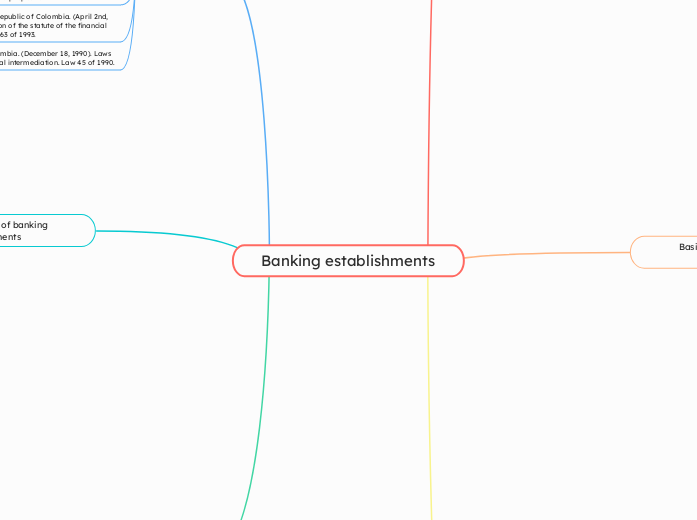

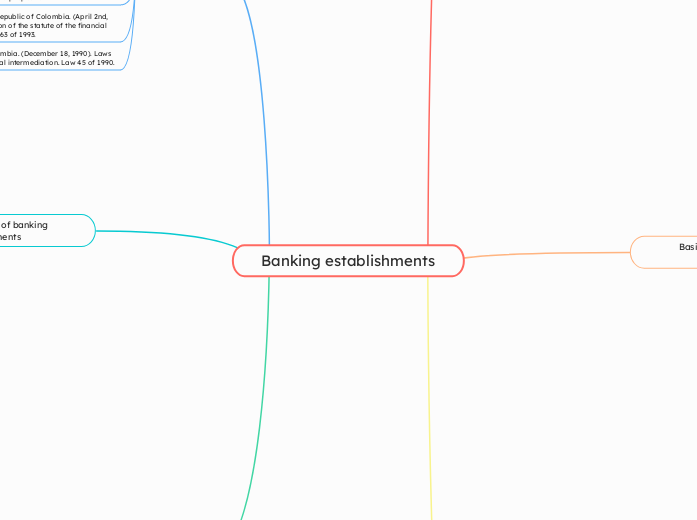

Banking establishments

Corporate purpose of banking establishments

According to article 7 of Decree 663 of 1993, Banks have the corporate purpose of practicing authorized operations such as: negotiating commercial papers, receiving deposits in checkings accounts and savings accounts, collect debts and make payments, buying and selling currency and bills of exchange, loan money, amongst others.

Article 99 of the Commercial Code states that companies legal capacity is limited to their corporate purpose. Banks are financial institutions, which means that their corporate purpose can't be determined by its associates, it is only determined by its legal regime.

Minimum capital of banking establishments

In the year 2024, the minimum capital is $133.321.000.000 Colombian pesos.

This amount is yearly incremented using the consumer price index (IPC) that is determined by DANE.

The minimum capital that a bank must have in order to exist is $8.000.000.000 Colombian pesos.

References

Congress of Colombia. (December 18, 1990). Laws regarding financial intermediation. Law 45 of 1990.

President of the republic of Colombia. (April 2nd, 1993). Actualization of the statute of the financial system). Decree 663 of 1993.

Bancolombia Group. (n.d). Our purpose. Retrieved from https://www.grupobancolombia.com/corporativo/conocenos/nuestro-proposito

Financial Superintendency of Colombia. (January 24, 2024). Minimum capital required. Retrieved from https://www.superfinanciera.gov.co/publicaciones/61318/industrias-supervisadasinteres-del-vigiladoconstitucioncapital-minimo-requerido-61318/

President of the Republic of Colombia. (July 4th, 1991). Statute of the financial system. Decree 1730 of 1991.

Main functions of banking establishments

Money issuance: Although this function is exclusive to the Banco de la República, commercial banks contribute to the circulation of currency through credit and payment operations.

Financial advice: They offer advisory services to their clients, helping them make informed financial decisions about investments, insurance, pensions, and other financial products.

Supporting economic development: They finance productive projects that contribute to the country's economic growth, such as business creation, business expansion, and infrastructure development.

Financial intermediation: They act as intermediaries between those with surplus funds (savers) and those in need of financing (borrowers). They collect deposits from savers and lend them to businesses, individuals, and the government.

Facilitating payments and transfers: They enable secure and efficient monetary transactions, both domestically and internationally. This includes electronic transfers, credit and debit card payments, and other similar services.

Risk management: They assess and manage the risks associated with their operations, such as credit risk, market risk, and operational risk. This ensures the stability of the financial system and protects the interests of depositors.

Basic structure of banking establishments

Other Relevant Entities

External Auditor: An independent professional who verifies the bank's financial information and issues an audit report.

Customer Advocate: Represents the interests of customers and addresses their complaints and claims.

Functional Areas

Compliance: Ensures the bank adheres to all applicable laws and regulations, including anti-money laundering and counter-terrorism financing rules.

Technology: Manages the bank's information systems, digital channels, and cybersecurity.

Human Resources: Manages the bank's human capital, including recruitment, training, performance evaluation, and employee relations.

Treasury: Manages the bank's liquidity, ensuring sufficient funds to meet its obligations.

Accounting: Records the bank's financial transactions and prepares financial statements.

Internal Audit: Evaluates the bank's internal processes to ensure efficiency and compliance with regulations.

Retail Banking: Serves the financial needs of individual customers, offering products like savings accounts, credit cards, and personal loans.

Corporate Banking: Focuses on the financial needs of businesses, providing services such as commercial loans, project financing, and treasury management.

Investment Banking: Offers financial services to large corporations and governments, including mergers and acquisitions advisory, bond issuance, etc.

Risk Management: Assesses and manages the risks faced by the bank, such as credit risk, market risk, and operational risk.

Management Bodies

Senior Management: These are the units in charge of specific areas of the bank, such as retail banking, corporate banking, risk management, technology, etc.

Chief Executive Officer (CEO): The executive responsible for the day-to-day operations of the bank. Implements board decisions and oversees the various departments.

Governing Bodies

Board of Management: In some cases, a separate Board of Management collaborates with the Board of Directors in making strategic decisions.

Board of Directors: The highest governing body of a bank. It sets overall policies, approves business plans, and oversees the management of the bank. Board members are typically elected by shareholders and possess expertise in finance, economics, and other relevant fields.

What are banking establishments?

According to Decree 1730 of 1991, banks are credit establishments that are in charge of the collection of funds through checkings accounts, and deposits with the objective of performing credit operations. Banking establishments are divided in commercial banks and mortgage banks.

Mortgage banks

It is an establishment that loans money that is guaranteed by real estate through mortgages, and payment must be covered in instalments.

Commercial banks

It is an establishment that receives peoples funds through general deposits and uses them along with its own funds to loan it, and to buy or discount promissory notes, bills of exchange, and transfers.