

More capital can be raised

Shareholders have limited liability

What is it

However, a small minority are large

Business that tend to be small or

medium sized

Main features

To form a limited company, it is necessary

to follow a legal procedure

Whereas soletraders and partnerships pay

income taxes, companies pay corporation

tax on profits

The shareholders elect directors to run the

company

The business raises capital by selling shares

Owners have limited liability

Social enterprises

Varieties of forms

Charities

Some run business ventures such as charity

shops

They may also organise fundraising events

such as cake sales, sponsored actvities and

selling greeting cards.

They rely on donations for their revenue

They exist to raise money for good causes

draw attention to the needs of

disadvantaged groups

Worker cooperatives

Workers will contribute to production and be

involved in decision making, share in the profit

and provide some capital when buying a share

in the business

They are businesses in which its employees

share ownership

Cooperatives

Any profit made by the cooperatives is

given to members

They buy shares which entitle them to

elect directors to make key decisions

They are owned and controlled by

their members

Usually operate as consumer

cooperatives or reatail cooperatives

Reinvest most of their profits

Generate most of their income

through trade or donations

Have a clear social and/or

envoronmental mission

A business that aims to improve

human or environmental well-being.

Sole traders

Advatages and disadvantages

Disadvantages

No continuity

Long hours and hard work

Independence maybe too much

of a responsibilities

May struggle to raise finance

Owner has unlimited liability

Advantages

May qualify for government

help

Can offer personal

service because they

are small

Flexibility

Simple setup

Independent

Owner keeps all the profit

What is it?

Owner has umlimited liabibility

No legal requirements for setup

It is the simplest form of business

A business owned by a single person