Cryptocurrency 101 - Day 3

CBDC

CBDC Roadmap

CBDC Progress

Indonesia

Korea

Japan

USA

Pros & Cons

Why CBDC

CBDCs aim to provide a secure and efficient medium of exchange with enhanced transparency and traceability.

Several central banks worldwide are exploring the concept of CBDCs to leverage the benefits of blockchain technology.

Central Bank Digital Currencies, or CBDCs, are digital representations of a country's fiat currency.

Use cases: HBAR

Use cases: Solana

Use cases: Cardano

Use cases: Ripple

Use cases: Ethereum

Energy Trading: EVM can be utilized for peer-to-peer energy trading, enabling individuals to buy and sell excess energy directly, promoting renewable energy adoption.

Decentralized Autonomous Organizations (DAOs): EVM allows the creation of DAOs, where governance and decision-making are decentralized and transparent, enabling community-driven organizations.

Gaming and Virtual Worlds: EVM powers blockchain-based gaming platforms and virtual worlds, enabling ownership and trade of in-game assets, as well as verifiable scarcity.

Real Estate Transactions: EVM enables the tokenization of real estate assets, facilitating fractional ownership, transparent transactions, and simplified property management.

Insurance and Claims: EVM-based smart contracts can automate insurance policies, claims processing, and payouts, increasing transparency and streamlining the insurance industry.

Identity Management: EVM can be utilized to create self-sovereign identity systems, providing individuals with control over their personal data and eliminating reliance on centralized authorities.

Voting and Governance: EVM allows for the development of decentralized voting and governance systems, enabling fair and transparent decision-making processes.

Supply Chain Management: EVM-based solutions can enhance supply chain transparency, traceability, and efficiency, reducing fraud and improving accountability.

Non-Fungible Tokens (NFTs): EVM facilitates the creation and trading of NFTs, revolutionizing the digital art, gaming, and collectibles industries.

Decentralized Finance (DeFi): EVM powers various DeFi protocols like decentralized exchanges, lending platforms, and stablecoins, enabling secure and transparent financial transactions.

Use cases: Bitcoin

Bitcoin: Lightning Network

Scalability and Throughput: Layer 2 solutions help improve the scalability and throughput of the Bitcoin network. By moving some transactions off-chain and settling them on the Layer 1 blockchain later, Layer 2 solutions can handle a higher volume of transactions. It's like adding extra lanes to a road to accommodate more traffic, relieving congestion and allowing for smoother and faster movement.

Lightning Network: The Lightning Network is a Layer 2 solution for Bitcoin that enables faster and cheaper transactions. It creates payment channels between participants, allowing them to conduct multiple transactions without the need to record each one on the main Bitcoin blockchain. It's like having a separate "tab" at your favorite café, where you can make multiple purchases without having to pay and record each transaction individually.

Highlight:Layer1, Layer 2, Sidechain

Summary

In summary, Layer 1 is the foundational blockchain layer, while Layer 2 is an additional layer that extends the capabilities of Layer 1. Sidechains, on the other hand, are separate chains connected to the Layer 1 blockchain, providing specialized features or use cases. It's like having a building with multiple floors (Layer 1), adding extra rooms on those floors (Layer 2), and attaching separate compartments for specific purposes (sidechains) to the building.

To understand sidechains, imagine having different compartments attached to a piggy bank. The main piggy bank represents the Layer 1 blockchain, while the compartments represent sidechains. Each compartment can hold different types of assets or offer specialized functionalities while remaining connected to the main piggy bank.

Sidechains are separate chains that run in parallel to the main Layer 1 blockchain. They operate independently but are still connected to the main blockchain network. Sidechains are designed to offer specific features or use cases that may not be available or efficient on the Layer 1 blockchain.

Layer 2

An analogy for Layer 2 can be compared to adding extra floors or rooms on top of an existing building. The base layer (Layer 1) provides the foundation, while Layer 2 builds upon it to offer more space and functionality. Similarly, Layer 2 solutions build on top of Layer 1 blockchains to provide improved scalability, faster transactions, or additional features.

Layer 2: Layer 2 refers to a secondary layer that operates on top of Layer 1. It is designed to enhance and extend the capabilities of the underlying Layer 1 blockchain. Layer 2 solutions aim to address the scalability and speed limitations of Layer 1 networks. They offer additional features and functionalities without directly modifying the base layer.

Layer 1

ex

To understand Layer 1, think of it as the foundation of a building. It provides the main structure and supports all the floors and rooms above it. Similarly, Layer 1 is the foundational layer of a blockchain network that enables basic functionalities like storing and transferring digital assets.

Layer 1: Layer 1 refers to the base layer of a blockchain network, which is the underlying foundation. It is the main blockchain protocol that operates independently and has its own set of rules and features. Bitcoin and Ethereum are examples of Layer 1 blockchain networks.

Sidechain

Disadvantages

Certainly! Let's explore some disadvantages of using sidechains, whether in Bitcoin or other cryptocurrencies, in simple terms:

Fragmented ecosystem: Sidechains can sometimes lead to a fragmented ecosystem. When different projects create their own sidechains, it can create a situation where assets or applications are spread across multiple networks, making it harder for users to access and interact with everything in one place. It's like having different toy collections scattered across various compartments, making it harder to gather and play with all of them together.

Interoperability challenges: Another disadvantage is the potential for interoperability challenges. Sidechains are designed to have their own rules and features, which can make it difficult for assets or data to move seamlessly between different sidechains or the main blockchain. It's like having toys that can only be used in specific compartments, making it challenging to bring them from one container to another without some extra effort or adjustments.

Trust requirements: Sidechains typically require users to trust a specific set of validators or entities that secure and operate the sidechain. This trust requirement can be seen as a potential disadvantage because it introduces a level of reliance on those validators. If the validators act dishonestly or become compromised, it could affect the security and integrity of the sidechain. It's like relying on a group of friends to keep your toy car collection safe, but if one friend starts misplacing or taking your cars, it can be a problem.

Centralization risk: One potential disadvantage is the risk of centralization. Sidechains are separate networks that operate alongside the main blockchain. Depending on the design and governance of a sidechain, there is a possibility that it may become more centralized compared to the decentralized nature of the main blockchain. It's like having a separate playground that starts with a few kids, but over time, more kids join and a few end up having more control or influence over the games being played.

Usecases

Bitcoin

examples

Smart contracts and decentralized applications: Bitcoin sidechains can also support smart contracts and decentralized applications (DApps). Smart contracts are like digital agreements that automatically execute actions based on predefined conditions. With a Bitcoin sidechain like RSK (Rootstock), you can build and deploy smart contracts, similar to how you would on the Ethereum network. It's like having a mini digital playground attached to the Bitcoin network, where you can create games, apps, or other innovative solutions.

Tokenized assets: Another use case is tokenizing assets on a sidechain. Tokenization means representing real-world assets, like real estate or stocks, as digital tokens on a blockchain. With a Bitcoin sidechain, you can create tokens that represent these assets, making them easier to transfer and trade. It's like turning physical items, such as your favorite collectibles or toys, into special tokens that can be easily bought, sold, and traded with others.

Faster and private transactions: One use case of sidechains is to enable faster and more private transactions. Think of it like using a separate express lane on a highway just for certain types of vehicles. With a Bitcoin sidechain like Liquid, you can move your Bitcoin to the sidechain and transact with others more quickly and with enhanced privacy features. It's like taking a shortcut lane where your transactions are processed faster, and the details are kept more confidential.

Bitcoin itself doesn't have a built-in sidechain, but there are projects that have created sidechains that are connected to the Bitcoin network. One popular example is the Liquid Network, which is a sidechain built on top of Bitcoin.

Background

What

So, in simple terms, Bitcoin is the main network where you store and transfer digital money, while sidechains are separate containers that allow you to experiment with different digital assets or applications without risking the security of the main Bitcoin network. It's like having a piggy bank for your regular money and another container attached to it for storing and playing with toy cars.

So, a sidechain is like a special container that holds something different than Bitcoin. It can represent other digital currencies, assets, or even applications. The main advantage of using a sidechain is that it allows you to experiment with new features and functionalities without risking the security and stability of the main Bitcoin network.

Now, let's talk about sidechains. Think of sidechains as separate containers attached to the piggy bank. These containers are also secure and can hold different types of digital assets or currencies. They are connected to the main piggy bank (the Bitcoin network) but operate independently.

Imagine you have a piggy bank where you store your money. This piggy bank is like the Bitcoin network. It's a secure and decentralized system where people can store and transfer digital money, called Bitcoin.

Why

Another significant sidechain project is RSK (Rootstock), which introduced the concept of smart contracts on the Bitcoin network. RSK was launched in 2018 as a sidechain that utilizes a virtual machine called EVM (Ethereum Virtual Machine), similar to the one used in the Ethereum network. This allows developers to create and deploy smart contracts on the Bitcoin network itself.

One of the earliest and most well-known sidechains is the Liquid Network. It was developed by Blockstream and launched in 2018. The Liquid Network is a sidechain connected to the Bitcoin blockchain that enables faster and more private transactions. It provides a way for exchanges and other businesses to transact and transfer assets more efficiently.

The idea of sidechains was first introduced in a whitepaper titled "Enabling Blockchain Innovations with Pegged Sidechains" by Adam Back, Matt Corallo, Luke Dashjr, Mark Friedenbach, Gregory Maxwell, Andrew Miller, Andrew Poelstra, Jorge Timón, and Pieter Wuille. This paper was published in 2014 and outlined the concept and potential benefits of sidechains.

The concept of sidechains emerged as a way to expand the capabilities of blockchain networks like Bitcoin. Sidechains were proposed as an additional layer that could run alongside the main blockchain, providing new features and functionalities while leveraging the security of the main network.

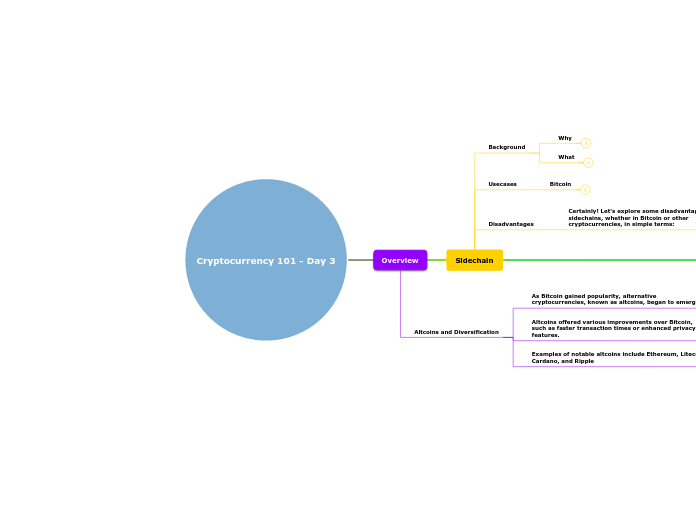

Overview

Altcoins and Diversification

Examples of notable altcoins include Ethereum, Litecoin, Cardano, and Ripple

Altcoins offered various improvements over Bitcoin, such as faster transaction times or enhanced privacy features.

As Bitcoin gained popularity, alternative cryptocurrencies, known as altcoins, began to emerge.