door Lauren Molly 6 jaren geleden

200

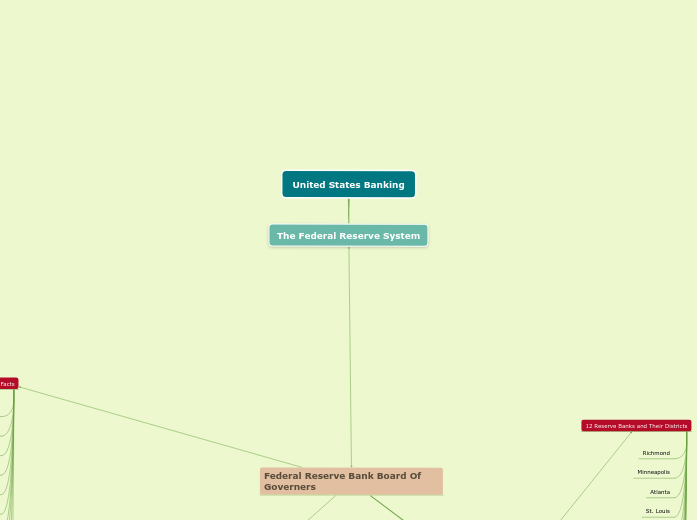

Student Banking Services

Students can benefit from various banking services tailored to their needs. A savings account allows them to save money for tuition and other school-related expenses, offering low balance requirements and the ability to earn interest, with minimal fees for those over 18.