av Владислав C för 5 årar sedan

273

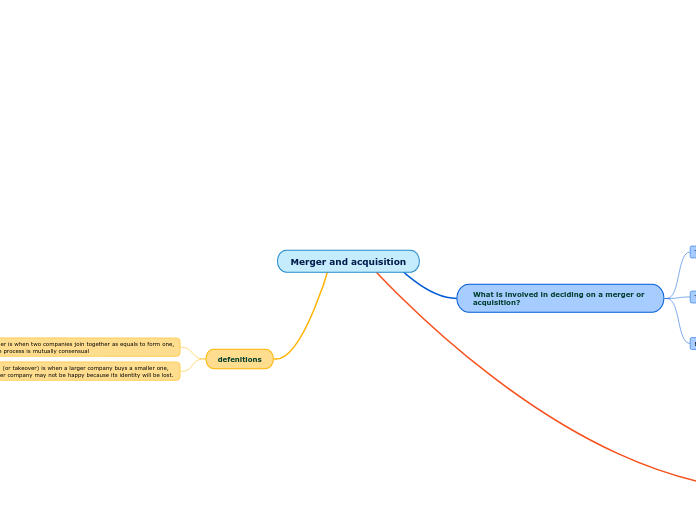

Merger and acquisition

Deciding on a merger or acquisition involves thorough analysis and strategic consideration. Initially, two key financial figures are determined: the value of the company to its current owners and its worth to the acquiring company.