door nava nouralian 1 jaar geleden

153

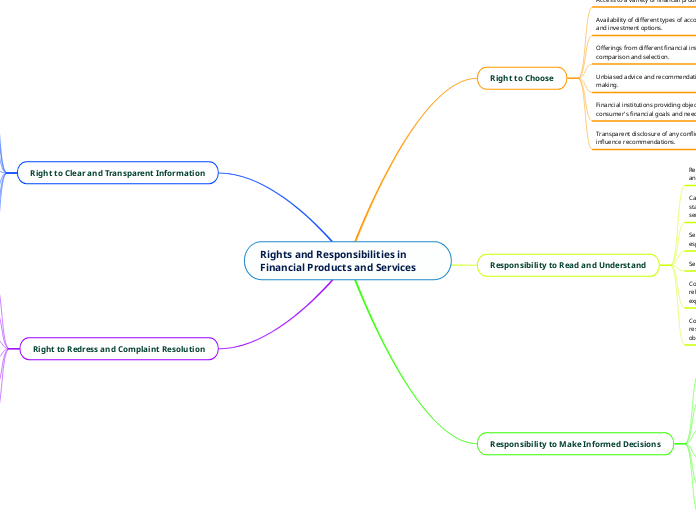

Rights and Responsibilities in Financial Products and Services

When dealing with financial products and services, individuals have both rights and responsibilities. It's crucial to make informed decisions by evaluating one's risk appetite, financial situation, and goals.