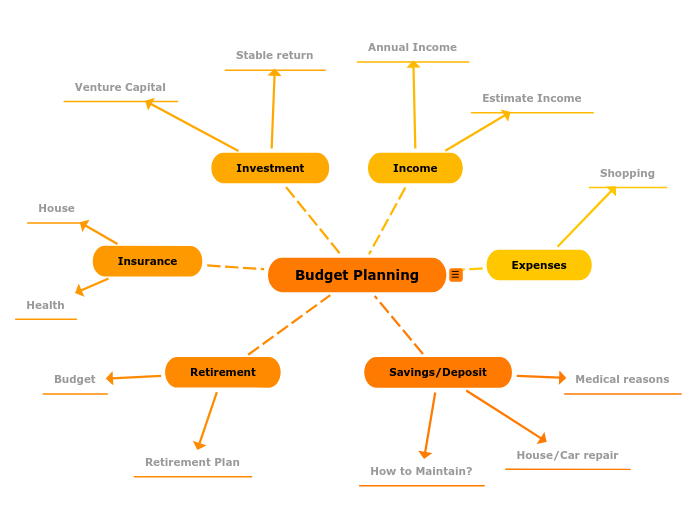

Budget Planning

Keywords: budget, financial plan, savings, investing, costs

Budgeting is the process of planning and creating a detailed scheme on how you will spend and/or invest the money you have.

Expenses

Your expenses are the necessities you are using against cost.

These are recurrent expenses as you would need to pay monthly (rent, bills, etc.) according to your usage.

Shopping

Income

Income represents the payment you get from your work.

For most people, income is the same for a longer time. So you need to estimate your next year's income to make a financial plan.

Estimate Income

Annual Income

Investment

If you want higher interest rates than the savings can offer you, you can invest your money.

Investing is not an easy decision as you will bear the high risk with the possibility of loss.

You should do an analysis of different investment programs to maximize your profits.

Venture Capital

Stable return

Insurance

Insurance is a kind of protection against loss. Anyone can face accidents, and insurance would take the pressure off, as well as support your family.

Health

House

Retirement

Plan your retirement and put aside separately for this budget.

Budget

Retirement Plan

Savings/Deposit

A deposit is money you put aside for later use.

If you choose to deposit your money in a bank for a longer period, you can get back a stable interest rate at the end of that period.

You should also know that savings will fluctuate, sometimes you will need to use them sometimes you will be able to put aside more. However, you should maintain the habit of saving money.

How to Maintain?

House/Car repair

Medical reasons