9A 3 Accounting

Types of Companies

Partnership

Owned by 2 or more people

Sole Proprietorship

Owned by only one person

Corporation

Owned by a large group of people

Employees

Forms of getting paid

Hourly

Some federal regulations establish which employees should be paid per hour. An employee should complete 40 hours of work, any extra hours worked should be paid at a rate not less than time and one half their regular rates of pay

Salary

Salaried employees are paid based on a weekly, monthly or annual salary. They are designated this way because their responsibilities are not related to the time spent on the task. It does not increase or decrease with extra or fewer hours.

Formulas

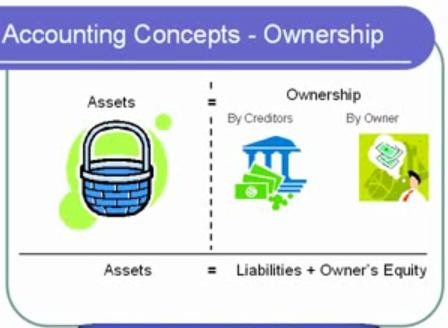

Assets = Liabilities + Owner's Equity

Net Pay = Gross Pay - Deductions

Hourly Pay: $12.50 Hours worked: 42

Overtime Pay = 12.5 x 1 - .5 = 18.75

Weekly Pay = (40 x 12.5) + (2 x 18.75) = $537.50

Terms

Assets

Anything owned by a company that has a value

Liability

The amount owed

Owner's Equity

The rest of the company's assets

Gross Pay

The pay an employee receives before any deduction