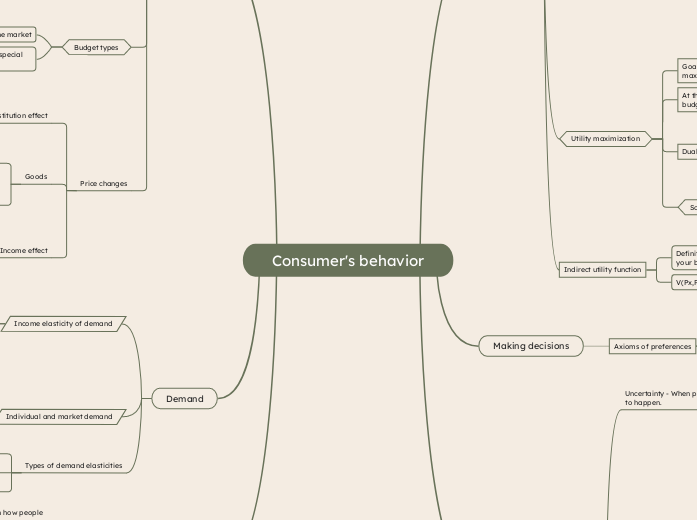

Consumer's behavior

Utility

Utility measures how much satisfaction or happiness you get from consuming something.

Utility = U(x,y)

Indifference curves

MRS - Marginal rate of substitution

MRS represents how much of one good you are willing to trade for another while keeping utility constant

Peculiarities of MRS

Convexity - Person prefers balanced bundles

Diminishing MRS - the more of a good 1 you have, the less good 2 you are willing to give up for an extra good 1

Marginal Utility(MU)

MU - The extra utility from one more unit of something

Calculation of MU - To calculate MU you need to take a derivative of U(x,y) with respect to each variable

MRS formula: MU1/MU2

Indifference curves - are just a graph of all combos of x and y that give the same utility

Key aspects

Key rule - Indifference curves never cross, because that would brake the logic of transitivity

Shape - Indifference curves usually slope downward

Definition - A curve showing all the combinations of two goods that give you the same level of Utility

Higher curves - higher level of Utility

Different types of preferences

Perfect substitutes

Utility function: U(x,y) = ax+by

Indifference curves: straight line as person is ready to trade one good for another at a constant rate

Perfect complements

Utility function: U(x,y) = min(ax,by)

Indifference curves: L-shaped as happiness is only increased if person gets more of both goods

Cobb-Douglas preferences

Utility function: U(x,y) = x^a+y^b

Indifference curve: Smooth, convex curves. They show diminishing MRS - you're willing to trade less of one good for the other as you get more

Utility maximization

Goal - Find the perfect mix of goods that maximizes utility while staying in the budget

Maximize U(x,y) subject to Px*x+Py*y=I

At this moment indifference curve must touch the budget line

MRS = MRT

MUx/MUy=Px/Py

Dual problem of consumer choice

You can not only try to maximize utility, but also to minimize expenditure, while keeping the utility at the same level.

Expenditure function - E(U,Px,Py)

E = total expenditure

U = The target utility level

Px, Py = the prices of the goods

Solutions

Lagrange method

Corner solution

Interior solution

Indirect utility function

Definition - how much utility you get from spending your budget, given certain prices and income

V(Px,Py,I)

Making decisions

Axioms of preferences

Completeness

Any 2 things can be compated

Transitivity

if option 1 is preffered to option 2 and option 2 is preffered to option 3, then option 1 is preffered to option 3

Non-satiation

More is better

Uncertainty and risk

Uncertainty - When person is not sure what is going to happen.

Risk - quantifiable part of uncertainty

Assessing risk - expected utility

Expected utility - weighting each possible outcome by its probability

Expected utility = p1 * U(x1) + p2 * U(x2) + ...+ pn * U(xn)

Attitudes towards risk

Risk averse - people who prefer certainty

Risk loving - people who enjoy taking risks

Risk neutral - those, who rely only on expected value while making decisions

Risk premium

Risk premium - the amount of money that one will pay in order to avoid taking risks.

Risk premium is calculated as a difference between the expected value of the risky option and the amount that someone is willing to accept for certainty

Arrow-Pratt coefficient

This is the way to measure the risk aversion via math. This coefficient tells us how risk averse someone is by looking at the curvature of the utility function. The higher it is, the less risky they are.

Ways of reducing risk

Diversification

Insurance

Only this one is directly related to the topic

Fairness

Fair insurance

The premium that you pay is equal to the expected cost of the risk

Unfair insurace

The premium that you pay is higher than the expected cost of the risk

Hedging

Budget

Definition - The budget constraint shows all the combinations of goods that person can afford with their income and the prices of those goods.

Formula - Px*x + Py*y <= I

Px = price of good x

Py = price of good y

x,y = quantities of the goods

I = income

Budget line

Definition - Budget line is a line which shows combos of goods where you spend all your money

Formula: Px*x+Py*y=I

Slope: -Px/Py

Slope is equal to MRT

MRT

Definition: how much of one good you have to give up to get more of the other

MRT formula: -Px/Py

Change in income or prices

Change in income

More income - Line shifts outward

Less income - Line shifts inward

Change in prices

If Px increases, the line rotates inward

If Py decreases, the line rotates outward

Budget types

Competitive budget: Prices are set by the market

Non-competitive budget: Some might get special offers or advantages

Price changes

Substitution effect

If a good becomes cheeper, you'll tend to buy more of that good and less of other goods that are now relatively more expensive. So, substitution effect is more about relative prices

Normal goods: Price goes down, you buy ,more

Inferior goods: Price goes down, you buy less

Goods

Normal

We buy more when income increases

EI > 0

Inferior

We buy less when income increases

EI < 0

Income effect

If a good becomes cheaper, you fell like you have more free money to spend, so you might buy more of that good or spend money on something else

Normal goods: Price goes down, you buy ,more

Inferior goods: Price goes down, you buy more

Demand

Income elasticity of demand

It measures how much the quantity demanded of a good changes when there's a change in income

EI formula: % change in quantity demanded/% change in income

EI interpretation

EI > 1

Good is income elastic

0<EI<1

Good is income inelastic

EI = 0

Good is income independent

Individual and market demand

Individual - how much a single consumer wants to buy at a specific price

Market demand - the total demand from all the consumers in the market

Types of demand elasticities

PED

Price elasticity of demand

YED

Income elasticity of demand

XED

Cross-price elasticity of demand

Behavioral economics

Behavioral economics focuses on how people actually behave

Main violations of tradicional choice theory:

Bounded rationality

Heuristics

Loss aversion

Framing effects

Anchoring

Time incosistency

Social preferences