作者:fernanda rodriguez 4 年以前

559

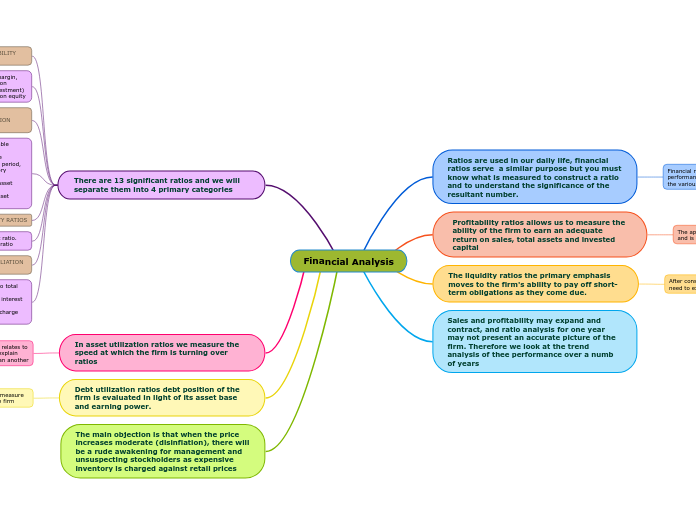

Financial Analysis

Financial ratios provide a comprehensive way to evaluate a firm's overall performance and operational efficiency. Debt utilization ratios help determine how well a company manages its debt relative to its asset base and earning power.