по daniel kashani 3 лет назад

134

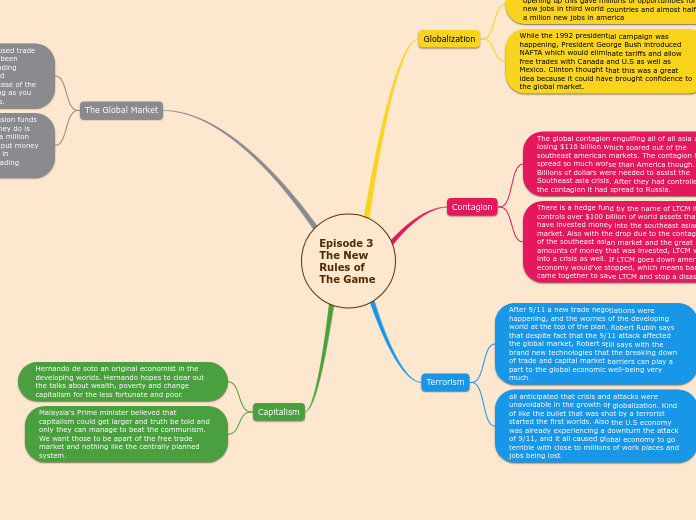

Episode 3 The New Rules of The Game

The episode delves into the intricate dynamics of global finance, highlighting a significant event involving a hedge fund named LTCM. LTCM, with its substantial investments in Southeast Asia, faced a monumental crisis when the Asian market experienced a severe downturn, threatening the broader American economy.