International Trade Finance

Doctrine of Strict Complicance(strict principle)

'fraud exeception'

constructive knowledge sufficient

ought to have known when every reasonable care is taken

establish: S acting fraudulently in tendering docs under LC

courts will interfere with IB's obligation to pay under LC / Bank can refuse to pay on docs

Sztejin v J. Henry Schroder Banking Corporation

Held

S restrained from calling payment under LC

IB's obligation should not protect unscrupulous seller

before docs presented

fraud brought to IB's attention

'payment against documents'

buyer has to seek remedy for breach in separate action

Hamzeh Malas & Sons v British Imex Industries Ltd

innocent party can't stop bank from paying under LC

seek remedy: breach of contract

banker is not concerned with contract of sale

Art 3 UCP

in breach of contract

goods sent are wrong

payment effected on transfer of documents

why

buyer & seller unknown to each other

distance

documents in order

Art 4 UCP - parties deal with docs only

applies to all contracts involving credits

Raising finance - Security of Imported Goods

trust receipt

B undertakes

holds proceeds on trust

sells goods as agent for bank

to hold docs released on trust for Bank

common form of security

pledge of goods

other shipping docs

bills of lading

Involves contracts between parties in at least 2 different countries

Buyer's obligation is to pay

Seller's obligation is to deliver the goods

Different Types of Credit

"Back-to-back" Credits

issued at S’s request to his supplier(entirely distinct from the credit issued at B’s request to S)

Transferable Credit

Art 48 UCP

a. beneficiary has right to request bank to effect payment /acceptance/ negotiation to 1/ more parties (2nd beneficiaries)b. credit can be transferred only if expressly designated as “transferable” by IBc. bank required to effect transfer is not obliged to effect such transfer except to extent & manner expressly consented to by bank

Negotiation Credit

*that payment will be made w/o recourse to drawers/bona fide holders of bill of exchng

AB (authorised by IB) negotiates bill

S draws bill of Xchange on IB

Acceptance Credit

*that IB will accept drafts

accepting bank pay at maturity of accepted bill

S present term bill of xchange to IB/AB

Deferred Credit

*that payment will be made per contract

Sight Credit

terms: *that payment will be made

sight bill of xchnge is drawn on IB/AB

payment against documents

Standby Credits

promise by IB to pay S

certain events only

not used to effect payment

default by B (IB's Customer)

similar to guarantee

payment on presntatn docs

Documentary Credit

S sends doc bill

arrange collection thru bank

CB (in B's ctry) instructed not to part with it til payment/acceptance

S's bank (remitting) despatch doc bill to collecting bank

direct to Buyer

accepts/pays on bill

return to S

"documentary bill"

a/c by shipping docs

bill of exchange

Confirmed CreditArt 9(b)

undertakes to pay S on presentation of docs

confirm irrevocable LC

AB becomes CB

AB confirms LC

Art 6a UCP

Art 6(b) clearly indicate

Art 6(c) absence, deemed irrevocable

Irrevocable

Art 9(a) definite undertaking - IB has to honour credit once S fulfils terms*

regardless of C's instructions

Revocable

Art 8(a) can be cancelled by IB w/o notice

Art8(b) reimburse othr bank if docs accepted prior Notice of Cancellation

lower fees (to bank)

obligation to honour can be withheld

contrary instructions from C

ensure $ paid for intl sale of goods

Methods of Effecting Payment

Guarantee from 3rd party

standby credit

documentary credit

performance bond

guarantee

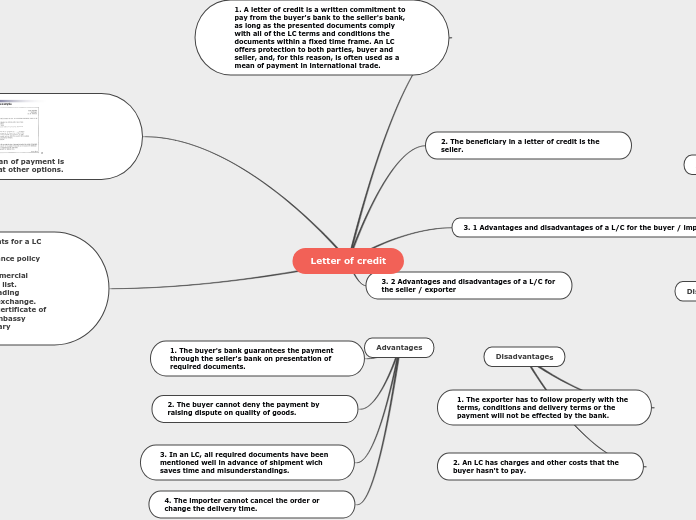

Letters of Credit (LC)/Documentary Credit

defined Art 2 UCP

IB instructed to

OR (b) authorise another bank to effect such payment

provided T&C of credit complied with

against stipulated documents

to pay/accept/negotiate Bill of Xchg

(a) make payment

or to pay/accept bills of exchange drawn by B

to the order of a 3rd Party (Beneficiary)

Customer - applicant for credit

arrangement: IB acts on request and instructions of C

Regulated by UCP

Effective Application

terms interpreted by courts(jurisdictional)

consistant

reliance

certainty

expressly incorporated into contract

Art 1 UCP

Not an intl treaty/convention

supplementted by eUCP(electronic guide)

issued by ICC

Payment in Advance

Financial Instrument

Instructs bank to pay indicated party

eg: cheque