door El Marto 3 jaren geleden

209

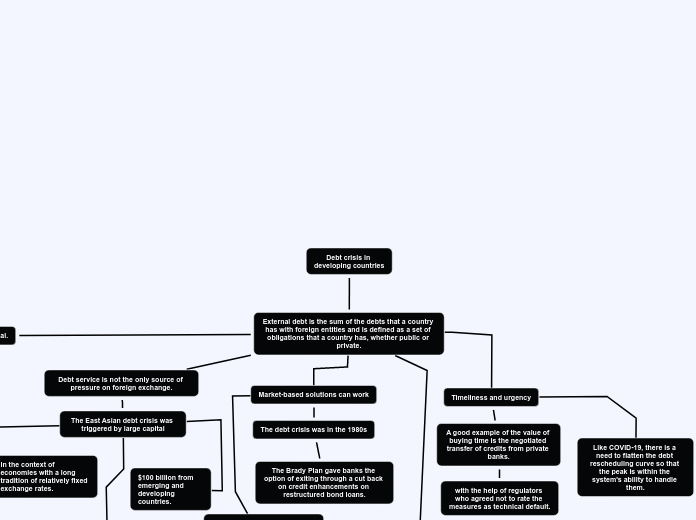

Debt crisis in developing countries

Developing countries often face significant external debt, which includes obligations to foreign entities. To address this, reforms within debtor countries are crucial. There is an urgent need for more creditors and development measures, particularly in light of global challenges like pandemics.