GET BRENE THE

$4 MILLION

SHE'S OWED FROM

HER RATFACED

FATHER >=(

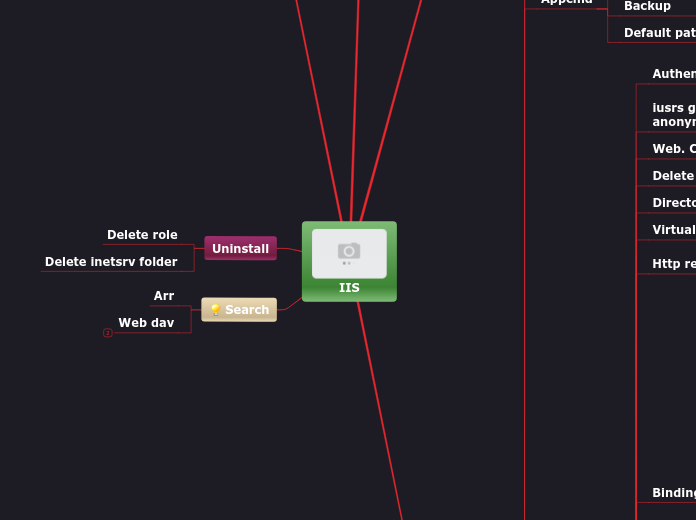

title here

ACCESS TO DOCUMENTATION

Schnidt v rosewood:

the right to seek a courts intervention and due administration of the trust does not depend on entitlement to a fixed and transmissble beneficial interest.

additionally, the mere existence of a power of addition having the ability to block a beneficiaries right to due administration of a trust is contrary to the ratio in schmidt

the fact that the beneficiaries of a discretionary trust do not have absolute/indefeasible intrerests makes no difference; it is enough that they are currently the only persons entitled to due administration of the trust

~CPT custodian pty ltd v commissioner of state revenue 2005 hca 54 @ 44

the fact that the beneficiaries of a discretionary trust do not have absolute/indefeasible intrerests makes no difference; it is enough that they are currently the only persons entitled to due administration of the trust

~CPT custodian pty ltd v commissioner of state revenue 2005 hca 54 @ 44

The ability of beneficiaries of a discretionary trust to require trustees to terminate a trust and distribute the trust property, even in circumstances where a breoad power to add further (unspecified) beneficiaries exist.

ARGUMENT TWO:

Breach of trustee duties /

breach of fiduciary duties

A trustee ought to conduct the business of the trust in the same manner that an ordinary prudent [businessperson] would conduct [their] own, and that beyond that there is no liability or obligation on the trustee’

Speight v Gaunt (SB 434-5)

Each trustee has a separate responsibility to ensure the terms of the trust are carried out: Bahin v Hughes (1886) 31 Ch D 390

COuld removal of brenee potentially as a brenficiary be a breach?

On rare occasion, a removal of beneficiaries can be challenged as a breach of a fiduciary duty.

POTENTIAL RESULT

CHANGE TRUSTEE!!

potentially to Brene fufufuf

Tobias book exceprt:

A supporting remedy is to change the trustees. Considerable trust litigation is actually about who the trustees should be. Often it is more effective to change the trustees than attempt to challenge their decisions.

ARGUMENTS AGAINST

Gisborne v Gisborne (1877) 2 App Cas 300

defining a power as absolute or uncontrolled excludes a jurisdiction of the court to interven with how it was exercised

does s 16 of the deed remvoe thefiduciary duties? I don't think so

However, the courts as often ignore these terms

Karger v Paul; Pitt v Holt

Exclusion Clauses

A remaining issue that can limit trustee accountability is where the trust deed attempts to exclude trustees’ duties. This area has been clarified somewhat by the Trusts Act. The Act makes the duties of proper purpose, honesty and good faith mandatory so they cannot be modified or excluded

The investments are actually reasonable.

dont need to provide evidence; brene has no right ot ask for them as a discretionary beneficiary

see schmidt v rosewood trust regarding rights of discretionary beneficiaries to view trust docs

He was acting in the best interests of A beneficiary: himself.

How could Sigmund be in breach?

DUTY TO INVEST

Source:

trust instrument

Equity

Trustee Act

S 12C: Factors Court may take into account in action for breach of trust

In proceedings against a trustee for breach of trust in respect of a duty under this Part relating to the trustee's power of investment, the Court may, when considering the question of the trustee's liability, take into account—

(a) the nature and purpose of the trust; and

(b) whether the trustee had regard to the matters set out in section 8 so far as is appropriate to the circumstances of the trust; and

(c) whether the trust investments have been made pursuant to an investment strategy formulated in accordance with the duty of a trustee under this Part; and

(d) the extent the trustee acted on the independent and impartial advice of a person competent (or apparently competent) to give the advice

s8 Matter to which trusts MUST have regard:

(1) Without limiting the matters that atrusteemay take into account when exercising a power of investment, atrusteemust, so far as they are appropriate to the circumstances of the trust, have regard to—

(a) the purposes of the trust and the needs and circumstances of the beneficiaries; and

(b) the desirability of diversifying trust investments; and

(c) the nature of and risk associated with existing trust investments and other trust property; and

(d) the need to maintain the real value of the capital or income of the trust; and

(e) the risk of capital or income loss or depreciation; and

(f) the potential for capital appreciation; and

(g) the likely income return and the timing of income return; and

(h) the length of the term of the proposed investment; and

(i) the probable duration of the trust; and

(j) the liquidity and marketability of the proposed investment during, and on the determination of, the term of the proposed investment; and

(k) the aggregate value of the trust estate; and

(l) the effect of the proposed investment in relation to the tax liability of the trust; and

(m) the likelihood of inflation affecting the value of the proposed investment or other trust property; and

(n) the costs (including commissions, fees, charges and duties payable) of making the proposed investment; and

(o) the results of a review of existing trust investments.

s6 Duty to exercise care:

(1) Subject to the instrument creating the trust, a trustee must, in exercising a power of investment—

(a) if the trustee's profession, business or employment is or includes acting as a trustee or investing money on behalf of other persons, exercise the care, diligence and skill that a prudent person engaged in that profession, business or employment would exercise in managing the affairs of other persons; or

(b) if the trustee is not engaged in such a profession, business or employment, exercise the care, diligence and skill that a prudent person would exercise in managing the affairs of other persons.

TA s7: duty to act impartially

must be performed in the 'best interests of all present and future benficiaries of the trust'

Cowan v Scargill

S 6 Duty to exercise care

S 8 Matters to be considered

S 7 equitable duties preserved

Best interests

Speculation

Impartiality

Advice

S 12C factors the court will look at when deciding whether duties breached

urposes of Trust and Needs and Circumstances of Beneficiaries

[18-16]

While under the general law there is, unless statute or the trust instrument provides to the contrary, no express obligation on the trustees to consult the beneficiaries, it has been seen as a reasonable course.54 Under this provision it may not be possible to consider the needs and circumstances of the beneficiaries without inquiring what they are, so that the provision has the indirect effect of creating a duty to consult.

Re Pauling's Settlement (No 2) [1963] Ch 576 at 586

TA s5 power to invest

Atrusteemay, unless expressly prohibited by theinstrumentcreating the trust—

(a) invest trust funds in any form of investment; and

(b) at any time, vary an investment.

APPLICATION:

Sigmund's expensive cars and housing has all gone into the trust. Most cars depreciate in value and are not investments. Review of proper handling of duties required.

the investing must have been done in regards to the beneficiaries best interests as a whole

were the houses prudent investments? were they done for the benefit of the trustee? if the properties weren't bought for the benefit of growing the trust for the benefit of the beneficiaries, then does that mean that he does doing it for the benefit of sigmund the trustee? if it was for sigmund the beneficiary, if discretionary, he would have no right to request anything of himself due to the nature of the right, so the only way for it NOT to be a breach would have been to distribute the assets to himself as a beneficiary

No evidence of 'turning his mind' to the discretionary distribution of the funds. He doesn't need to state reasoning why or why not, just that he's actually contemplated it as part of his duties as a trustee

karolidis "discreitonary trusts - not without limitations (blog post):

Owies v jj nominees pty lltd [2022] vsca 142 - trustees of family discreionary trusts must give "real and genuine consideration" to all circumstances of beneficiaries when exercising their power regarding income of the trust.

- court has the power to invalidate income distributions and remove trustees

was found that the trustee did not make any enquiry as to any need they may have of a distribution of income

what DIDN'T he need to turn his mind to?

what did he need to turn his mind to?

How do discretionary trusts differ?

What duties are required of trustees?

duty to keep funds separate

is there evidence of this?

not to make a profit/be in conflict (unless authorised)

Australian law: Hospital products v united states surgical corp:

-there is no fiduciary relationship where a 'claimed fiduciary' was not required to have regards to the prioncipals interests to the exclusion of their own"

Barkley (2019) quoting criddle 2019)

stakeholder trustees: in what way must a fiduciary be other-regarding and no self-regarding? could a trustees right or power to act in her own interests, whether in the exercise of manaemtn or distributive discretiones, be inconsistent with the definition of a trustee

the fudicary duties not explicityly excluded

must consider exercising their discretions from time to time (standard is once per year)

duty to act personally / not delegate

speight v gaunt

act honestly and in good faith

Barley (2019), quoting Armitage v nurse:

the tudy of the trustees to perofrm the trusts hoestly and in good faith for the benefit of the beneficiareis is the minium necessary to give substance to the trusts, but in my opinion it is sufficient."

Show any dishonesty?

would not distributing to himself from trust again be malice to avoid payment to Brene?

Kain v Hutton [2007] NZCA 199 [243] (Glazebrook J):

no duty to act prudently or impartially

A-G (Cth) v Breckler (1999) 197 CLR 83 [7] (quoting another case):

“The exercise of a [distributive] discretion by trustees cannot of course be impugned upon the basis that their decision was unfair or unreasonable or unwise.”

to not take into account irrelevant considerations

to take into account relevant considerations

very hard for a jduge to objectlively assess the criteria

supporting duty to gather information where necessary to do so

- must be aware, even if they completely disregard it