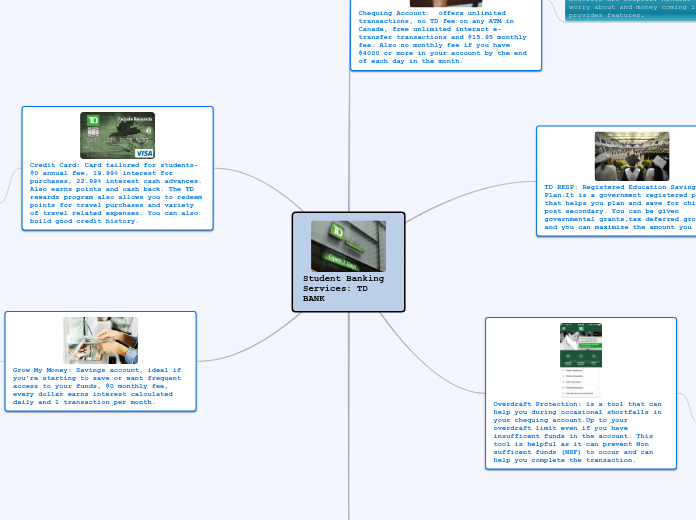

Business; Student Banking Services

By: Jasmine Thind and Teresa Pham-Le

TD International Student Package

You may qualify for the International Students Package if

You are the age of majority in your Province or Territory of Residence

You have never opened or held a TD Chequing Account

You provide proof of your status through your Temporary Permit, Permanent Resident Card or Student Permit

You are a student registered full-time and attending a post-secondary program at a registered University or Community College

You are a Temporary or Permanent Resident of Canada for 2 years or less

From everyday banking, money transfers to flexible financing and credit cards, see how we’ve got you covered while you settle in.

Get a Student Line of Credit

Get a credit card, no credit history required

Get a savings account with a bonus rate

Get a TD Student Chequing Account

Student Line of Credit

Help cover the costs of your education with a line of credit

Convenient access to your credit through your TD Access Card

Competitive variable interest rates and your get the same interest rate after you`re done school

Minimum payment during school and up to 24 months after graduation and residency or post-graduate training

Monthly payments don’t start until 24 months after school, your line of credit will be converted to a student loan with comfortable fixed payments

Only apply once for a credit limit that you can continue to access (use and reuse)

Credit Cards

Build credit and earn rewards by using a credit card for purchases

Allow students to get used to having a credit card

Different credit cards vary. Some offer no annual fee while others do. Interest on purchases and cash advances and the authorized user fee also vary.

Bibliography:

-https://www.td.com/ca/en/personal-banking/solutions/student-banking/

TD Professional and Graduate Student Banking Packages

A package including TD Student Line of Credit, All-Inclusive Banking Plan chequing account, and a Premium TD Credit Card, designed to make financing easy for the graduating student.

A student would need this package because it gives them access to their credits, loans them a large amount of money, there is a minimum payment period, no set-up fee, and a 20 year pay down after completing the program.

All-Inclusive Banking Plan chequing account includes

Unlimited transactions

Minimum monthly balance for monthly fee rebate $5,000

$29.95 monthly fee

Line of credit for

Graduate students ‑ $80,000

Naturopathic students ‑ $80,000

Chiropractic students ‑ $100,000

Law, optometry, pharmacy, MBA students – $125,000

Medical & dental students ‑ $300,000

Veterinary students ‑ $140,000

Savings account

An account designed to store and save the student's money, or for frequent use.

A student would benefit from this account because they earn interest for every dollar in the account.

Allows a total of 1 transaction per month. If user goes over 1 transaction, they will charge $3.00.

Chequing account

An account designed to give students quick access to their money for daily banking needs.

A student would need this service because it does not charge monthly fees, and it gives them daily access to their money.

Allows a total of 25 transactions per month.

If user goes over 25 transactions, they will charge $1.25.

No minimum monthly balance required

No monthly fees