av Kittipong H. 1 år siden

120

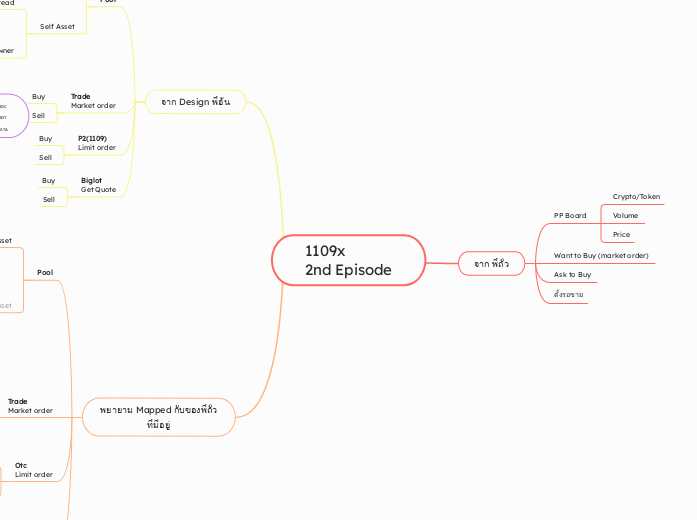

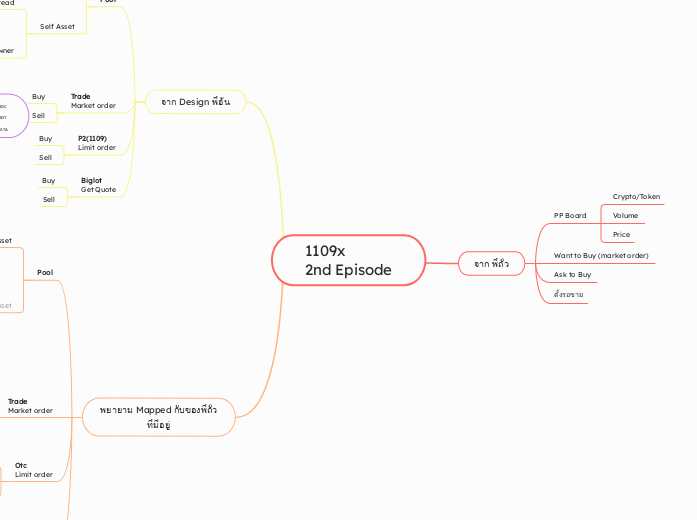

1109x 2nd Episode

av Kittipong H. 1 år siden

120

Mer som dette

Self define pricing Pool Self define pricing based on Token owner (พักไว้ก่อน ยังไม่ทำ)

Realtime treasury Pricing based on Realtime price + spread (พักไว้ก่อน ยังไม่ทำ)

Self define pricing Pool Self define pricing based on Token owner

Static treasury for Tokens Pricing based on Owner price + spread (eg. YES! GAFF)

Gasta Pricing based on Gasta Algorithm price + spread

Realtime treasury Pricing based on Realtime price + spread

PP Dynamic pool Pricing based on algorithm