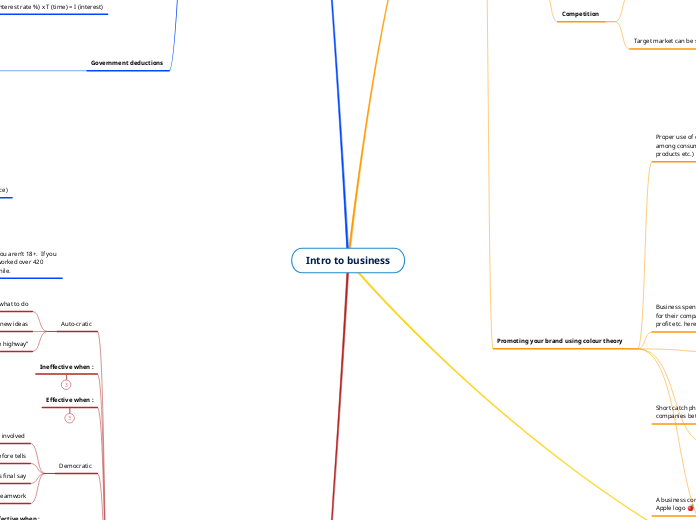

Intro to business

Marketing

All business activities used to

Good or services to satisfy consumers needs and wants

Marketing is the process that connects suppliers with end user

Plan

Promote

Distribute

Price

Fundamental roles

To sell what business make

To manage a business brand or brands

Roles of marketing

Sales

Revenue of your amount of sold products

Distribution

Disregarding a product

Advertising

Promoting a product for your company/business to create revenue and profit and sales

Promotion

Marketing mix (4 p’s)

How potential consumers will find out about a new product

What the message will be (form/content)

What and when will it be delivered

What incentives to buy the new product

Product

Price

Place

Promotion

Development

Creating your product or the contribution to the creation of your product

Research

Gathering data or information to developing your product or creating a business plan etc.

The two C’s

Direct competition

Very similar products addressing the same need. I.e Coke vs Pepsi

Indirect competition

The options are not directly related to each other

Competition

Consumers and the Target Market : The specific segment of population that buys your product is your target market.

Target market can be segmented in two ways

Demographics

Relating to the structure of population

Lifestyle

Not easily defined examples include :

- Social Class

- Opinion

- Activities

- Attitudes and beliefs

Promoting your brand using colour theory

Proper use of colour can effectively create a positive image among consumer and will attract them (into buying your products etc.)

WARM COLOURS

Red, pink, yellow, black

These colours can make and draw a lot of attention to your image to stand out more boldly and legible for consumers to read and as well be more attracted to look at

COOL COLOURS

Blue, green, purple, white

These colours are what makes your image more toned down from all the bold colours and letters but instead allow you to process what’s happening in the image more clearly

Business spend lots and lots of money just to create an image for their company in order to attract consumers and produce profit etc. here is how they do it : ⤵️

SLOGANS

Short catch phrase/Jingle used for consumers to memorize companies better e.g “Finger lickin’ good” (kfc)

LOGO/TRADEMARKS

A business combines their name with a special symbol e.g Apple logo 🍎

BRAND NAME

A word, or a group of words to distinguish a business product from its competitors e.g McDonald’s

Accounting

Balance sheets

Assets

Things that you own with a $ value i.e cash

Liabilites

Things you owe to a business or person i.e bank loan

Owners equity

“What’s leftover”

(ONLY) 4 $ signs per balance sheet

ACCOUNTING EQAUTIONS

Fundamental accounting equation

A = L + OE

assets = liabilities + owners equity

Income statement eqaution

R - E = NI/NPL revenue - expenses = net income/net profit loss

Income statements

Revenue

$ (money) earned from performing a service or selling goods

Expense

$ (money) spent on things

Net income/loss

Net loss : expenses are greater than your revenue

Net income : profit

(ONLY) 3 $ signs per income statement

Personal finance

Types of payment

Salary

Based on a annual (yearly) amount, you can get paid in multiple ways : paid on a regular schedule, paid weekly, bi-weekly (every 2 weeks) or monthly.

FORMULA (just salary)

Annual salary/ # of pay periods

FORMULA’S (for how you can get paid)

Weekly (every 7 days or 1 week)

Salary/52 = $ amount paid/week (per week)

Bi-weekly (every 2 weeks)

Salary/26 = $ amount paid/week (per week)

Monthly (every month)

Salary/12 (months in a year) = $ amount paid/month (per month)

Hourly rate + Overtime

Get paid a set amount per hour. If any overtime (O/T) you will get paid an extra (1.5) double

FORMULA

Hourly rate x # of hours worked

Commission

Get paid a % amount depending on your sales or how much you sell

Straight commission

% (percentage) rate x amount sold

Salary + commission

% (percentage) x amount sold + (yearly/annual) salary

Piecework

Get paid for every item you make. The more you produce/make the more profit (money) you generate

FORUMLA

PW (piecework) rate x # of items

MANAGING YOUR PERSONAL FINANCES

The main part on “Personal finance” is to find way to organize and learn how to manage your spendings. Here are some things to consider and follow before making “big purchases” or big decisions.

Having money available

Need to get pre-approved from bank : used to determine how much of a loan you can quality or be trusted with. Banks will look into your financial position : Salary, credit rating, assets, cash, work history etc.

Costs (expenses)

How much disposable income (take home pay) is left to pay your monthly bills such as : Food, clothing, taxes, utilities etc.

Buyer behaviour

Individuals have different needs and wants that influence their buying decision.

Quality

Should you pay more & get high quality or should you pay less and mediocre quality?

Comparison shopping & product info

How do you compare big items? Make a list detailing important ‘must haves’ for YOU. Compare your different choices (pros vs cons) to decide on what’s best for YOU.

Service

Something that you pay someone else to do for you because you don’t have the particular skills or knowledge to do so. i.e Real Estate Agent, mechanics, stock broker etc.

Warranties & guarantees

Warranty = provides after sales service on a product for a specified period of time.

Guarantees = a formal promise or assurance that goods/services are of a specific quality

Ways we spend our money efficiently

SPEND : goods & services

INVEST : to increase value overtime

SAVE : for future usage

DONATE : to help assist others in need

RULE OF 72

The “Rule of 72” is a formula used to calculate on how long it takes for your money to double

FORMULA

72/I (interest rate) = # of years to double money

CHEQUES

PAY CHEQUE FORMULA

GP (gross pay) - Deductions = NET PAY (your take Home pay)

COMPOUND INTEREST FORMULA

PV (present value) x R (interest rate %) x T (time) = I (interest)

Government deductions

By law, your employer/manager must take of 3 deductions off your paycheque to send money to the government. + The government also makes sure that you paid the correct amount of taxes and on time. You are expected to file an income TAX RETURN by April 30th every year.

THE 3 MANDATORY DEDUCTIONS

Income tax

Anyone who earns (any) income has to pay a mandatory federal and provincial income tax

CPP (Canada pension plan)

Anyone who works & is over 18 years of age must contribute to CPP. Employees, employers, bosses etc. all contribute to CPP.

EI (Employment insurance)

Pay into it from every pay cheque even if you aren’t 18+. If you ever get laid, haven’t been fire, and have worked over 420 hours you can collect an EI cheque for a while.

Leadership

3 types of leaderships

Auto-cratic

Telling others what to do

Not open to new ideas

“It’s my way or the highway”

Ineffective when :

Effective when :

Democratic

All members are involved

Ask before tells

Leader has final say

Support teamwork

Ineffective when :

Group is not intrested (being lazy)

Members don’t know how to do their job or are clueless

Members don’t like each other

Effective when:

More time

Members are more intrested

Members know how to do their job

Laissez - Faire

Gives little to no direction nor motivation to team members

Advice is offered only if asked

No one seems to be in charge

Ineffective when :

Group needs to be told what to do

Members don’t value each other

Members don’t like each other

Effective when :

Members like their job and know what to do

True team work

All members know what must be done

LEADERSHIP GOALS :

Leadership style is the manner and approach of :

Providing directions

Implementing ideas

Motivating teammates to do their best etc.

Positive leaders

Positive leaders use “rewards” to motivate their employees

Devolpment Opportunities

Independence

Acknowledgment

Raises, Bonuses

Lieu time off

Negative leaders

Negative leaders use “penalties” or “discipline” with their employees. These leaders act domineering and feel superior.

Days off without pay

Reprimanding in front of others

Assigning unpleasant job tasks (to employees)