Transfer

Tax Aspects

Federal Income Tax

benefits

depreciation, 1031 tax defer and installment sales.

Basis

Adjusted Cost Basis

e.g. building a wall

Cost Basis

purchase price

Special Assessments

Mello-Roos act

More general

Must be disclosed to buyer

Street Improvement Act of 1911

Specific location tax

For streets, side walks and curves

Senior Citizen

State Controller

for deferment options

Tax bill does not have legal descriptions

use tax assessor's parcel number

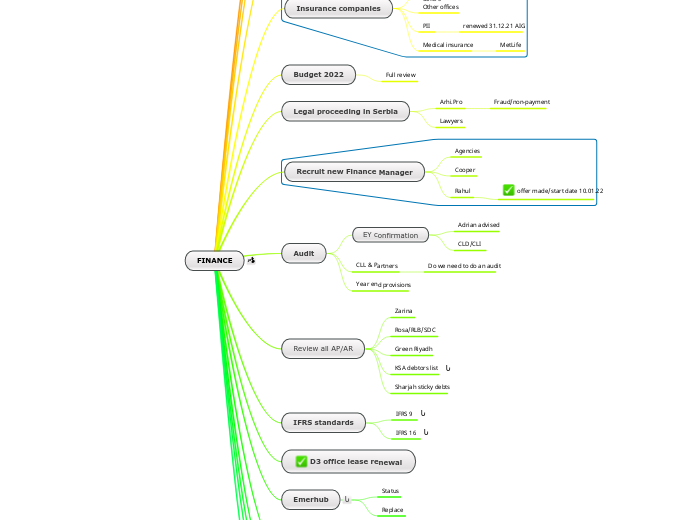

Tax Calendar

e.g. sold home in 10/01

buyer would pay remainder tax bill plus supplement if any

Seller would pay taxes from 07/01 to 10/01 by pro-ration into escrow

06/30

starts the 5 year lien period

Second installment

Due 02/01 to 04/10 delinquent

First installment

Due 11/01 to 12/10 delinquent

01/01

lien date

precedes tax year

07/01 to 06/30

Assessment Appeals Board

hears appeals from owners who believed they have been over assessed

Tax collector

Prepares the bill

County board of supervisors

Determine the tax rate

limited to 1% plus an amount to cover existing debt

County Tax Assessor

Property assessed at 100% of taxable value

creates assessment roll

assesses the value of all taxable property

Transfer Document Tax

$.55 per $500 of new money

Miscellaneous

Warranty Deed

Replaced by Title Insurance

Trust Deeds and re-conveyance deeds

Not Deeds

Loan Documents

Notary employee of a corporation

may notarize

when notary has no personal interest

Escrow

Broker must record a deed within one closing

Short rate

Home owners insurance is cancelled

refund will be less than a pro-ration

Pro-ration

use 30 day month and 360 day year

Who is going to pay

Closing

Debit and Credits

are usually different for buyer and seller

Recurring cost

impounds

Assumed loan is a debit to seller and credit to buyer

Interest on an assumed loan does not appear as a debit to the buyer

Prepaid Takes is a credit to seller

Selling price is a debit to buyer

Inter-pleader Action

Broker may file if disputes over the deposit before opening of escrow

unresolved disputes between buyer and seller preventing closing

Only seller can give the buyer permission to move prior to close

buyer or seller

Can authorize changes or cancel Escrow

Seller should order termite Report before listing

preventative work is usually paid by buyer

Broker Escrow

Otherwise needs license Department of Corporations

Charge fee only if agent to seller or buyer

Dual agent for buyer and seller

After Escrow agent may become the separate agent of either party.

Make sure conditions of transfer are met

Land Description

Township and Sections

Recorded tract

Metes and Bounds

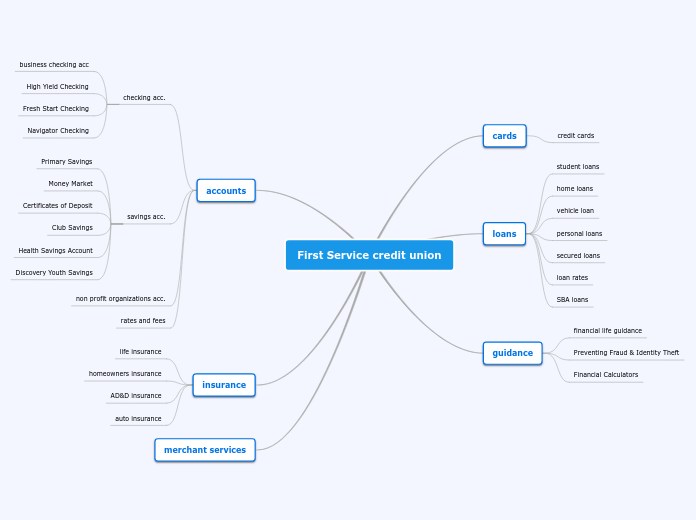

Types of Title Insurance

Exclusions

Acts by government

Defects known by buyer and seller

extended coverage

ALTA (lender)

includes survey and unrecorded events

Standard CLTA (buyer)

Defective Delivery

Forgery

Lack of Capacity

Matter of Records

Seller is the trust-or in a preliminary title report

Title Plant

records of recorded documents by insurance companies

give grantee and heir of a marketable title

Title Vesting

Community Property

Statue of Succession

.333 to spouse; .666 two children if more than one

.5 to spouse; .5 to only child

One to list; two to sell

One party can lease for a period of less then one year

Purchase of real property encumbered by one spouse is voidable within one year by the non consenting adult

Husband and wife

each owns 50%

The assumption is CP

Tenancy in Common

One tenant in common cannot grant an easement

May will there share

Right of Possession

May hold unequal share

Join Tenancy

Only One Title for all

Recording a Lien

will not sever interest

Foreclosure lien will sever his particular interest

Rights of survivor-ship

May sell without permission new buyer often new buyer holds community property

Disadvantage it can be severed by voluntary transfer or operation of law

They can do anything with their interest except will it

Possession

Interest

Title

Time

Notice

Actual Notice

taken possession

Constructive Notice

Taking possession

with unrecorded deed

recording

Priority of Valid Deed

first valid deed recorded determines ownership

Unless prior to recording

actual or constructive had been given

Types of Deeds

Quick Claim Deed

to quiet title

Grant Deed

implies there are no encumbrances other than those revealed

is the only deed which confers after-acquired title

Valid Deed

Not required

Acknowledgement

Required for recording

prima facie evidence in court

Delivery and Acceptance

possession

of deed by grantee

presumes a valid delivery

Intention

title of pass immediately

Acceptance

grantee must accept

Grantor's Signature

Description of the physical property

Description of the parties

Granting Clause

Action Clause

convey

transfer

grant

In Writing

Capacity

grantee

grantor