av Natalia Aguilar för 3 årar sedan

288

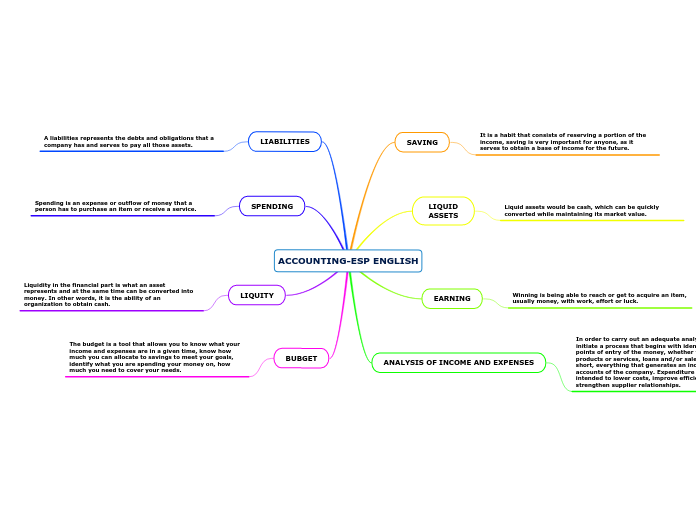

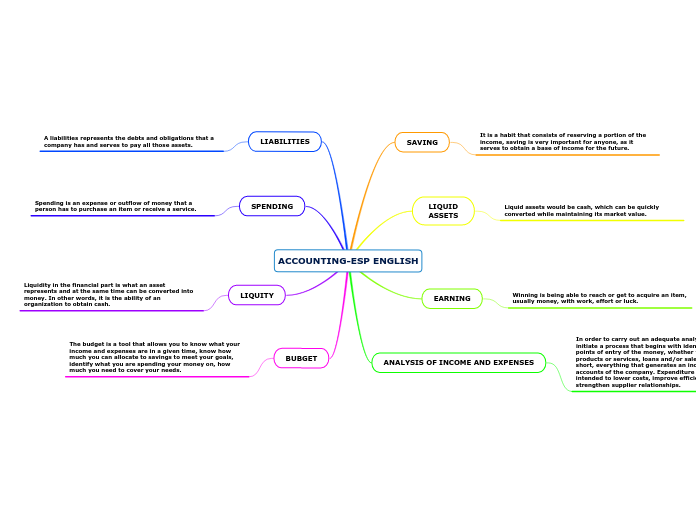

ACCOUNTING-ESP ENGLISH

Achieving financial stability involves understanding and managing various aspects of accounting and finance. Winning, in this context, refers to acquiring income through effort or luck.

av Natalia Aguilar för 3 årar sedan

288

Mer av detta