Cryptocurrency 101 - Day 2

Web3

NFT: New-meta Soulbound token

Benefits

One more concern is that a reputation-based community may turn into a social credit system where people with higher ratings will get more benefits and others may get banned. This raises ethical questions and doesn’t give people a chance to improve.

Another method requires a person to choose a group of so-called guardians and give them the right to change their wallet keys by majority vote. What if a person loses contact with one of them or their relationship sours? This is life, anything can happen, so it will be difficult to entrust your Soul recovery to a group of people who may let you down, even if they did not do it intentionally.

The whitepaper by Vitalik Buterin, Glen Weyl, and Puja Ohlhaver suggests a number of methods to recover Souls, but those methods still need to be tried out and approved. For example, a community recovery model would require a member from a qualified majority of a (random subset of) Soul’s communities to consent when recovering a Soul’s private keys.

There are several concerns related to the possible implementation of soulbound tokens in the future, and the absence of 100% proven methods to recover lost Souls is one of them.

Enhance trust among members of the decentralized society

SBTs will provide DeSoc members with the means to check people’s reputations, so they will trust each other more than they would through casual interactions on social media or through digital projects.

Guarantee document authenticity

Digital verification and documentation will be typical features of soulbound tokens, to the benefit of both individuals and institutions. Your documents will be easy to store and take with you anywhere, and it will be faster for agencies to verify their authenticity.

Non-tradable and non-transferable

Compared to NFTs, which are easy to buy, collect, or hoard, SBTs don’t offer that. Why is this a benefit? Because soulbound tokens will require effort to get, and they will serve a more important purpose than just making money, such as building a person’s reputation and allowing them to take out loans and access specific projects.

Reduce dependence on centralized services

Currently, most of the services are centralized, which means that companies can access and collect our personal information for marketing and other purposes. With soulbound tokens, people have sovereignty over their data. It will be users themselves who manage their personal info and decide who can access it and for what reasons.

Usecases

Reputation indicator

Soulbound tokens can also become an indicator of reputation on the Web3 network. People with a good reputation can help develop decentralized autonomous organizations (DAOs) that will be even more active in Web3. For example, people holding respectable SBTs can get majority votes to stand guard over the DAO’s integrity and protect the organization from bad actors.

Attendance verification

This use case is very similar to what a Proof of Attendance Protocol (POAP) offers these days. The difference is that the SBTs’ main purpose is to verify that the user actually attended an event and a POAP is an NFT that organizations use as part of their loyalty programs and marketing campaigns.

Digital ID and memberships

Users will also find it convenient to keep all their IDs inside one digital wallet instead of always having to carry a physical wallet full of cards.

Our IDs and membership cards can also be presented in the form of soulbound tokens. Gyms, sports clubs, libraries, and any kind of institution can issue SBTs to their members and enable them to store tokens in their wallets. In this way, people will have access to their data and visits and can keep these tokens for life.

Medical record management

It will be patients who have full control and access to their medical records, and they will be able to quickly verify their identity and share their medical history with doctors. This is especially important when the patient switches doctors and hospitals and seeks insurance. With SBTs, they won’t need to make hard copies of their papers. Instead, they will share (as well as revoke) access to their data with a few clicks.

When people seek medical help, the extra headache of finding a doctor, explaining their medical history, and dealing with an insurance company is not exactly what they need at that moment. If doctors and patients start using SBTs to store medical records, most of these problems can be avoided.

Credit reports

If a user needs to take out a loan, they can provide lenders with access to their credit profile that will be represented by SBTs. In this way, lenders will be able to quickly check the user’s credit history and approve the loan (or not, depending on how diligent the user has been in their previous payments).

Proof of professional skills

Soulbound tokens can represent a person’s credentials related to their educational and work background in Web3. These can be diplomas, professional certificates, work history, and resumes. All this data will allow a potential employer to see that all documents are verified and the applicant’s skills are therefore proved.

All in all, the adoption of SBTs is a logical step towards decentralization. And this is exactly what blockchain and Web3 are striving to do.

Users will not be able to sell their soulbound tokens or transfer them to another person. Thus, SBTs will not bring users any financial gain, but instead will help people protect their identities and give them maximum control over their personal data. In fact, the soulbound token holder will be able to control who is granted access to the data behind the token and can decide to revoke this access.

It’s important to note that soulbound tokens, just like NFTs, cannot be issued without a blockchain. They will forever remain there and will be tied to a specific user for life.

On the other hand, wallets are also called Souls. People can have numerous wallets, or Souls, that will safely store records from different areas of their lives such as education, medical history, work experience, and so on.

Before getting into how SBTs work, we should first find out how and by whom they can be created. The term associated with the process of issuing and storing personal records is called a Soul. This can be a company, an institution, or an entity. For example, you graduate from a university and receive your degree certificate. Your university, which will issue a digital certificate and a token, will be the Soul in this case.

Who

The idea of soulbound tokens and a decentralized society (DeSoc) governed by its users was described fully in a whitepaper by Vitalik Buterin, Glen Weyl, and Puja Ohlhaver published in May, 2022.

NFT:Market History

Future Implications of NFTs

Cross-Industry Adoption: NFTs are extending beyond art and gaming, with applications emerging in fashion, sports, and even virtual identities.

Supply Chain Transparency: NFTs can be used to track the provenance and authenticity of physical goods, ensuring transparency and trust.

Tokenization of Real-World Assets: NFTs have the potential to tokenize real estate, collectibles, and other physical assets, enabling fractional ownership and liquidity.

NFTs in Music and Entertainment

Celebrity Engagement: NFTs have attracted celebrities who release exclusive content or merchandise in the form of NFTs, engaging directly with fans.

Ticketing and Events: NFTs are used for ticketing and event access, enhancing security and reducing fraud.

Royalties and Licensing: NFTs provide a new way for musicians and content creators to earn royalties and maintain control over their intellectual property.

NFTs in Gaming

Virtual Real Estate: NFTs extend to virtual worlds, where players can buy, sell, and develop virtual properties.

Play-to-Earn: Blockchain-based games leverage NFTs to enable players to earn real-world value by participating in the game's ecosystem.

In-Game Assets: NFTs allow gamers to own and trade in-game items and assets securely.

NFTs in the Art World

Marketplaces: Platforms like OpenSea, SuperRare, and Rarible have emerged as popular NFT marketplaces.

Authenticity and Scarcity: NFTs provide a way to verify the authenticity and scarcity of digital art, giving artists more control and ensuring value for collectors.

Digital Art: NFTs have revolutionized the art world by enabling artists to sell and monetize digital artworks directly to collectors.

History of Cryptokitties and Success Stories in the NFT Space (Early to 2023)

The Origin of NFTs

Ethereum Blockchain: NFTs are predominantly built on the Ethereum blockchain, utilizing its smart contract functionality to ensure ownership and traceability.

Early Adoption: NFTs first gained significant attention with the introduction of CryptoKitties in 2017.

Key characteristics

Programmability: Smart contracts enable additional functionalities such as royalties for creators.

Interoperability: NFTs can be bought, sold, and traded on various marketplaces.

Ownership: NFTs provide verifiable ownership and provenance.

Uniqueness: Each NFT is distinct and cannot be replicated.

Explanation: Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are unique digital assets that represent ownership or proof of authenticity of a specific item or piece of content.

Definition: NFT stands for Non-Fungible Token.

NFT

DeFi

Lending

Higher Rates than tradional banking

Why

DeFi applications offer various financial services, such as lending, borrowing, and yield farming, without intermediaries.

DeFi aims to recreate traditional financial systems with decentralized, blockchain-based alternatives.

Decentralized Finance, or DeFi, is an emerging sector within the cryptocurrency ecosystem.

DApp

Initial Coin Offering (ICO): Revolutionizing Fundraising in the Crypto Market

Success Story

Tezos (XTZ): Tezos's ICO in 2017 gathered significant funding for its self-amending blockchain platform, emphasizing governance and flexibility.

EOS (EOS): EOS's ICO in 2017 raised substantial funds for building a scalable and decentralized blockchain platform, attracting attention for its ambitious goals.

Chainlink (LINK): Chainlink's ICO in 2017 enabled the development of its decentralized oracle network, which has become a crucial infrastructure for connecting smart contracts with real-world data.

Binance Coin (BNB): Binance's ICO in 2017 helped fund the development of the Binance cryptocurrency exchange, which has since become one of the largest and most influential in the industry.

Ethereum (ETH): Ethereum's ICO in 2014 raised funds to develop a decentralized smart contract platform, becoming one of the most successful ICOs and paving the way for a multitude of projects.

ICOs have given rise to several success stories, with some projects achieving remarkable growth and success. Here are five notable examples:

Investors participate in ICOs by purchasing the project's tokens, often in exchange for established cryptocurrencies like Bitcoin or Ethereum.

ICOs typically occur in the early stages of a project's development and aim to secure capital to fund further development, marketing, and operations.

An Initial Coin Offering (ICO) is a fundraising method used by blockchain-based projects to issue and sell their native tokens or coins to investors.

ICOs provided an alternative to traditional funding methods and facilitated the rapid growth of the cryptocurrency market.

ICOs allowed startups to raise funds by selling their own tokens in exchange for cryptocurrencies like Ethereum or Bitcoin.

The rise of Ethereum also led to the emergence of Initial Coin Offerings (ICOs).

Stablecoins

Stablecoins provide stability and act as a bridge between traditional financial systems and cryptocurrencies.

Stablecoins, pegged to fiat currencies like the US Dollar, were introduced to address this issue.

Volatility has been a significant concern in the cryptocurrency market.

Shitcoins: Exploring the World of Alternative Cryptocurrencies

Summary

As with any investment, conducting thorough research and exercising caution is essential to minimize risks and make informed

Understanding what defines a shitcoin and its impact on the market is crucial for investors to navigate the crypto landscape wisely.

Shitcoins represent a speculative and high-risk aspect of the cryptocurrency market.

Shiba inu (SHIB)

SHIB operates on the Ethereum blockchain and utilizes decentralized exchanges for trading.

It takes its inspiration from the Shiba Inu dog breed and aims to be the "Dogecoin Killer" by offering meme-inspired features and a community-driven ecosystem.

Shiba Inu Coin was created in 2020 as an experiment in decentralized community building.

$1 Billion

Dogecoin (DOGE)

While it started as a joke, Dogecoin lacks inherent utility and a clear long-term development roadmap, making it a prime example of a shitcoin.

Dogecoin began as a meme cryptocurrency but gained popularity due to its vibrant community and viral content.

$88.8 Billion

Bitconnect (BCC)

The project eventually collapsed in 2018 amid regulatory scrutiny, resulting in significant losses for investors.

It operated as a lending platform promising high returns through a volatile trading bot.

The crypto platform launched in 2016 but collapsed in 2018 after pilfering $2.4 billion from over 4,000 people from 95 countries. The alleged founder of Bitconnect, Satish Kumbhani, was charged by the DOJ in February. He is also subject to a police investigation in India and his whereabouts are currently unknown

Market cap

$2.5 billion

Impact of Shitcoins on the Market

Negative impacts:

Fraudulent shitcoins can lead to scams, financial losses, and reputational damage to the cryptocurrency industry.

Shitcoins can create market noise and distract investors from legitimate projects.

Positive impacts:

Shitcoins can also serve as experimental platforms for testing new ideas or technologies.

Some investors see opportunities for quick profits by trading shitcoins during periods of market volatility.

Shitcoins can have both positive and negative impacts on the crypto market.

How

to identify

Poor community engagement: Legitimate cryptocurrencies usually have active and engaged communities, while shitcoins often lack genuine support.

Excessive marketing: Shitcoins may rely heavily on aggressive marketing tactics, promising unrealistic returns or exaggerated features.

Lack of transparency: Shitcoins often have limited information available about their team, technology, or roadmap.

It's crucial to differentiate between legitimate cryptocurrencies and shitcoins to make informed investment decisions.

Unlike established cryptocurrencies like Bitcoin or Ethereum, shitcoins are typically associated with high-risk investments.

These coins often have limited functionality, poor development, or are created purely for speculative purposes.

A shitcoin refers to a cryptocurrency that lacks fundamental value, utility, or credibility.

Introduction

Let's explore what exactly defines a shitcoin and its impact on the crypto market.

In this presentation, we will delve into the concept of "shitcoins," a term used to describe alternative cryptocurrencies with questionable value.

Cryptocurrencies have gained widespread popularity, but not all cryptocurrencies are created equal.

Token vs Coins

Fun fact

Examples

Governance Tokens

Utility Tokens

Transactional Tokens

Security Tokens

Platform Tokens

Differences

Coin has its own blockchain, while token uses other's blockchain

Marketcap

Layer 2

Use Cases

other

Privacy and Confidentiality: Certain Layer 2 solutions on Ethereum can provide enhanced privacy features. They allow users to transact with a higher level of anonymity and confidentiality, ensuring that their financial activities are kept private. It's like wearing a mask or using a secret code when conducting financial transactions, protecting your identity and sensitive information.

Interoperability with Other Blockchains: Layer 2 solutions in Ethereum can also enable interoperability with other blockchains. Through mechanisms like cross-chain bridges, assets and data can be transferred between Ethereum and other blockchain networks, expanding the possibilities for decentralized finance (DeFi) and other applications. It's like having a bridge connecting two islands, allowing people and goods to move freely between them.

Improved User Experience: Layer 2 solutions aim to enhance the user experience by making transactions faster, cheaper, and more efficient. Users can interact with decentralized applications (DApps) on Layer 2 with near-instant transaction confirmations and minimal fees. It's like upgrading from a slow and expensive internet connection to a high-speed and affordable one, enabling smooth and seamless interactions with online services.

Lower Transaction Fees: Layer 2 solutions can also reduce transaction fees on the Ethereum network. Since some transactions are processed off-chain and settled on the Layer 1 blockchain later, it reduces the burden on the main network, resulting in lower fees for users. It's like getting a discount or a special offer when using a specific payment method, making transactions more affordable for everyone.

Scalability and Transaction Speed: One of the primary use cases of Layer 2 in Ethereum is to improve scalability and transaction speed. Ethereum's Layer 1 blockchain has a limited capacity to process a certain number of transactions per second. Layer 2 solutions, such as Optimistic Rollups or Plasma, help increase the network's capacity by moving some transactions off-chain. It's like having a highway with limited lanes, and Layer 2 solutions add extra lanes to accommodate more cars, reducing traffic congestion and allowing for faster transactions.

Gaming and Virtual Worlds: Layer 2 solutions enable high-performance gaming experiences, supporting real-time interactions and reducing latency.

Non-Fungible Tokens (NFTs): Layer 2 can facilitate the seamless trading and interaction with NFTs, allowing for a more user-friendly and affordable experience.

Decentralized Finance (DeFi): Layer 2 solutions can significantly enhance the scalability and cost efficiency of DeFi protocols, making them more accessible to a wider audience.

Type

Rollups: Rollups aggregate multiple transactions into a single transaction on the Ethereum mainnet, improving scalability. There are two types: Optimistic Rollups and ZK-Rollups.

Sidechains: Sidechains are separate chains connected to the Ethereum mainnet, allowing for increased transaction capacity. Examples include Polygon (previously Matic) and xDai Chain.

State channels: State channels enable off-chain transactions between participants, only settling the final outcome on the Ethereum mainnet. Examples include the Lightning Network and Raiden Network.

Improved user experience: Faster confirmation times and lower fees contribute to an enhanced user experience, attracting more users and driving adoption.

Lower transaction costs: By offloading transactions to Layer 2, businesses can potentially reduce gas fees, making transactions more affordable and efficient for their customers.

Enhanced scalability: Layer 2 solutions allow for a higher throughput of transactions, enabling businesses and users to process more transactions per second.

These solutions operate "on top" of the Ethereum mainnet and handle a significant portion of transactions, relieving the load on the main chain.

Layer 2 refers to a set of solutions designed to improve the scalability of the Ethereum network without compromising security or decentralization.

Ethereum:EVM

Why many blockchain used EVM?

Tooling and Documentation: The EVM offers a rich set of development tools, frameworks, and comprehensive documentation, making it easier for developers to build on top of the platform.

Network Effect: Ethereum's extensive user base and network effect make it an attractive choice for blockchains that seek to leverage the existing infrastructure and user adoption.

Smart Contract Standards: Ethereum's established smart contract standards, such as ERC-20 and ERC-721, have gained widespread adoption, attracting developers to utilize the EVM.

Security and Auditing: The EVM has undergone extensive testing and auditing, making it a trusted platform for secure and reliable smart contract execution.

Developer Community: Ethereum has a vibrant and experienced developer community, which contributes to the ongoing development and improvement of the EVM.

Interoperability: The EVM standardizes smart contract execution, allowing for seamless interaction and compatibility between different Ethereum-based blockchains.

Several blockchains have adopted the EVM due to its wide-ranging benefits and established ecosystem. Here are a few reasons why many blockchains choose to utilize the EVM:

Who utilize EVM?

These are just a few examples of blockchain platforms that have integrated the EVM to provide a familiar and compatible environment for developers who are already familiar with Ethereum and Solidity. The EVM's widespread adoption promotes interoperability among different blockchain networks, expanding the possibilities for decentralized applications and smart contract development.

Avalanche: Avalanche is a decentralized platform that supports the creation and execution of smart contracts. It utilizes the EVM, enabling developers to build and deploy Ethereum-compatible applications on the Avalanche blockchain.

Polygon (formerly Matic): Polygon is a scaling solution for Ethereum, aiming to improve its scalability and reduce transaction costs. It utilizes the EVM, enabling developers to deploy and run Ethereum-compatible smart contracts on the Polygon network.

Binance Smart Chain (BSC): BSC is a blockchain platform that supports smart contracts and decentralized applications. It incorporates the EVM, allowing developers to use Solidity and deploy existing Ethereum smart contracts on the BSC network.

How does EVM work?

The EVM operates as a sandboxed environment, isolating the execution of smart contracts from the underlying computer system. It provides a secure and standardized environment where smart contracts can run without affecting the network's overall stability. Each node on the Ethereum network has its own instance of the EVM, ensuring that all computations and contract interactions are replicated across the network.

The EVM works by processing transactions and executing smart contracts on the Ethereum network. It functions as a decentralized virtual computer, capable of running complex computations across a network of distributed nodes. Smart contracts, written in Solidity or other Ethereum-compatible languages, are compiled into bytecode that the EVM can understand and execute. The EVM's consensus algorithm ensures the integrity and immutability of the executed code, making it a reliable and secure platform for decentralized applications.

What does it do?

The EVM is responsible for processing and executing smart contracts written in Ethereum's programming language called Solidity. It ensures that smart contracts are executed accurately and consistently across all participating computers (nodes) on the Ethereum network. The EVM also manages the allocation and distribution of Ethereum's native cryptocurrency, Ether (ETH).

The Ethereum Virtual Machine (EVM) is a crucial component of the Ethereum blockchain. It's a virtual machine, which means it's a software environment where smart contracts are executed. Smart contracts are self-executing agreements with predefined rules and conditions. The EVM enables the execution of these smart contracts on the Ethereum network.

Ethereum: Evolution 2.0

Transitioning from Ethereum 1.0 Mining to Ethereum 2.0 Staking: Implications for Miners

Implications for Ethereum 1.0 Miners

This means that their mining equipment, specifically ASICs or GPUs, will no longer be needed for mining Ether.

Ethereum 1.0 miners will no longer be able to mine new blocks and earn block rewards once the transition to Ethereum 2.0 is complete.

Transition to Ethereum 2.0 and PoS

This transition aims to improve scalability, reduce energy consumption, and enhance the security of the Ethereum network.

Ethereum 2.0 introduces a transition from PoW to PoS, eliminating the need for mining as validators are chosen based on the amount of ETH they hold and are willing to "stake" as collateral.

Ethereum 1.0 Mining

Miners use specialized hardware (ASICs or GPUs) to perform the computational work required to mine Ether (ETH) and earn block rewards.

Ethereum 1.0 currently relies on PoW mining, where miners compete to solve complex mathematical problems to validate transactions and secure the network.

ETH 2.0

Why

Technical Perspective

Layer 2 Integration: Ethereum 2.0 is designed to integrate seamlessly with Layer 2 scaling solutions like rollups. This enables further scalability enhancements and improves the overall efficiency of the Ethereum ecosystem.

Beacon Chain: The Beacon Chain serves as the backbone of Ethereum 2.0, coordinating validators, managing consensus, and facilitating communication between shards.

Shard chains: Ethereum 2.0 introduces shard chains, which split the network into multiple pieces called shards, enabling parallel processing of transactions and smart contracts.

Proof-of-Stake (PoS): Ethereum 2.0 replaces the energy-intensive PoW consensus with a PoS mechanism, where validators are chosen based on the number of coins they hold and are willing to "stake" as collateral.

Business Perspective

Ecosystem Growth: Ethereum 2.0's improved scalability and performance are expected to attract more developers and businesses to the ecosystem, fostering innovation and the creation of new decentralized applications (dApps) and use cases.

Security and Finality: Ethereum 2.0 introduces guaranteed block finality through its PoS consensus, providing increased security against potential attacks and reducing the risks associated with chain reorganizations.

Enhanced Performance: With improved scalability and higher transaction throughput, Ethereum 2.0 offers faster confirmation times and improved user experience, making it more attractive for businesses and applications with demanding performance requirements.

Lower Costs: The shift to a Proof of Stake (PoS) consensus mechanism in Ethereum 2.0 reduces the need for expensive mining equipment and energy consumption, leading to lower transaction costs and increased accessibility for users and developers.

Scalability: Ethereum 2.0 aims to address the scalability limitations of Ethereum 1.0 by introducing a multi-chain architecture. This allows for parallel processing of transactions, increasing the network's capacity and throughput.

It introduces a shift from the current proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) consensus, along with other technical enhancements.

Ethereum 2.0, also known as ETH2 or Serenity, is a major upgrade to the Ethereum blockchain aimed at improving scalability, security, and sustainability.

Ethereum: Smartcontract

How much does it cost

The cost of smart of contract determined by the work it performs (reading/writing data)

Limitations

How to deploy

How to build

How it works?

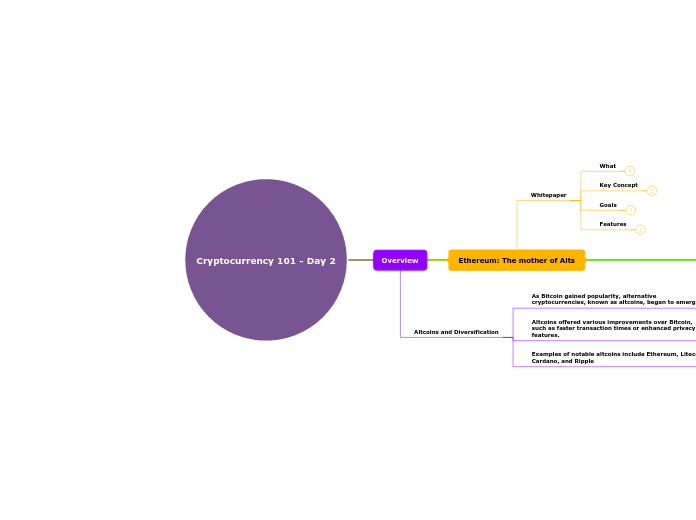

Ethereum: The mother of Alts

Whitepaper

Features

Interoperability: Ethereum enables interoperability between different smart contracts and dApps, fostering a thriving ecosystem of decentralized applications.

Gas: Ethereum introduced the concept of gas, a measure of computational effort required to execute operations on the network, which helps manage network resources.

Turing-completeness: Ethereum's programming language, Solidity, allows developers to build complex and versatile smart contracts.

Goals

Empowering developers: Ethereum provides developers with a powerful and flexible platform for building decentralized applications, promoting innovation and collaboration.

Enabling trustless transactions: By utilizing smart contracts and cryptographic techniques, Ethereum seeks to facilitate secure and trustless transactions.

Building a decentralized platform: Ethereum aims to create a platform that is resistant to censorship, tampering, and single points of failure.

Key Concept

Ethereum Virtual Machine (EVM): The EVM is a runtime environment that executes smart contracts on the Ethereum network.

Smart Contracts: The whitepaper introduced the concept of smart contracts, self-executing agreements with the terms of the contract directly written into code.

Decentralization: Ethereum aims to create a decentralized platform, eliminating the need for central authorities and intermediaries.

What

It outlined the technical details, design principles, and vision for a programmable blockchain platform.

Published in 2013 by Vitalik Buterin, the Ethereum 1.0 whitepaper introduced the concept of Ethereum as a platform for creating decentralized applications.

Unlike Bitcoin, Ethereum goes beyond a digital currency and provides a programmable environment for building decentralized applications on its blockchain.

Ethereum is an open-source blockchain platform that enables the development and execution of smart contracts, along with the creation of decentralized applications (dApps).

Overview

Altcoins and Diversification

Examples of notable altcoins include Ethereum, Litecoin, Cardano, and Ripple

Altcoins offered various improvements over Bitcoin, such as faster transaction times or enhanced privacy features.

As Bitcoin gained popularity, alternative cryptocurrencies, known as altcoins, began to emerge.