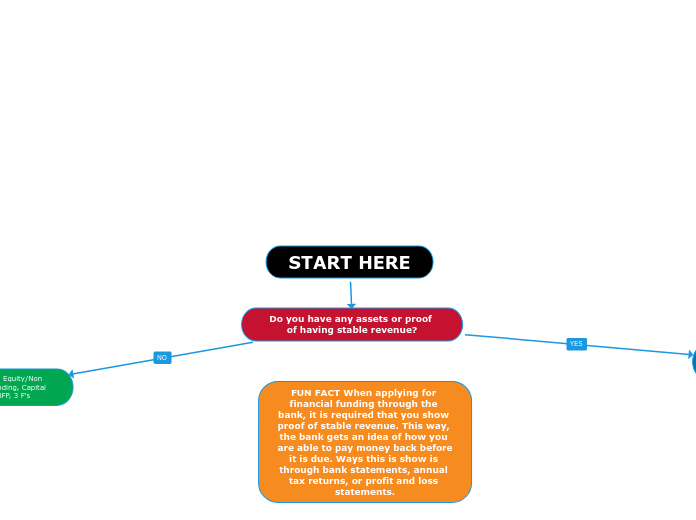

FUN FACT When applying for financial funding through the bank, it is required that you show proof of stable revenue. This way, the bank gets an idea of how you are able to pay money back before it is due. Ways this is show is through bank statements, annual tax returns, or profit and loss statements.

FUN FACT Warren Buffet is considered the most successful investor in the world and also one of the richest men in the world. It is said that the markets change based on his words and financial ear.

FUN FACT Did you know how much of a difference paying an extra $5 off you mortgage could make everyday instead of spending on non essential things? Over a lifetime, $5 every day can save you over $20,000 in interest over the next coming years.

FUN FACT The highest funded crowdfunding campaign was through Kickstarter and raised $20.8 million in just 3 days.

FUN FACT In Canada, there are around 96.8 million credit cards in circulation, meaning the average person has 2.5 credit cards. Having no more than 2 credit cards is considered optimal, as there is no way to loose track of payments and it is more convenient in case you loose your primary credit card.

Are you willing to lose partial ownership of your business to gain funds?

Angel Investor, Equity Crowdfunding

Do you wish to receive expertise from someone experienced or rather work solo and build a consumer audience?

Equity Crowdfunding

A form of financing where money can be raised for a business and anyone can invest in exchange for shares in the business. The way this is done is through the internet where other people can invest in businesses within their early stages. People can invest within their own budget, however, you will have to give up a small portion of your business in order to receive these funds. While this platform allows businesses to find people that really believe in your vision, average successful equity crowdfunding campaigns don’t receive as many funds.

Angel Investor

An angel investor is an experienced business person who invests their time and money into a business. This form of financing requires you to give up equity of your business so that the investor can make money when the business does well. This way of funding works best if you have a vision that spikes interest and your business is in its early stages of growth.

Non Equity Crowdfunding, Capital Lease, CSBFP, 3 F's

Are you financing for short term (1-12 months, or long term (2+ years)

CSBFP, Capital Lease

Are you financing for assets (e.g. equipment) required for your business or for major assets (e.g. Buildings)

Canada Small Business Financing Program

This financing option takes assistance from the federal government so that businesses can be supported with their finances. With this program, you don’t have to worry about having any personal assets or collateral to secure any funding. This platform is a long-term financing option and is best used for financing major assets like land, buildings, and vehicles. To apply for this program, you will have to pay a registration fee with little to no interest on the loan.

Capital Lease

A capital lease is a form of lease where you can temporarily own assets important to your business instead of buying them at full price. This lease is good as a long-term financing option and reduces the risk of obsolescence. This platform however may end up being more expensive than compared to buying assets in the long run because of frequently hidden fees added.

Non Equity Crowdfunding, 3 F's

Do you have friends or family who believe in your ideas?

Non Equity Crowdfunding

A form of financing where money can be raised for a business without requiring the owner to give up shares or control over their business. The way this is done is through the internet where other people can pitch in money towards ideas and visions they’d like to see come to life in the future. Although this platform is effective for new business owners who don’t have any assets, this form of financing is typically difficult to reach funding goals and requires hard work to run a successful campaign.

3 F's

Standing for Friends, Family, and Fools, if no other option works out, its best to speak with people who are trustable and are willing to pitch in money for what ever you are trying to fund for. With this option, it is important to communicate with everyone involved on how much the goal is, identify any risks upfront, and letting those see your investment and commitment. These people will believe in your idea the most and will try their best to support your goals.

START HERE

Do you have any assets or proof of having stable revenue?

Angel Investor, Equity/Non Equity Crowdfunding, Capital Lease, CSBFP, 3 F's

Bank Loan, Bank/Retail Credit Card, Venture Capitalist, Grants Mortgage, Line of Credit

Are you financing for short term (1-12 months) or long term (2+ years)

Bank Loan, Grants, Venture Capitalist, Mortgage

Do you have a vision or product to offer to the public when regarding your business?

Bank Loan, Grants, Mortgage

Do you have any other assets to offer as collateral

Grants, Mortgage

Do you need funding for a property or funding overall for your business

Grants

A form of funding where a sum of money is given by companies or federal governments that are looking to increase economic development. Money given through grants dont need to be repaid and you wont lose any ownership on your business from receiving funding from these companies. Not having any assets to list as collateral is also not a problem since grants dont require any money to be paid back. Grants however, can be difficult to obtain and may only be given through strict guidelines and reporting back.

Mortgage

A mortgage is a long-term loan that is used for buying a home or most properties. These financing options have either constant interest rates or variable interest rates depending on the market. Mortgages are paid off using installments and can take years to fully pay off. Although mortgages don't require other assets to be listed as collateral, if a mortgage can’t be paid off, the house that is being paid for can be taken away.

Bank Loan

Venture Capitalist

A form of financing where an experienced business person invests large sums of money in a business. This form of financing requires you to give up equity of your business so that the investor can make money when your business does well. This way of funding works best if you have a vision that spikes interest and your business is already thriving to where you can provide information on future projected sales.

Bank Credit Card, Retail Credit Card, Line of Credit

Are you able to pay off higher interest rates for more rewards, or would you rather keep your funding more convenient?

Line of Credit

This platform is similar to a bank loan, however, it's pre-approved where only the money available to borrow is charged on interest. Line of credit is convenient and has lower interest rates than compared to other financing options in the same space. This option should be used as a short-term financing option and the loan is reduced through installment payments.

Bank Credit Card, Retail Credit Card

Would you rather have lower interest rates or more rewards available for your spending?

Bank Credit Card

A form of funding where money is loaned to you at interest which is due at a certain period of time. Money borrowed should be paid back, otherwise, the bank can seize any assets you have listed as collateral. Bank loans are beneficial to those who need funding for the long term, or those who need large sums of money to be repaid at lower interest rates. In order to apply for a bank loan, however, you must prove that you have stable revenue along with owning many assets in case the loan can’t be repaid.

Retail Credit Card