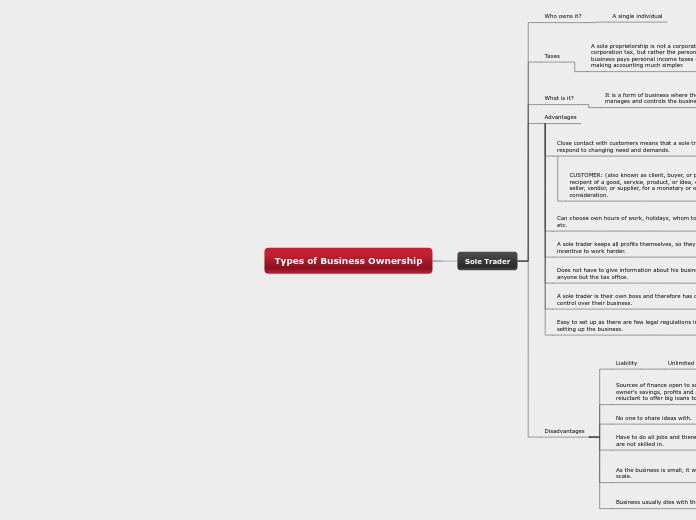

Types of Business Ownership

Sole Trader

Disadvantages

Business usually dies with the owner.

As the business is small, it will not benefit from economies of scale.

ECONOMIES OF SCALE: are the cost advantages that enterprises obtain due to size, with the cost per unit of output generally decreasing with increasing scale as fixed costs are spread over more units of output.

Have to do all jobs and therefore will do many jobs that they are not skilled in.

No one to share ideas with.

Sources of finance open to sole trader are limited to the owner's savings, profits and small bank loans. Banks are reluctant to offer big loans to sole traders.

Liability

Unlimited liability

UNLIMITED LIABILITY: means that all debts of the business, are debts of the owner.

Advantages

Easy to set up as there are few legal regulations involved in setting up the business.

A sole trader is their own boss and therefore has complete control over their business.

Does not have to give information about his business to anyone but the tax office.

A sole trader keeps all profits themselves, so they have an incentive to work harder.

Can choose own hours of work, holidays, whom to employ, etc.

Close contact with customers means that a sole trader can respond to changing need and demands.

CUSTOMER: (also known as client, buyer, or purchaser) is the recipent of a good, service, product, or idea, obtained from a seller, vendor, or supplier, for a monetary or other valuable consideration.

What is it?

It is a form of business where there is only one owner who manages and controls the business.

Taxes

A sole proprietorship is not a corporation; it does not pay corporation tax, but rather the person who organized the business pays personal income taxes on the profits made, making accounting much simpler.

CORPORATION TAX: is a tax paid by limited companies on their profits

INCOME TAX:a tax on money people earn (income), which is paid to the national government.

Who owns it?

A single individual