realizată de Hammad Aziz 4 ani în urmă

262

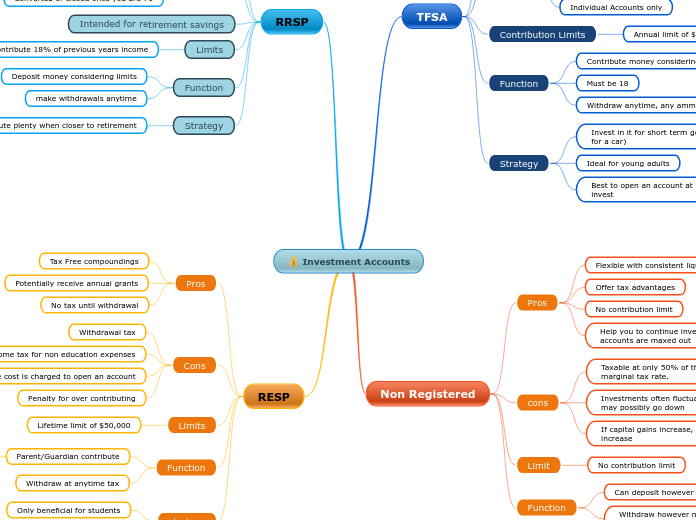

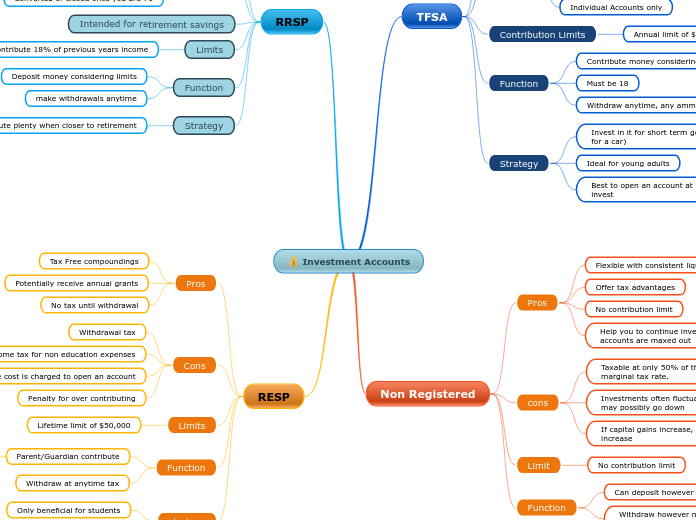

Investment Accounts

Different types of investment accounts offer distinct benefits and drawbacks depending on the financial goals and situations of the account holders. Registered Education Savings Plans (

realizată de Hammad Aziz 4 ani în urmă

262

Mai multe ca aceasta

Type in the name of the company you are going to have an interview with.

How ambitious are you?

Government grants an additional 20% of contribution

What are your long-term goals ?

Type them in.

What are your short-term goals ?

Type them in.

Or

Maximum contribution of $27,230

How would you describe yourself?

Type in a short description.

What are your hobbies?

What do you like to do in your free time? What was the last film you saw or the last book you read? Think of the activities that relax you the most. Fill in several hobbies.

Research the company

You should find and learn as much as you can about the company where you are having an interview.

The interviewer will want to see what you know about them and why you chose the company.

Doing your homework will show that you are really interested.

What kind of innovations does this company have?

Type in several examples.

What is the company's turnover for last year?

What products does this company have?

Type in several examples.

What is the size of this company?

Why do you want to work for this company?

Think of what you can do for them, not of what they can do for you.