por Isabel Alfaro 5 anos atrás

589

Alfaro_Isabel_MPI_Task4

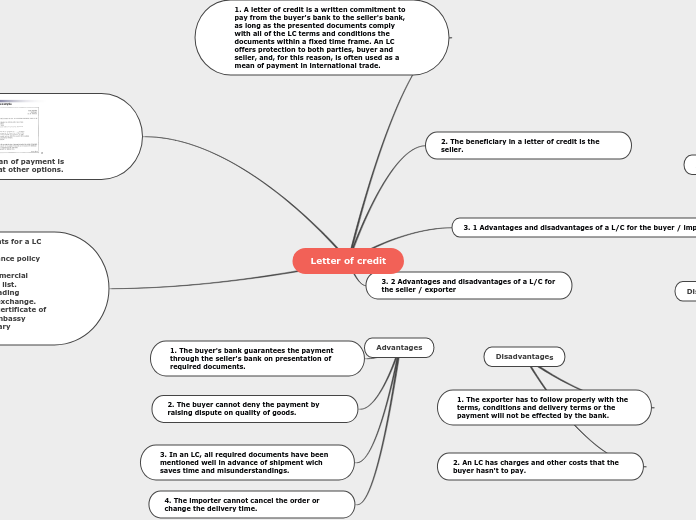

A letter of credit (LC) serves as a reliable financial instrument in international trade by offering a guarantee of payment from the buyer's bank to the seller's bank, contingent upon the presentation of specified documents.