av Avalos Ramos Ashley för 6 årar sedan

215

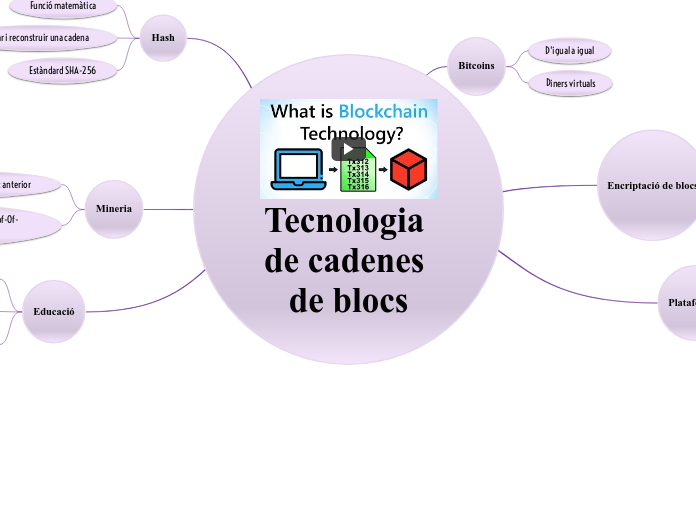

Sample Mind Map

In the realm of tax obligations, a substitute may be designated to fulfill the primary tax duty on behalf of the original taxpayer. This individual or entity must possess a legal or factual relationship with the taxpayer that enables them to bear the economic burden and potentially seek reimbursement for the tax paid.