af Alina Micu 4 år siden

762

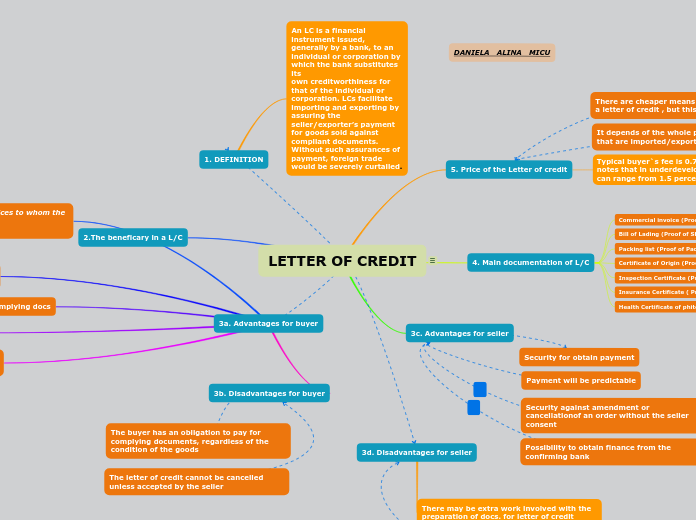

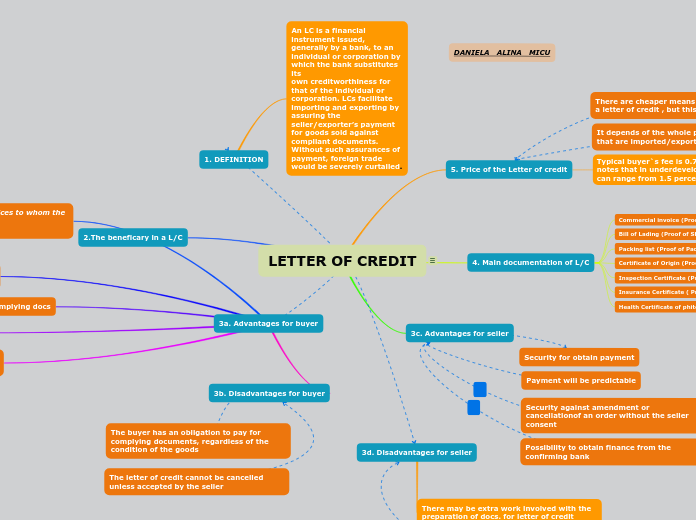

LETTER OF CREDIT

A letter of credit (LC) is a financial instrument typically issued by a bank to facilitate international trade by ensuring that payment will be made once specific documents are presented.

af Alina Micu 4 år siden

762

Mere som dette

Letter of credit