作者:Mohamed Shuman 13 年以前

357

Sources of Finance

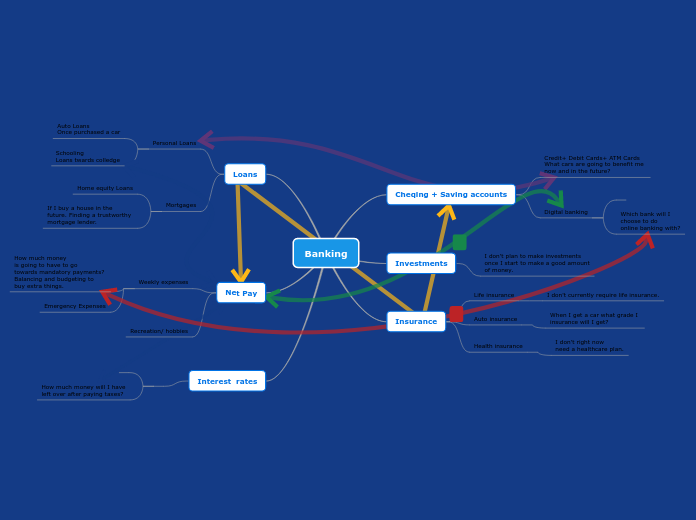

When looking for ways to fund a business, owners have several internal and external options. Internally, they can use personal savings or reinvest profits back into the business, which gives them control and avoids interest payments.

開啟

Sources of Finance External Government grants and prince's trust loans and grants Business run by people between the age 18 and 30 can apply for a government grant, these include students, charities. A grant is money given to an entrepreneur that is not needed to be paid back Friends or family Invested in the business in exchange for share or paid back as a loan Lower interest rate than a bank or an other lender Share-issues Good way for many companies to raise fianance Able to sell shares on the stock exchange Factoring Sell its debts to another company and receives some of the money immediately Takes a percentages cut for the service Venture capitalists People who invest new and up coming risky ventures in return for a share of the ownership Leasing Business does not own the goods and it's often used by companies for vehicle A business can use of resources and pay to use them every month Hire purchase The goods are not owned by the business Hire purchase means that resources can be used by the business while they're being paid for Building societies Some scurity will be needed to be provided for example, assets Offer loans, business accounts commercial mortages and overdraft facilities Banks Subtopic In order to get a loan from the bank you will need to provide some security for instance, assets such as a house Internal Owners savings Interest does not need to be paid to someone else Is in the control of the owner Capital from profits Once the business if operating it is able to invest the money that it makes as profits back in the business