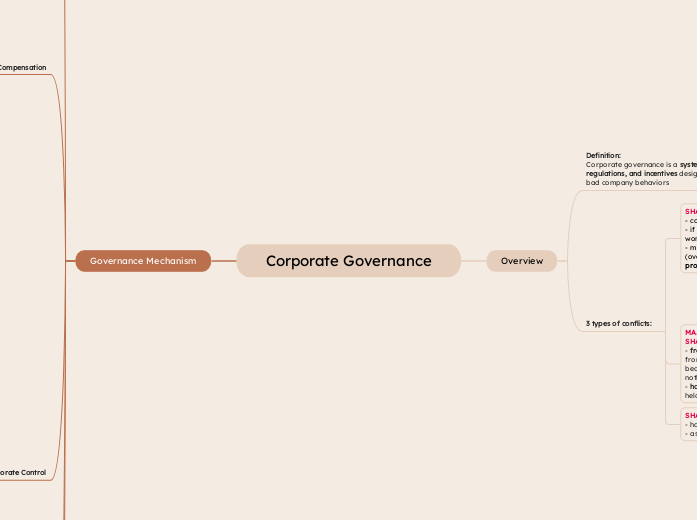

Corporate Governance

Governance Mechanism

Regulation

The SOX Act

In response to massive failures of large public companies and corporate fraud. The accuracy of information given to both boards and shareholders by:

– Mandating a majority of board independence for firms

– Strengthening the auditing processes

– Stiffening penalties for providing false information

– Forcing firms to validate their internal financial control processes

Armstrong et al. (2014): Do independent directors cause improvements in firm transparency?

- independent directors reduce IAC Spread (the cost of issuing new shares, especially when investors don’t have full information and the company must offer a discount to sell the shares), so that it reduces information assymmetry

- when companies add more independent directors, they tend to give more and better forecasts and attract more analyst attention. those all point to higher transparency

Guo & Masulis (2015): Board Structure and Monitoring: New Evidence from CEO Turnovers

- research question: Does the mandated increase in board independence due to NYSE and NASDAQ listing rules (as part of SOX in 2002) in 2003 improve board governance?

- After governance reforms (like stronger committees), boards are more likely to fire underperforming CEOs. This means boards are doing a better job — holding CEOs accountable when performance is poor.

Ownership Structure: Family Ownership

Pro's and Con's

Pro's:

- Little separation of ownership from control

- Focus more on long-term value creation

- Family CEOs may obtain intangible resources such as goal congruence, trust, and social interactions from other stakeholders

Con's:

- Family managers could be difficult to monitor and dismiss

- Conflicts sometimes arise between family owners and other non-family owners

- Succession be problematic sometimes, such as heir is less competent than the founder

- Good for a group may be bad for economy:

-) Market power: When a group controls a large part of the market, it can set prices, block competitors, or reduce innovation

-) Missallocation of resources: The group may grow, but the overall economy grows less because talent and capital are stuck in less productive areas

Anderson & Reeb (2003): Founding-Family Ownership and Firm Performance: Evidence from the S&P 500

Does founding-family ownership matter for firm performance?

- While Faccio et al. (2001) found that family ownership in East Asia can harm performance due to conflicts, the current findings suggest that in well-regulated, transparent markets, family ownership can reduce agency problems—as long as effective outsider monitoring is in place. Thus, family ownership isn’t inherently inefficient; its impact depends on governance quality.

- Using profitability-based measures of firm per-

formance (ROA) it has been fond that family firms are significantly better performers than nonfamily firms

- Family firms, whether young or old, tend to have higher Tobin's Q values than firms not owned or controlled by families. On average, about 10% higher.

- One interpretation is that the family understands the business and that involved family members view themselves as the stewards of the firms.

The Market for Corporate Control

The threat of takeover

- takeover is to replace poorly performing management

- the stronger the protections that prevent managers from being removed during a hostile takeover, the weaker the corporate governance tends to be

Bertrand & Mullainathan (2003): Enjoying the Quiet Life? Corporate Governance and Managerial Preferences

- anti-takeover laws, allow:

-) creating a moratorium (waiting period) of 3–5 years where certain business deals are blocked

-) Board must approve deals like mergers, selling assets, or big stock transactions must be approved by the board before takeover happens

- When BC law passed, wages increased by about 1.3%

- before the law, the wage incremental is low

- after the law, the wage incremental keeps raising

- Plant death (less likely shut down existing plants after law passage), Plant birth (less likely to open new plants after law passage), firm size insignificant change insignificant change in Capex after law passage, firm size is insignificant change after law passage

- both of productive efficiency represented by total factor production and profitability represented by return on capital go down after law passage

- overall, after the laws passed, managers become protected by anti-takeover laws (less pressure), but corporate governance become weaker, and hurts company performance.

Bebchuk et al. (2009): What Matters in Corporate Governance?

- Entrenchment Index (E-index) is a score that measures how much protection managers have from being removed by shareholders or hostile takeovers

- They calculate the Entrenchment Index for many companies. They run regressions to see how the E-index relates to firm value (measured by Tobin's Q)

- The result is higher E-index, the lower is Tobin's Q (only 6 important anti-takeover provisions (rules) that have been chosen by the author are significant).

Executive Compensation

Compensation and Risk Taking

Shue and Townsend (2015): How Do Quasi -Random Option Grants Affect CEO Risk -Taking?

- research question: does gicing CEOs more stock options make them take more risks?

- giving CEO more options makes CEO taking more risks and company's stock becomes more volatile

- giving CEO more options makes them taking more debt

- giving CEO more options do not significantly increase investment

Compensation and Firm Performance

Core and Larcker (2002): Performance consequences of mandatory increases in executive stock ownership

- companies with bad stock performance and the CEOs own less stock than expected are more likely to adopt a target ownership plan

- operating performance (ROA) improves after adopting the plan (it has been seen since year 1)

- stock price performance slightly improved in the first six months

- These results illustrate that when managers with below-equilibrium equity ownership are required to increase their ownership levels, there are improvements in firm performance.

Mehran (1995): Executive Compensation Structure, ownership, and firm performance

- Executives who already own shares don’t get as much additional equity pay

- Independent boards (more outside directors) tend to favor equity-based pay

- Large outside investors might reduce the use of equity pay — possibly to avoid dilution

- when CEOs own more shares or are paid more in equity, they work harder for shareholders and the company performs better. it represents by positive and significant sign between dependent variable (Tobin's Q and ROA) and independent variables (% CEO's equity based on compensation and % shares and stock option outstanding held by CEO)

Compensation Policies and Types of Compensation

conflict of interest between managers and owners can be mitigated by aligning their interests through managerial compensation policies, such as:

- bonuses linking to earnings growth

- restricted stock

- stock options

Board of Directors

Co-opted / Capture board

- are those appointed after the CEO assumes office

- the board is no longer independent because it works more for the managers than for the shareholders

Hwang and Kim (2009): It Pays to Have Friends

- CEO with less independent board (more friends) get paid more , even if they don't deserve it

- CEOs who get extra money from having friendly boards don't make the company better represented by negative and significant in all of performance indicators as independent variables (ROA, ROE, ROS)

- When the board is not independent (friendly), the link between CEO pay and company performance gets weaker

- In friendly boards, bad performance does not lead to CEO being fired easily

Coles et al. (2014): Co-opted Boards

- co-option & CEO turnover-performance sensitivity: when there is more co-options, the board becomes weaker. it becomes harder to fire a bad CEO when the company's performance is poor. that's why CEO turnover is decreased

- co-option and CEO-pay: with co-option, CEO payment is increased even if the CEO didn't necessarily perform better

- co-option and CEO pay-performance sensitivity: when the CEO has picked most of the directors, the link between CEO pay and company performance become weaker. in co-opted boards, CEOs get paid a lot even if the company does badly

- co-option and investment: when the board is co-opted, companies spend more on investment.

- Co-opted Independent and Co-opted Non-Independent directors are both bad for governance

- Non-Co-opted Independent directors are good monitors

Are their service valuable?

Nguyen and Nielsen (2010): Evidence from Independent Directors Sudden Death

- when an independent director dies, the stock price drops, especially around the event dates (between -1 and +2 days of the death). it means that investors believe independent directors are valuable, losing one is bad for company

- when the death of independent director causes a loss of independent control (majority of change), the stock price drops more. investors worry that losing independent majority leads to lack company monitoring and managers act in their own interest more.

- if an independent director with an important job (e.g., chairman, audit committee, compensation committee, etc) dies, investors get more worried and the stocks fall more

The role of directors

- monitor management, make sure management acts in the best interests of shareholders

- set strategic directions

- appoint and remove CEO

- protect shareholders' interest

Types of board directors:

- inside directors

- gray directors (not as directly connected as inside directors)

- outside (independent) directors

Overview

3 types of conflicts:

SHAREHOLDER VS CREDITORS

- happen during firms in distress

- asset substitution and debt overhang

MAJORITY SHAREHOLDERS VS MINORITY SHAREHOLDERS

- free rider problem, Since all shareholders benefit from improved governance, but only the activist bears the cost, most investors choose to do nothing.

- hard to monitor managerial actions in widely held company

When ownership is concentrated (diffuse), agency conflicts between shareholders and manager are small, however:

- Large controlling shareholders could extract private benefit of control from

minority shareholders (e.g. self dealing transactions, not-profit maximizing objectives)

- entrenches managers because less subject to monitoring by boards of directors

prevalent in a country where ownership concentration tends to be high and legal protection is weak

SHAREHOLDERS VS MANAGERS

- comes from separation ownership and control

- if each party maximizes their own utility, agent won't act in the best interest of principals

- managers may engage in empire building (overinvestment), quiet live (underinvestment), pet projects, and excessive perquisites

To mitigate:

-align the interests of both parties by monitoring them involving shareholders and BOD

- reward and punishment

Definition:

Corporate governance is a system of controls, regulations, and incentives designed to prevent bad company behaviors