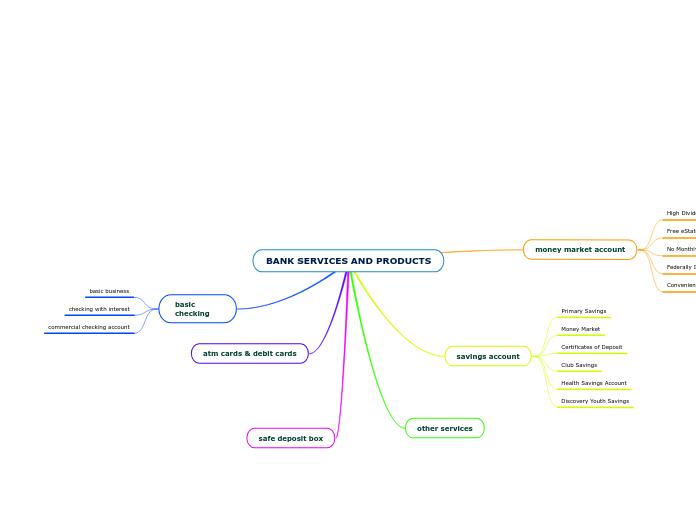

Student Banking Services

(RBC)

Sources

http://www.rbcroyalbank.com/student-solution/

RBC High Interest

e-Savings

Description

An Online Savings Account Offering

High Interest On Every Dollar. Free

online transfers from this account to

other RBC Royal Bank accounts in

your name — 24/7 with no delay.

Interest Rate: 1.200%

Benefits

-High interest on every dollar

-No minimum deposit requirements

-Free electronic self-service transfers 24/7 with no delay

(Including ATM and unassisted telephone fund transfers)

Free access to RBC Online, Mobile, and Telephone Banking3

-Know what your money is up to with MyAdvisor (A powerful digital service that can help capture all of your savings and investments in one place.)

Fees/Costs

-Debits Exceeding Monthly Limit: $5.00 each

(monthly limit is 1)

-Interac and PLUS System ATM Network Access Fees

Interac: $1.50

PLUS System: $3.00 (Within Canada and U.S.)

PLUS System: $5.00 (Outside Canada and U.S.)

-Interac e-transfer: $1.00 each

-Cross-border Debit= $1.00 each

RBC No Limit Banking for Students

Description

Get unlimited transactions

Benefits

-Unlimited Monthly Debits

-Unlimited Interac e-Transfers

-Get Credit Where Credit is Due

(Up to $39 rebate on the annual

fee of an eligible credit card)

-No minimum balance required

Fees/Costs

$10.95 a month

RBC Student Banking

Description

A no monthly fee student bank account

designed to save you money. Plus, free

unlimited Interac e-Transfers.

Benefits

-Use your account as often as you need

(25 free debits each month, $1.00 thereafter)

-Pay Your Friend Back with Interac e-Transfer

Unlimited

-Get credit where credit is due

(Up to $39 rebate on the annual fee of an eligible credit card)

-No minimum balance

-Instant Fuel Savings at Petro-Canada

Royal Credit Line for Students

Description

Only RBC gives you 2 years after you

finish school before you have to start

repaying your loan with full access to

your credit line during the grace period.

Benefits

-Flexible credit limits that meet your borrowing needs.

-Lower interest rates. Competitive interest rates as low as Prime Rate minus .25% disclaimer based on program of study, budget and qualifications.

-More time to repay. After you’ve finished school, you have up to 2 years before you have to start repaying the principal amount with full access to your credit line

-Optional LoanProtector Insurance. Designed to provide financial backup during difficult times, LoanProtector life and disability or critical illness insurance provides low-cost, valuable protection to you and your loved ones

Cash Back Mastercard

Description

-Get unlimited cash back credits on all your on your purchases

-Annual Fee: $0

Additional Card: $0

Purchase Rate: 19.99%

Cash Advance Rate: 21.99%

Benefits

-Unlimited cash back and 2% back on groceries

-Purchase security and extended warranty protection

-2% cash back credits† on grocery store purchases

-Up to 1% cash back credits on all other qualifying purchases and pre-authorized payments

-Unlimited cash back. Plus your credits accumulate automatically so you don't need to keep track.

-Get personalized offers to save money on shopping, dining and more.

By: Kimachi

RBC Awards + Visa

Description

Earn more RBC Rewards points on

your everyday purchases!

Benefits

-Earn 1 RBC Rewards point for every $1 spent on gas, grocery and drug store purchases

-Earn 1 RBC Rewards point for every $2 spent on all other purchases

-No annual fee

Fees/Costs

none