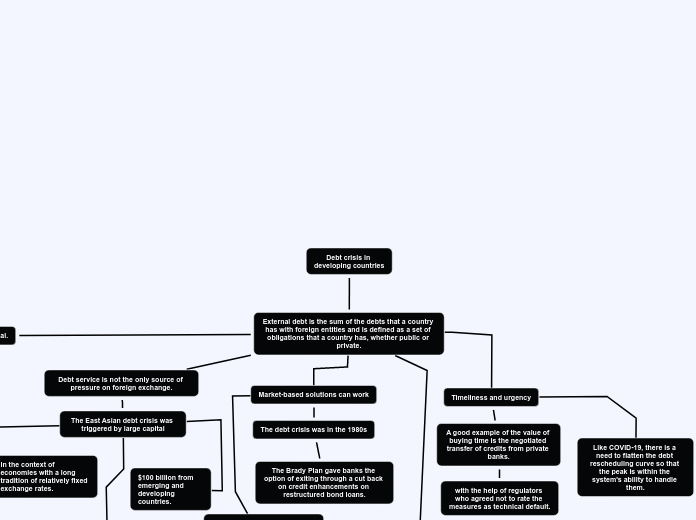

Debt crisis in

developing countries

External debt is the sum of the debts that a country has with foreign entities and is defined as a set of obligations that a country has, whether public or private.

Debtor country reforms are crucial.

there is a need for more creditors and for development measures to be taken to address the pandecimal disease

The key takeaway from this brief review is that there is an imminent global debt-servicing problem of large but unknown dimensions.

that requires a globally coordinated solution to forestall damaging long-term economic consequences.

Subsequent debt restructurings, such as the Idea for Highly Indebted Poor Nations.

they emphasized to find relief and tranquility in debts

Debt service is not the only source of pressure on foreign exchange.

The East Asian debt crisis was triggered by large capital

the most vulnerable countries where higher initial debt levels

$100 billion from emerging and developing countries.

in the context of economies with a long tradition of relatively fixed exchange rates.

Market-based solutions can work

the UN Security Council, grants the debt protection mechanism to prevent commercial creditors from suing the government of Iraq to collect the sovereign debt

Small Debtors is a debt-for-debt swap with a haircut for larger creditors.

Iraq was able to pay off its commercial debts through a combination of debt buybacks.

The debt crisis was in the 1980s

The Brady Plan gave banks the option of exiting through a cut back on credit enhancements on restructured bond loans.

All creditors must participate.

political and financial reasons would be more difficult to have an effective response, today without including these two groups of creditors.

there are two groups of potential free-rider creditors that are the Paris or London clubs and official lenders from China and other non-OECD countries.

Baker's plan sought voluntary extensions of new loans by banks to heavily indebted countries, to allow them to emerge from the crisis

the first debt crises started in the mid-1980s

Timeliness and urgency

Like COVID-19, there is a need to flatten the debt rescheduling curve so that the peak is within the system's ability to handle them.

A good example of the value of buying time is the negotiated transfer of credits from private banks.

with the help of regulators who agreed not to rate the measures as technical default.