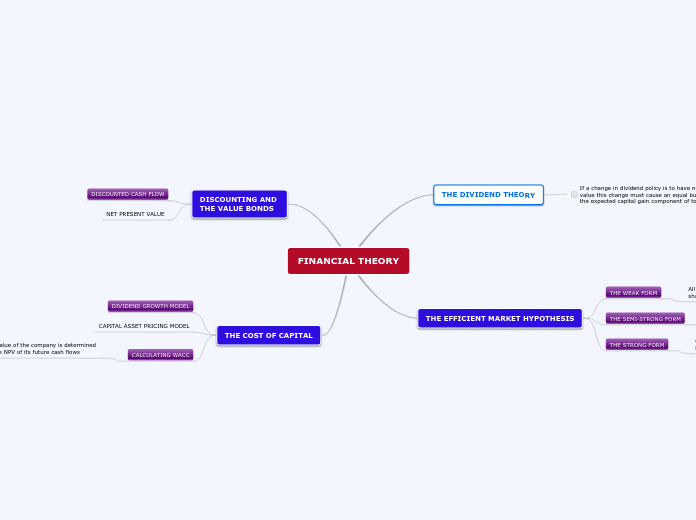

FINANCIAL THEORY

THE DIVIDEND THEORY

If a change in dividend policy is to have no effect on share value this change must cause an equal but opposite change in the expected capital gain component of total return.

THE EFFICIENT MARKET HYPOTHESIS

THE WEAK FORM

All historical price information is incorporated into current share prices.

THE SEMI-STRONG FORM

All published financial information is already included in the current share price.

THE STRONG FORM

Current prices reflect all the available information which could be known.

DISCOUNTING AND

THE VALUE BONDS

DISCOUNTED CASH FLOW

NET PRESENT VALUE

THE COST OF CAPITAL

DIVIDEND GROWTH MODEL

CAPITAL ASSET PRICING MODEL

CALCULATING WACC

The value of the company is determined

by the NPV of its future cash flows