Example

If we purchase a bond with a price RM1000,(P) coupon rate 10%(C) and maturity of 10 years (n=10) wee will gate YTM 10%

FORMULA CALCULATE YTM

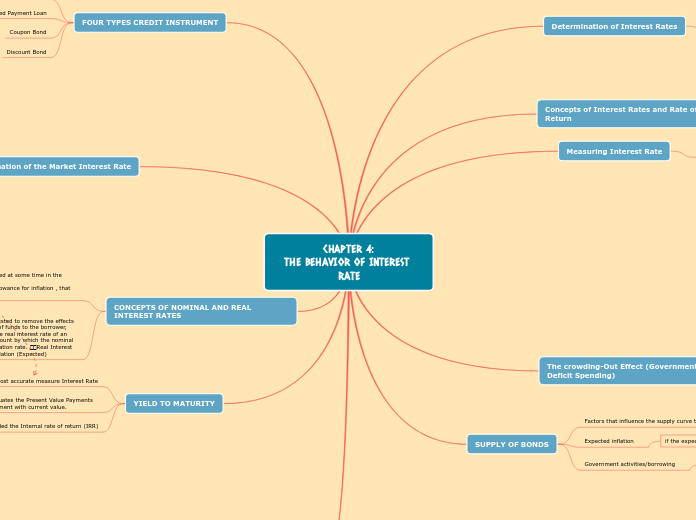

CHAPTER 4:

THE BEHAVIOR OF INTEREST RATE

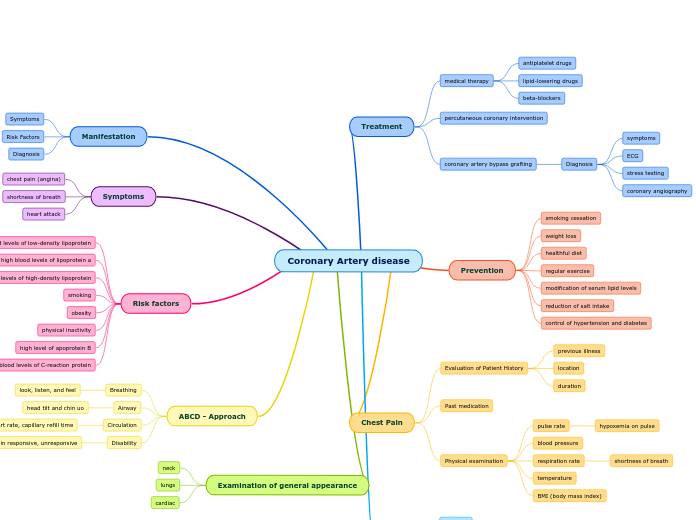

This ancient civilization of Northeastern Africa is one of the most spectacular of the ancient world. Find out more about the people of Ancient Egypt, their gods and goddesses, magical land and daily life.

SUPPLY OF BONDS

Government activities/borrowing

decision by governments can affect bond prices and interest rates in the economy.

Expected inflation

if the expected inflation increased, the real interest rate falls.

Factors that influence the supply curve to shift

Expected profitability of investment opportunities

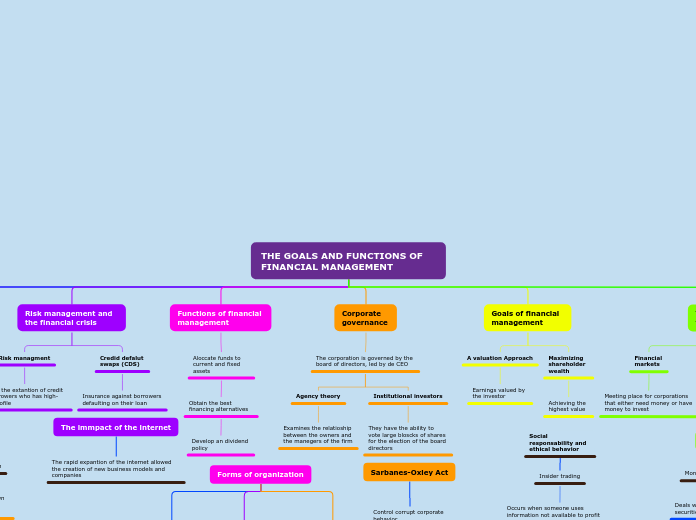

SHIFTS IN BOTH DEMAND AND SUPPLY OF BONDS

The liquidity preference framework

The keynesian approach focuses on the supply of money and demand of money.

Total wealth= total money + total Q of bonds in economic.

Keynes holding highly liquid money:

*Transaction

*Precaution

*speculation

CHANGES IN EXPECTED INFLATION : THE FISHER EFFECT

*expected inflation ↑,expected return on bond relative to real assets or goods falls for any given price and interest rate.

*When expected inflation rises, interest rates will rise.

*When expected inflation fallen, interest rates will fall.

The crowding-Out Effect (Government Deficit Spending)

supplier/ seller bond = demander loanable fund

Demander/ buyer bond =

Supplier loanable fund

YIELD TO MATURITY

Egyptian Art has a major role in conveying the essential traits of this great civilization.

The Egyptian art portrays best what this civilization valued the most, what people looked like, how they dressed, the jobs they had, etc.

YTM also called the Internal rate of return (IRR)

YTM is interest rate that equates the Present Value Payments received from a debt instrument with current value.

YTM is the most accurate measure Interest Rate

Period

Periods in Ancient Egyptian art

Type in the 6 periods in the Egyptian art. Example: Old Kingdom (2680 BC-2258 BC) .

Measuring Interest Rate

Yield to Maturity

Concepts of Interest Rates and Rate of Return

Rates of Returns (ROR)

Interest Rate

CONCEPTS OF NOMINAL AND REAL INTEREST RATES

Real Interest Rate

An interest rate that has been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower, and the real yield to the lender. The real interest rate of an investment is calculated as the amount by which the nominal interest rate is higher than the inflation rate. ��Real Interest Rate = Nominal Interest Rate - Inflation (Expected)

Nominal Interest Rate

Is the rate of interest that is accrued at some time in the future

Nominal interest rate makes no allowance for inflation , that is, it ignores the effects of inflation

Determination of the Market Interest Rate

Interest Rate Determination in a Economic System

An Introduction(Demand and Supply in the Credit market)

Subtopic

Theory of Asset Demand

All the determining factors above can be assembled into the theory of asset demand

The quantity demanded of an asset is positively related to its liquidity relative to alternative assets

The quantity demanded of an asset is negatively related to the risk of its returns relative to alternative assets

The quantity demanded of an asset is positively related to its expected return relative to alternative assets

The quantity demanded of an asset is positively related to wealth

Determinants of Asset Demand

An asset is a piece of property that is a store of value

1. Wealth

2. Expected return

3. Risk

4. Liquidity

Determination of Interest Rates

The classical model

FOUR TYPES CREDIT INSTRUMENT

Discount Bond

Egyptians wore make-up and jewelry because they believed this made them more attractive for the Gods. Also, jewelry was a sign of wealth - the more jewelry someone had, the richer he/she was.

Coupon Bond

Fixed Payment Loan

Simple Loan