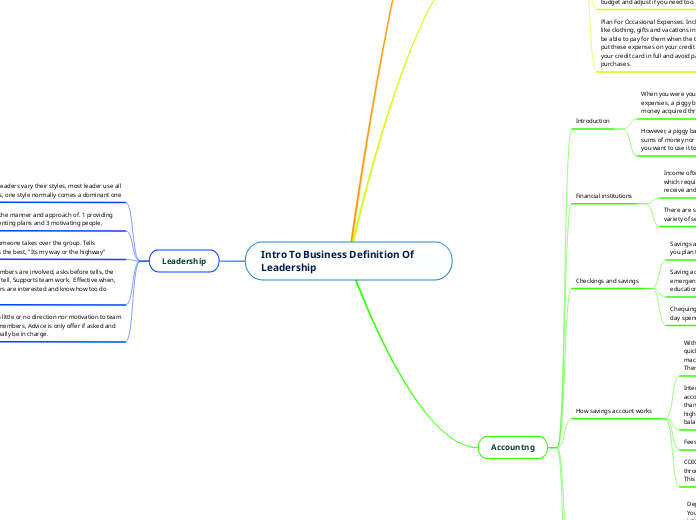

Intro To Business Definition Of Leadership

Leadership

Leadership goals- Leaders vary their styles, most leader use all three of there styles, one style normally comes a dominant one

Leadership style is the manner and approach of. 1 providing direction 2 implementing plans and 3 motivating people.

Autocratic- when someone takes over the group. Tells everyone his idea is the best, "Its my way or the highway"

Democratic- All members are involved, asks before tells, the leader has the final tell, Supports team work. Effective when, more time, members are interested and know how too do there job.

Laissez- faire-Gives little or no direction nor motivation to team members to team members, Advice is only offer if asked and nobody seems to really be in charge.

Marketing

Marketing has 2 main roles. One, to sell what a business makes. two, to manage a business brand or brands

Branding, Brand name. A word or group of words, to distinguish a business product from its competitors. Logo/trademark A business combines their name with a special symbol. Slogan, short catchy fraze

The product service mix, Retail stores provide value to the products they sell. Delivery, Installation, Extended warranties, Alterations, Advice, Carry outs, Gift outs.

Personal Finance

Income management. Expectation's , distinguish between types of personal income and types of business income. identify the factor that need to be assessed in order to make effective purchasing decisons. demonstrate financial planning skills and produce a business or personal finance plan.

To calculate your income, follow these rules. weekly checks multiply by 4.333,Every 2 weeks checks multiply by 2.167, Twice a month checks multiply by 2, and irregular annual income divided the net total by 12

Estimating Your Variable Expenses. your income and fixed expenses should be straightforward, for variable expenses use reasonable estimates to create your first budget, Then track your spending over the next few months right down everything you buy in a notebook keep for everything or create a spreadsheet. After tracking for a few month go back to your budget and adjust if you need too.

Plan For Occasional Expenses. Including occasional expenses like clothing, gifts and vacations in your budget means you will be able to pay for them when the time comes, if you choose to put these expenses on your credit card, you'll be able to pay off your credit card in full and avoid paying interest on your purchases.

Accountng

Introduction

When you were young and you had very little income and few expenses, a piggy bank might have worked to collect and store money acquired through an allowance, gifts, or doing odd jobs.

However, a piggy bank is neither a secure location for large sums of money nor a convenient place to have your money if you want to use it to pay bills or purchase large items.

Financial institutions

Income often comes in the form of a cheque or a direct deposit which requires a financial institution to process so that you can receive and use the money you earned.

There are several types of financial institutions that offer a variety of services to help you manage your money.

Checkings and savings

Savings and chequing accounts are safe places to put money you plan to spend soon:

Saving accounts – allow you to set money aside for emergencies, save for a large purchase or build funds for your education – while keeping your money readily accessible.

Chequing accounts – for money that you plan to use for day-day spending or to pay bills

How savings account works

Withdrawals – You can get money out of the account easily and quickly by using a debit card, withdrawing cash at a bank machine (ATM) or withdrawing cash through a bank teller. There may be daily limits on how much you can withdraw.

Interest – You will earn some interest on the money in your account. Savings accounts usually pay slightly more interest than you would get in a chequing account. You may get a higher interest rate if you keep more than the minimum balance in your account.

Fees –.fees vary depending on the type of account you choose

CDIC protection – Your money is protected, up to set limits, through the Canada Deposit Insurance Corporation (CDIC). This doesn't apply to U.S. dollar accounts.

How checking account works

Deposits – You can deposit any amount of money at any time. You can also get your employer to deposit your pay directly into your account.

Withdrawals – You can get money out of the account easily and quickly by using a debit card, withdrawing cash at a bank machine (ATM), withdrawing cash through a branch teller, writing a cheque, paying bills online, either one at a time or through automatic monthly payments, and moving money from one account to another. There may be daily limits on how much you can withdraw and the number of withdrawals.

Interest – You will earn little interest, if any, on the money in your account. Savings accounts pay slightly more interest.

Fees – Fees will vary, depending on the type of account you choose.

CDIC protection – Your money is protected, up to set limits, through the Canada Deposit Insurance Corporation (CDIC). This doesn't apply to U.S. dollar accounts.

Ways to lower account fees

1.watch how many transactions you make Some accounts let you make as many transactions as you like for a flat monthly fee, but it’s usually higher. Other accounts place a limit on how many transactions you can make for the fee you pay. You'll pay more if you go over your limit.

2. Watch your account balance Some accounts offer lower fees if you keep a minimum balance in your account at all times. You will pay an NSF (not sufficient funds) fee if you make a payment from your account and there is not enough money to cover it.