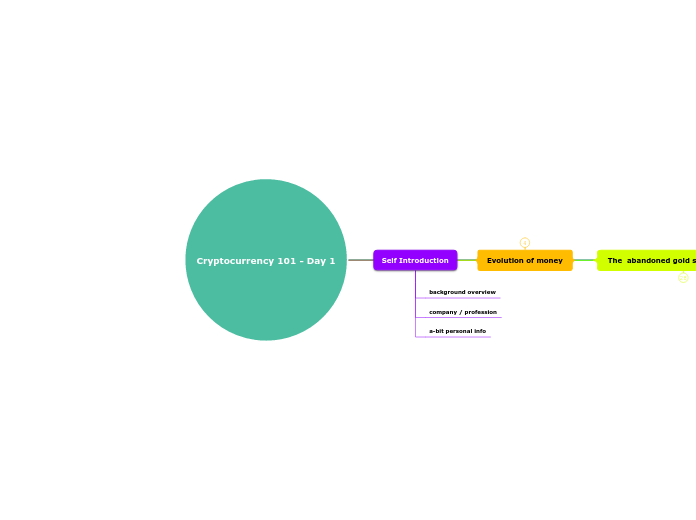

Cryptocurrency 101 - Day 1

Cryptocurrency as an Investment

Personal Finance Insights

When to buy

Where to buy

What to buy

Portofolio ratio

How much crypto shall we owned

Crypto-taxed

USA

between 0% to 20% tax on long-term capital gains

up to 37% tax on short-term capital gains and crypto income

Jepang juga mengenakan pajak cryptocurrency terhadap wajib pajak luar negeri yang memiliki aset kripto dengan tarif pajak final sebesar 20% atas penghasilan yang harus dibayarkan saat meninggalkan Jepang.

Pajak cryptocurrency atau pajak atas pendapatan dari cryptocurrency di Jepang sebesar hingga 55%.

2022:Crypto-tax

Bitcoin Regulation

Crypto-tax

PPN

1.1%

Pembeli aset kripto

0.11%

PPh

Penambang Aset Kripto (miner)

Penyelenggara PMSE

Penjual aset kripto

0.1%

Indonesian Financial Services Authority (OJK) announces plans to regulate cryptocurrency trading platforms, aiming to protect investors and prevent money laundering and terrorism financing. The regulations are expected to be implemented in the future.

Bank Indonesia issues a regulation banning the use of cryptocurrencies as a means of payment, citing concerns about financial stability and potential risks to the rupiah.

The Indonesian government imposes a capital gains tax on cryptocurrency transactions. Profits from cryptocurrency trading are subject to a tax rate of 5-30%, depending on the amount of profit generated.

The Indonesian Commodity Futures Trading Regulatory Agency (Bappebti) introduces regulations that recognize cryptocurrencies as commodities and require exchanges to register and obtain licenses.

Bank Indonesia issues another regulation that prohibits payment system service providers from processing transactions involving cryptocurrencies. The regulation aims to protect the rupiah as the official currency of Indonesia and to mitigate risks associated with cryptocurrencies.

Bank Indonesia prohibits financial institutions from facilitating Bitcoin transactions and warns against the use of cryptocurrencies.

Bank Indonesia issues a statement warning about the risks of using Bitcoin, stating that it is not a legally recognized medium of exchange.

Japan

The Japanese government continues to monitor and regulate the cryptocurrency industry, focusing on investor protection, cybersecurity, and AML measures. Discussions are ongoing regarding potential updates to existing regulations.

Japan introduces stricter rules for cryptocurrency margin trading, limiting leverage to protect investors from excessive risks.

FSA issues warnings to Binance, one of the largest cryptocurrency exchanges, for operating without proper registration in Japan. The exchange subsequently announces plans to comply with regulations.

FSA grants the cryptocurrency industry self-regulatory status, allowing the JVCEA to set rules and standards for exchanges. The move aims to foster a more mature and secure cryptocurrency market.

The G20 summit, hosted by Japan, highlights the need for international cooperation in regulating cryptocurrencies to combat money laundering and terrorism financing.

Japan strengthens its regulatory framework by amending the Payment Services Act and the Financial Instruments and Exchange Act. The revised laws provide further protection for investors and enhance oversight of cryptocurrency exchanges.

Japan's Virtual Currency Exchange Association (JVCEA) is established as a self-regulatory organization for cryptocurrency exchanges, aiming to maintain industry standards and protect consumer interests.

Japan becomes the first country to officially recognize and regulate cryptocurrency exchanges. The Payment Services Act is amended to include provisions for cryptocurrencies, enhancing consumer protection and anti-money laundering measures.

Japan's Cabinet approves a set of bills to recognize Bitcoin and other cryptocurrencies as legal payment methods, effective from April 2017. Exchanges are required to register with the Financial Services Agency (FSA) and implement customer identity verification measures.

Mt. Gox, one of the largest Bitcoin exchanges based in Tokyo, files for bankruptcy after losing a significant amount of customer funds. This event prompts the Japanese government to begin considering regulations for cryptocurrency exchanges.

China

Chinese government introduces a new regulatory framework for cryptocurrencies, allowing limited trading of digital assets under strict regulations. The government aims to promote blockchain technology while maintaining control over digital currencies.

PBOC declares that all cryptocurrency-related activities are illegal, including trading, mining, and Initial Coin Offerings (ICOs). Chinese authorities continue to enforce the ban and crackdown on cryptocurrency activities.

Chinese government intensifies efforts to crack down on cryptocurrency mining operations, citing concerns over energy consumption and financial risks. Several provinces in China announce bans or restrictions on cryptocurrency mining.

PBOC tests the digital yuan in several pilot cities across China. The digital currency is used for various transactions, including retail purchases and government payments.

PBOC announces plans to launch its own digital currency, the Digital Currency Electronic Payment (DCEP), also known as the digital yuan. The DCEP is aimed at replacing physical cash in circulation.

PBOC urges financial institutions to stop providing services to cryptocurrency-related businesses. Chinese authorities intensify efforts to crack down on cryptocurrency trading and mining activities.

PBOC launches investigations into major cryptocurrency exchanges in China and orders them to halt trading activities. The Chinese government bans Initial Coin Offerings (ICOs) and declares them illegal fundraising activities.

PBOC issues a statement clarifying that Bitcoin is not a currency and should not be considered as legal tender. Bitcoin exchanges are required to register with the government and implement anti-money laundering measures.

PBOC and four other government ministries release a joint statement warning about the risks of Bitcoin, including money laundering and fraud. Chinese Bitcoin exchanges are prohibited from accepting new yuan deposits.

The People's Bank of China (PBOC) issues a notice stating that Bitcoin is not a currency and should not be used as a form of payment.

United States

Congress introduces bills proposing regulatory frameworks for cryptocurrencies, including provisions for investor protection, consumer safeguards, and anti-money laundering measures. The legislation is under review.

SEC Chair Gary Gensler calls for increased regulation of cryptocurrency exchanges, highlighting the need for investor protection and market integrity.

Infrastructure Investment and Jobs Act is signed into law, requiring certain cryptocurrency businesses to report information on transactions exceeding $10,000 to the IRS.

The Internal Revenue Service (IRS) administers and enforces U.S. federal tax laws.

SEC files a lawsuit against Ripple Labs, alleging that its XRP token is an unregistered security. The case raises questions about the regulatory status of certain cryptocurrencies.

Office of the Comptroller of the Currency (OCC) clarifies that national banks and federal savings associations can provide custody services for cryptocurrencies and hold stablecoin reserves.

2019

Financial Action Task Force (FATF) releases global standards for regulating virtual assets and virtual asset service providers (VASPs), aiming to combat money laundering and terrorist financing.

SEC rejects multiple Bitcoin exchange-traded fund (ETF) proposals, citing concerns over market manipulation and investor protection.

Securities and Exchange Commission (SEC) issues a report stating that certain Initial Coin Offerings (ICOs) may be considered securities and subject to securities laws. SEC begins cracking down on fraudulent ICOs.

2015

New York introduces the BitLicense, a regulatory framework for virtual currency businesses operating in the state. Companies must obtain a BitLicense to operate in New York.

Internal Revenue Service (IRS) issues a notice classifying cryptocurrencies as property for tax purposes. Cryptocurrency transactions are subject to capital gains tax.

Financial Crimes Enforcement Network (FinCEN) releases guidance stating that virtual currency exchanges and administrators are subject to money transmitter regulations and must comply with anti-money laundering (AML) and know your customer (KYC) requirements.

Cryptocurrency Exchange

To be concern

tax

security

volatility

Who

International

Indonesia

How

KYC

What

Marketcap

Type of exchanges

DEX

CEX

How to get a Bitcoin

Bitcoin Buyer

Bitcoin Miner

Historical timeline of Bitcoin

2023

2022

Nigeria: Bitcoin adoption surges in Nigeria, driven by factors such as inflation, limited access to traditional financial services, and a tech-savvy population.

Ukraine: The Ukrainian government legalizes and regulates cryptocurrencies, paving the way for the growth of the digital asset industry in the country.

2021

Adoption

Tesla: Tesla, led by Elon Musk, announces a significant investment in Bitcoin and accepts it as a form of payment for its electric vehicles.

El Salvador: El Salvador becomes the first country to adopt Bitcoin as legal tender, allowing it to be used for everyday transactions alongside the US dollar.

Institutions Adoption

MicroStrategy: The business intelligence firm MicroStrategy becomes one of the first public companies to allocate a significant portion of its treasury reserves to Bitcoin, signaling institutional adoption.

2018

2017

Adoptions

Venezuela: In response to hyperinflation, many Venezuelans turn to Bitcoin as a store of value and a means of accessing international markets.

Japan: Bitcoin gains significant popularity in Japan, with several major retailers accepting it as a payment method after the government's recognition.

December: Bitcoin's price reaches an all-time high, surpassing 19,000 USD.

January: Bitcoin's price exceeds 1,000 USD again and begins a meteoric rise throughout the year.

South Korea: The South Korean government recognizes Bitcoin as a digital asset, bringing it under the purview of anti-money laundering regulations.

Australia: The Australian government removes the double taxation on Bitcoin, making it easier for businesses to accept Bitcoin as a form of payment.

2014

December: Microsoft starts accepting Bitcoin as a payment option for certain digital products.

FUD

February: Mt. Gox, once the largest Bitcoin exchange, suspends trading and files for bankruptcy after losing approximately 850,000 BTC.

Japan: The Japanese government declares Bitcoin as a legal payment method, recognizing it as a form of "electronic money."

INDODAX establishment

2013

November: Bitcoin's price surpasses 1,000 USD for the first time, driven by increased media attention and growing investor interest.

2011

November: The total market capitalization of Bitcoin exceeds 1 million USD.

June: WikiLeaks starts accepting Bitcoin donations, highlighting the use of Bitcoin for censorship-resistant transactions.

February: Bitcoin reaches parity with the US dollar, with 1 BTC equal to 1 USD.

2010

July: The Mt. Gox Bitcoin exchange is launched, becoming one of the earliest and most influential cryptocurrency exchanges.

May 22: Laszlo Hanyecz makes the first real-world purchase using Bitcoin, buying two pizzas for 10,000 BTC. This event is celebrated as "Bitcoin Pizza Day."

2009

October: The New Liberty Standard establishes the first Bitcoin exchange rate, valuing 1 USD at 1,309.03 BTC.

January 12: The first Bitcoin transaction takes place between Nakamoto and Hal Finney, a renowned cryptographer.

January 3: The first block, known as the Genesis Block, is mined by Nakamoto, marking the official launch of the Bitcoin network.

2008

October: Satoshi Nakamoto publishes the Bitcoin whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" on the Cryptography Mailing List. This marks the conceptualization of Bitcoin.

Consensus Mechanism : Proof of Work

Pro & Cons

What is Proof of Work ?

What is Consensus Mechanism ?

Bitcoin Whitepaper

Bitcoin halving

impact

Price

historically, halving events have been associated with significant price increases due to the decreased supply and increased demand.

Miners

miners adapt their strategies to remain profitable in a lower block reward environment, such as upgrading mining hardware or focusing on energy-efficient operations

halving involves reducing the block reward miners receive for validating transactions on the Bitcoin network

purpose

Economic Incentives

as the block reward decreases, miners rely more on transaction fees to sustain their profitability.

halving affects the economic incentives for miners to secure the network

Inflation Control

reducing the block reward helps maintain scarcity and prevents excessive inflation

Bitcoin halving ensures a controlled and predictable issuance of new coins over time

halving schedule

2024

reducing the block reward from 6.25 BTC to 3.13 BTC

2020

reducing the block reward from 12.5 BTC to 6.25 BTC

2016

reducing the block reward from 25 BTC to 12.5 BTC.

2012

reducing the block reward from 50 BTC to 25 BTC

definition

it is a programmed event that occurs approximately every four years

Bitcoin Supply

limited supply contributes to its value and scarcity as a digital asset.

Bitcoin has a finite supply of 21 million coins

Proof of Work

Miners solve complex mathematical problems to add new blocks to the blockchain, earning rewards in the form of Bitcoin.

Bitcoin utilizes a consensus mechanism called Proof of Work (PoW) to validate transactions and secure the network.

Blockchain technology

The blockchain ensures transparency, security, and immutability of transactional data.

The Bitcoin whitepaper introduced the concept of the blockchain, a distributed ledger that records all transactions.

Decentralized digital currency

The absence of a central authority allows for peer-to-peer transactions without intermediaries.

Bitcoin operates on a decentralized network, which means there is no central authority controlling it.

Bitcoin:The Godfather

Bitcoin Fact

Bitcoing Mining

carbon emission of bitcoin compared to

Bitcoin Holders

Fidelity Investments: A leading financial services provider that offers Bitcoin custody services to its institutional clients.

Coinbase: One of the largest cryptocurrency exchanges globally, Coinbase holds a portion of Bitcoin as part of its corporate treasury.

Square: A financial services company led by Jack Dorsey, the co-founder of Twitter. Square holds Bitcoin on its balance sheet and also offers Bitcoin purchasing options through its Cash App.

Galaxy Digital Holdings: A cryptocurrency-focused financial services firm founded by Mike Novogratz. They have a substantial amount of Bitcoin in their holdings.

8100 BTC

Grayscale Investments: A digital asset management firm that offers cryptocurrency investment products. They hold a significant amount of Bitcoin on behalf of their clients.

Grayscale Bitcoin Trust (GBTC) owns 636,696.620259 BTC as of August 19th, 2022. This accounts for approximately 3.032% of the total bitcoin supply of 21 million

Tesla: The electric vehicle manufacturer led by Elon Musk announced in 2021 that it had purchased $1.5 billion worth of Bitcoin for its corporate treasury.

MicroStrategy: A business intelligence company that holds a substantial amount of Bitcoin. As of June 2023, their holdings exceed 100,000 BTC.

Historical of bitcoin prices

USD to BTC

IDR to USD

USD to Gold

Market Cap

banks

samsung

tesla

apple

compared to gold

Why Bitcoin in a nutshell

Economic Efficiency

Bitcoin was designed to offer a more efficient and cost-effective alternative to traditional financial systems. By removing intermediaries and reducing transaction fees, Nakamoto envisioned a system that would enable faster and cheaper cross-border transactions, especially in areas with limited access to financial services.

Security

Nakamoto addressed the vulnerability of traditional financial systems to hacking and fraud. By utilizing cryptographic techniques and the decentralized nature of the blockchain, Bitcoin aimed to provide a secure platform for transactions, making it extremely difficult for malicious actors to manipulate or forge transactions.

Financial Empowerment

Another goal of Nakamoto was to empower individuals by giving them control over their own finances. With Bitcoin, people can have full ownership and control of their funds without relying on banks or other intermediaries. This financial sovereignty aligns with the principles of individual freedom and privacy.

Trust and Transparency

Nakamoto recognized the lack of trust in traditional financial systems and wanted to establish a system that would provide transparency. Bitcoin's blockchain technology, as outlined in the whitepaper, ensures that all transactions are recorded and can be verified by anyone, enhancing trust and transparency.

Decentralization

Nakamoto aimed to create a decentralized digital currency that would operate without the need for a central authority like a government or financial institution. This decentralized nature would enable peer-to-peer transactions, removing the reliance on intermediaries.

The genesis of Bitcoin

Bitcoin's impact has been profound, leading to the growth of the cryptocurrency market and challenging traditional financial systems.

It operates on a decentralized network, utilizes blockchain technology, and employs Proof of Work for consensus.

The whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" was published by Nakamoto in October 2008.

Bitcoin was created in 2008 by an anonymous person or group using the pseudonym Satoshi Nakamoto.

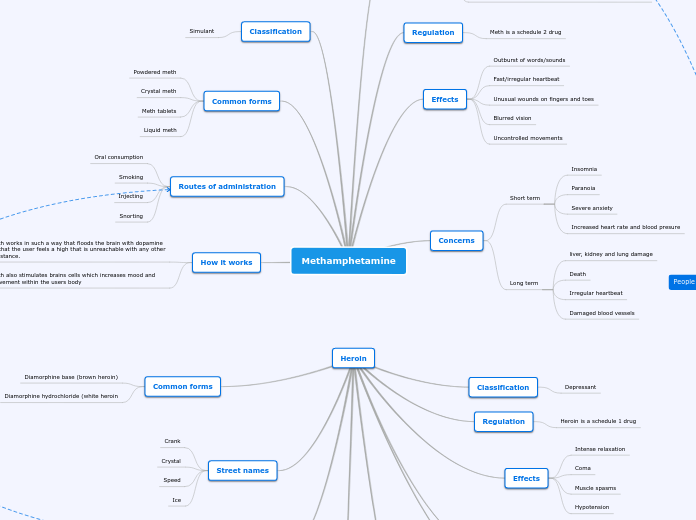

Cryptocurrency

Types of Cryptocurrencies

Other prominent cryptocurrencies and their unique features

Ripple: Cross-border payments and financial institutions

Ethereum: Smart contracts and decentralized applications (DApps)

Holders

source

Kraken: ~1.7 million ETH

Kraken, who was recently charged by the SEC for their ETH and various other staking options, is another exchange that’s a large ETH holder, coming in at 4th with over 1.7 million. Kraken is also one of the largest exchanges by trading volume, but it seems more likely this is some sort of storage as most exchanges would break up the holdings across wallets if they were “hot”.

Wrapped ETH Contract: ~3.7 million ETH

Wrapped ETH (WETH) is another popular contract. ETH itself isn’t an ERC-20 token, making it difficult to use with DeFi applications such as Uniswap, so the developers came up with a way to “wrap” Ethereum to make it an ERC-20 token. This allows it to be used in a variety of apps. It has no price difference to regular ETH, it’s just more functional. The WETH contract is the second-largest single address for ETH with over 3.7 million ETH.

Binance: ~4.4 million ETH

This is where the ETH is stored when Binance Smart Chain (BSC) users bridge their ETH to the BSC. It’s held at this Peg address until the ETH is withdrawn from the BSC back to Ethereum. Address 7, 8, and the peg address are all top 10 holders individually, while Binance 14 is 19th.

It should be no surprise that the world’s largest exchange by trading volume is also one of the largest holders of ETH. It may be surprising to realize that if you add up just 3 of the main Binance Ethereum addresses, they’re in fact the second largest holder of ETH, with over 4 million held. That’s easily the most Ethereum held by any one exchange. There are Binance 7, 8, and 14 addresses which are exchange wallets used for various exchange features, along with their Binance-Peg Tokens address.

Beacon Chain Contract: ~18 million ETH

The Beacon Chain contract is the contract that was used by Ethereum during the switch from proof of work to proof of stake, which culminated with the successful Merge phase in fall 2022. Ethereum holders were able to stake their Ethereum to this address in order to earn rewards once the switch to proof of stake was complete. Many big exchanges such as Coinbase and Binance pooled users ETH to stake to this contract, which is still being executed. It is the largest holder of ETH with over 18 million ETH in the contract.

Vitalik Buterin: ~240,000 ETH

Vitalik Buterin, one of the founders of Ethereum along with Gavin Wood (Polkadot) and Charles Hoskinson (Cardano), has many ETH addresses, but his VB 3 address is the largest. He currently holds over 240,000 ETH at this address, having sent 320,000 from his main VB wallet just under 2 years ago. This is well over $400 million USD in ETH, and certainly makes Buterin one of the largest owners of Ethereum. There are numerous Ethereum millionaires but it’s hard to compete with the creator of the network.

Bitcoin: The first cryptocurrency and its impact

Understanding Cryptocurrency

Cryptocurency Wallets

Cold wallet

Hardware wallets

Hot wallet

Hot wallets are internet-enabled and online, while cold wallets are offline and come in the form of a physical device, such as a USB stick. The primary benefit of using a hot wallet is its level of convenience: It can provide ease of use and a well-designed interface.

Desktop wallets

daedalus

exodus

electrum

Mobile wallets

Online wallets

crypto.com DeFi wallet

trust wallet

coinbase wallet

metamask

Transaction Example in crypto currency

Definition and characteristics of cryptocurrency

Not controlled by any third party itermediary such as banks

Provide faster mode of payment

Consensus Mechanism

Perform secure transaction through cryptography

Act as a digital asset that can be used as a medium of exchange

The abandoned gold standard in 1971

The impact of Nixon Shock

Wealth Inequality

Limited access to financial opportunities for marginalized communities

Widening wealth gap between the rich and the poor

Fiat currency policies can benefit certain sectors or individuals disproportionately

Government Manipulation

Lack of transparency and accountability

Politically motivated monetary policies

Central banks influence interest rates and money supply

Economic Instability

Unpredictable economic cycles

Asset bubbles and market volatility

Financial crises and recessions

Inflation

Loss of purchasing power over time

Increased money supply without a corresponding increase in value

Money Supply

Monetary Policy Flexibility

Reasons for Nixon's decision

international monetary system

economic independence

speculative attacks (geopolitics)

trade imbalance

economic stability

What is the gold standard?

The value of the currency was tied to the value of gold, providing stability and confidence in the monetary system.

Under this system, individuals, banks, and foreign governments could exchange their currency for a fixed amount of gold.

The Gold Standard was a monetary system where a country's currency was directly backed by gold.

Evolution of money

The gold standard and Fiat currency

Representative Money

Commodity Money

Barter System

Self Introduction

a-bit personal info

company / profession

background overview