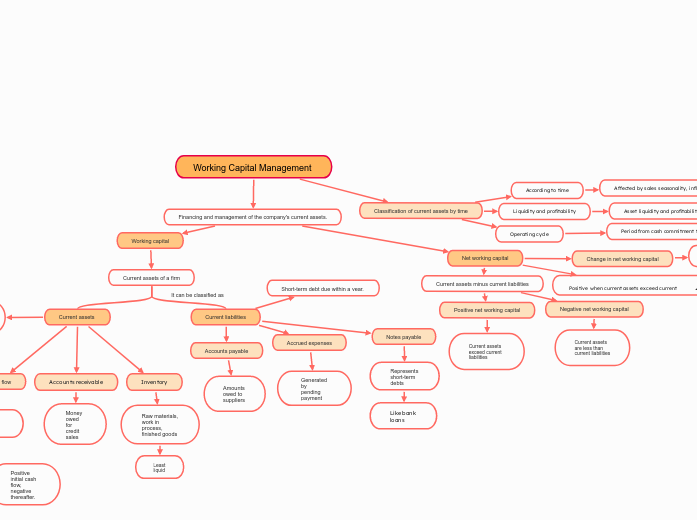

It can be classified as

Working Capital Management

Classification of current assets by time

Operating cycle

Period from cash commitment to accounts receivable recovery

Liquidity and profitability

Asset liquidity and profitability (net sales - total cost)

According to time

Affected by sales seasonality, influencing cash and inventory levels

Financing and management of the company's current assets.

Net working capital

Change in net working capital

Difference between changes in current assets and liabilities

Positive when current assets exceed current liabilities

Current assets minus current liabilities

Positive net working capital

Current assets exceed current liabilities

Negative net working capital

Current assets are less than current liabilities

Working capital

Current assets of a firm

Current liabilities

Short-term debt due within a year.

Notes payable

Represents short-term debts

Like bank loans

Accrued expenses

Generated by pending payment

Accounts payable

Amounts owed to suppliers

Current assets

Cash and assets convertible to cash within a year.

Inventory

Raw materials, work in process, finished goods

Least liquid

Accounts receivable

Money owed for credit sales

Cash flow

Direct indicator of company cash flow

Negative initial cash flow, positive thereafter.

Positive initial cash flow, negative thereafter.