по nurul farah khairul azman 13 лет назад

2250

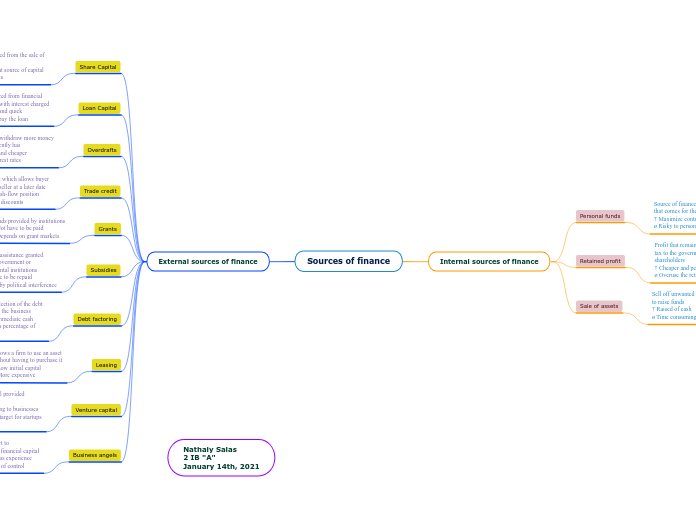

Sources of Finance

Businesses have various options for financing their operations, which can be broadly classified into internal and external sources. Internal sources include the owner's personal savings and reinvested profits, which help maintain full control but may be limited in scale.