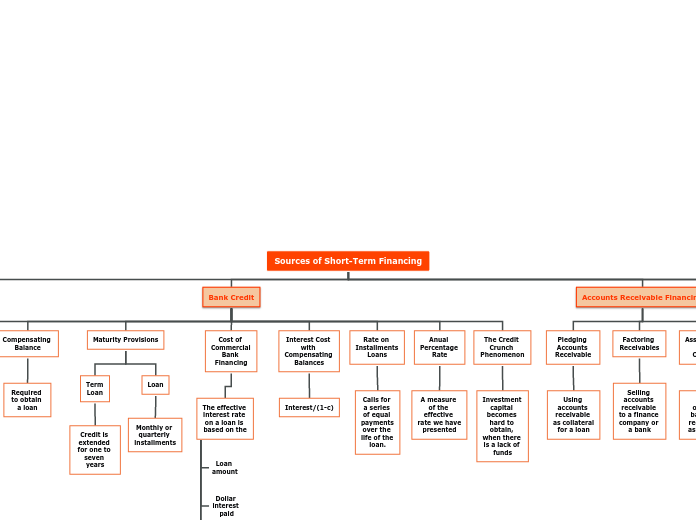

Sources of Short-Term Financing

Hedging

Engage in a transaction that reduces a prior risk exposure

Nature of Lender Control

Warehousing

Goods are stored by an independent warehousing company

Trust Receipts

Acknowledges that the borrower holds the inventory and proceeds from sales in trust for the lender

Accounts Receivable Financing

Asset-Backed Public Offerings

Public offerings backed by receivables as collateral

Factoring Receivables

Selling accounts receivable to a finance company or a bank

Pledging Accounts Receivable

Using accounts receivable as collateral for a loan

Bank Credit

The Credit Crunch Phenomenon

Investment capital becomes hard to obtain, when there is a lack of funds

Anual Percentage Rate

A measure of the effective rate we have presented

Rate on Installments Loans

Calls for a series of equal payments over the life of the loan.

Interest Cost with Compensating Balances

Interest/(1-c)

Cost of Commercial Bank Financing

The effective interest rate on a loan is based on the

Method of repayment

Length of the loan

Dollar interest paid

Loan amount

Maturity Provisions

Loan

Monthly or quarterly installments

Term Loan

Credit is extended for one to seven years

Compensating Balance

Required to obtain a loan

Prime Rate and LIBOR

Rate a bank charges most creditworthy customers

London Interbank Offered Rate (LIBOR)

Trade Credit

Net Credit Position

Determined by the relationship between accounts payable and receivable

Cash Discount Policy

Incentive that a seller offers to a buyer in return for paying a bill before the due date

Payment Period

30 to 60 days