realizată de irum mohammed 5 ani în urmă

204

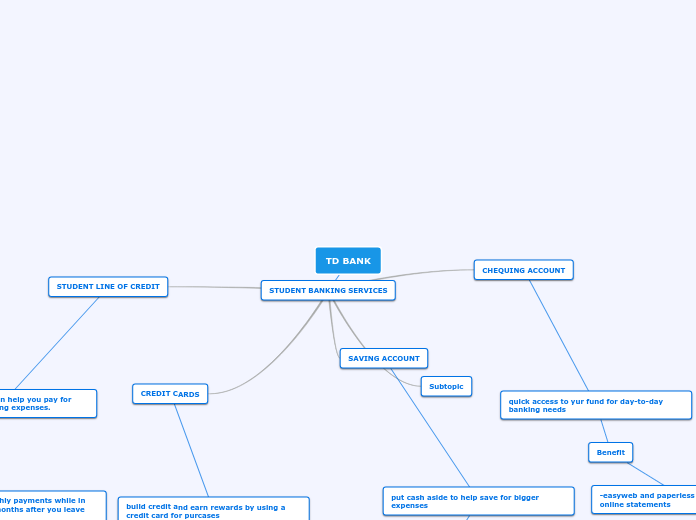

student banking services

A range of financial services tailored to students is offered, including credit cards and student lines of credit with no annual fees. Students can benefit from purchase security, extended warranty protection, and cash back rewards.