av Matthew McLaughlin 2 år siden

199

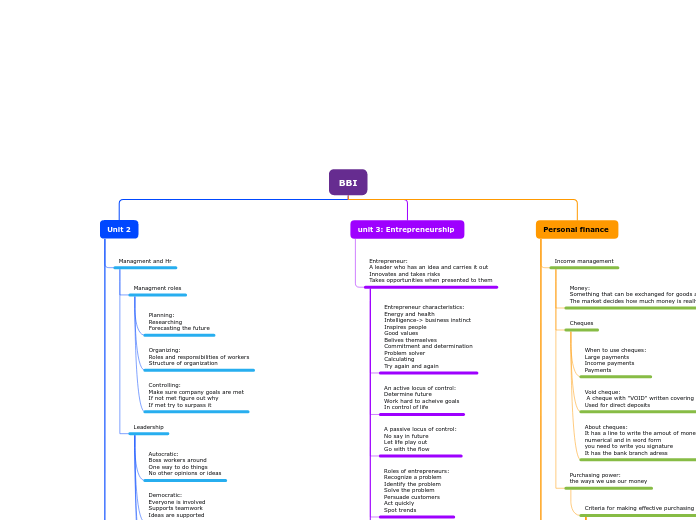

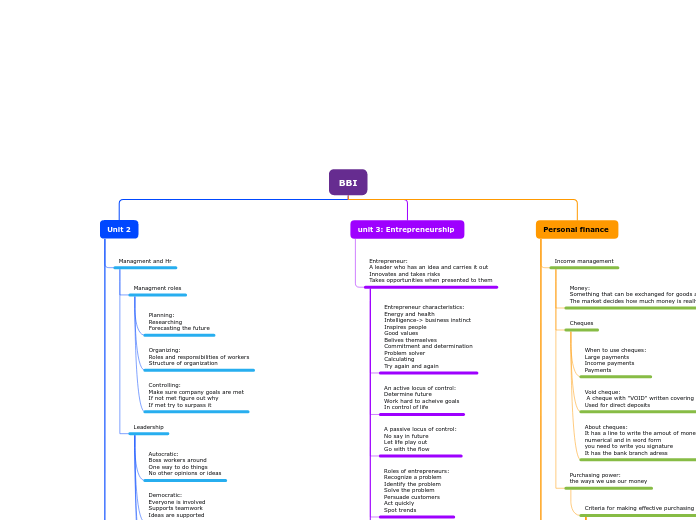

BBI

av Matthew McLaughlin 2 år siden

199

Mer som dette

Compound interest formula: PV(Present value) x R(Interest rate) x T(Time) = I(Interest)

Chequing account: Meant for money you pal to use for day to day purchases

Savings account: For setting aside money for large purchases or emergencie

Credit unions: Run and owned by members who use the bank Sometimes charge a refundable fee to be a member

Trust companies and banks: These make money for share holders

More taxes payed: Hst (13%) Property tax Other taxes (Things like tobacco)

Company pension plan Savings Life insurance

Income tax employment insurance Canada pension plan

Piecework: Paid depending on the number of items you make or sell Formula: Money per item x Number of items(made or sold)

Comission: Based on a percentage of the item you sell

Salary+Commision: A small salary+a small percentage of what you sell Formula: Amount sold x commision percentage(decimal form) + salary

Straight commision: You sell to be paid Formula: Amount sold x commision percentage(decimal form)

Hourly: Paid per hour worked Formula: Hourly money x Hours worked

Overtime: one and a half more than the normal hourly pay Formula: Regular hours + Overtime hours(1.5)

Salary: Monthly-12 pay cheques bi-weekly-26 pay cheques weekly-52 pay cheques Formula: Salary/number of pay periods = Money paid per cheque

Payroll terms

Salary: Paid the same amount without any overtime hour money

Piecework: Paid for every time you make the item

Comission: Paid a precentage amout based on your sales

Hourly rate: The set amount of money you make per hour You also get paid 1.5 x more money per overtime hour you work

Criteria for making effective purchasing decisions

Warranties and guarantees: Warranties: provides services after-sale on a product for a certain period of time Guarantees: A formal promise that goods or services are at a certain quality

service: What you're paying someone else to do for you

Comparison shopping and product information: How you compare items compare must haves and pro's vs con's of items

Quality: Should you pay more and get better quality goods/services or Should you pay less and get low quality goods/services

Buyer behavoir: Every buyer has different needs and wants

Costs: What are your monthly costs?

Money available: How much money can you get?

About cheques: It has a line to write the amout of money, numerical and in word form you need to write you signature It has the bank branch adress

Void cheque: A cheque with "VOID" written covering it Used for direct deposits

When to use cheques: Large payments Income payments Payments

Land/natural resources/raw material Capital Human resources/labour Entrepreneurship

Training Capital investment Investment in technology New inventory systems

Grading: Checking products for quality and size

Quality control: Standards needed to be met for the product

Processing: making one item into another

Purchasing: Buying raw material

Income statement rules: 3 dollar signs underline to end something Double underline to end income statement sheet Happens over a period of time

Income statement equation: Revenue-expenses=net income or net loss

Net loss: Losses Revenue is smaller than expenses

Net income: Profit Revenue is bigger than expenses

Expenses: Costs already paid Product expense

Revenue: Money earned by doing a service or selling something Tutoring fees

30 days poem

Balance sheet rules: Total assets = Total liabilities 4 dollar signs Underline to end something Double underline to end the balance sheet Assets - Liabilities = Owners Equity On assets side cash is 1st, accounts receivable is 2nd On liabilities side Accounts payable is 1st Balance sheets are based on a certain time Formula: A=L+OE

Fundamental accounting equation: Assets=Liabilities- Owners equity

Owners equity: Net worth What you own - what you owe = networth assets-liabilities=networth Capital

Liabilities: Debts that are owed Something not yet payed it is payable Car payements

Assets: Anything that's owned and has a money value Cash Boat land

Indirect competition: Companies competing for consumers Subway vs McDonalds

Direct competition: Similar products meeting the same need Gatorade vs Powerade

Factors to select the medium: Reach Selectivity Lead-time Technical requirements Cost

Cost: The money used to make the ad Can you get someone to promote for a low price

Technical requirements: how difficult is the process of making the ad

Lead-time: How much time is necessary to get the ad ready

Selectivity: Is the selected media able to target in on the audience

Reach: The amount of the target audience that is exposed to the message

Advertising medium: Print advertising: Magazines, fliers Broadcast advertising: Radio, television Outdoor advertising: Billboards, events Digital advertising: Internet, social media

Aida (The selling formula)

Action: Directly tell the audience what to do Make them decide to get it

Desire: Make them want the product or service Appeal to their needs and wants Explain why they need the it

Interest: Hold the consumers attention Make them take their time to read over the message Help them pick out the message

Attention: Use something big and bold to catch people's attention

Promotion: Advertising the product What can make people buy it How people find out about the product

Place: Location to sell product Manufacter, Wholesaler, Retailer, Consumer

Price: How much the product costs Find the equilibrium

Product: The product itself Name and labeling How to make it

Maslows motivators

Reasons for demotivation: Lack of recognition Boredom Criticism

Needs: Existence needs(Basics and saftey) People work to earn money Relatedness needs(Belonging and self esteem) Work to earn money but don't want to get to know colleagues Growth needs(Self esteem and self actualization) Work for promotion

Growth needs motivators: Offer support on completing tasks Encourage thinking for themselves Keep people informed

Relatedness needs motivators: Show respect Delegate responsibilities Praise people

Existence need motivators: Pay enough money Good workplace Incentives

Laisezz-Faire: Small direction to members Mainly independent Advice is only given if asked

Democratic: Everyone is involved Supports teamwork Ideas are supported

Autocratic: Boss workers around One way to do things No other opinions or ideas

Controlling: Make sure company goals are met If not met figure out why If met try to surpass it

Organizing: Roles and responsibilities of workers Structure of organization

Planning: Researching Forecasting the future