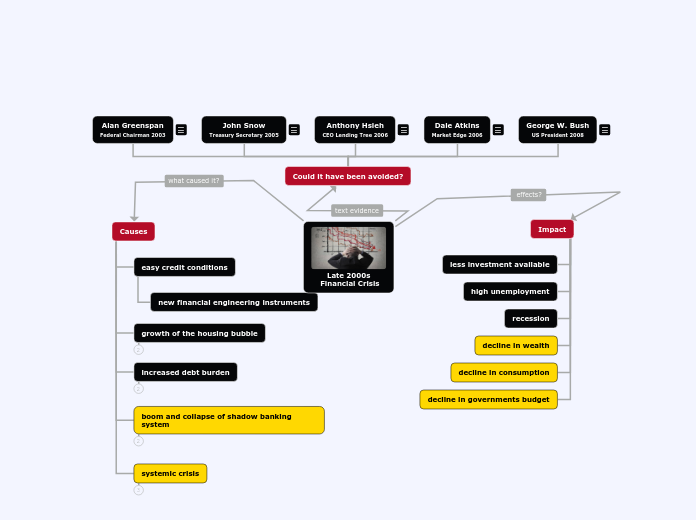

Floating topic

Late 2000s

Financial Crisis

Could it have been avoided?

George W. Bush

US President 2008

"We've got a big problem."

Dale Atkins

Market Edge 2006

"The National media is reporting a housing bubble. Don't believe it."

Anthony Hsieh

CEO Lending Tree 2006

"If you own your own home free and clear, people will often refer to you as a fool. All the money sitting there, doing nothing."

John Snow

Treasury Secretary 2005

"The idea that we're going to see a collapse in the housing market seems to me improbable".

Alan Greenspan

Federal Chairman 2003

"The notion of bubble bursting and the whole price level coming down seems to me as far as a national phenomenon, is really quite unlikely."

Impact

decline in governments budget

decline in consumption

decline in wealth

recession

high unemployment

less investment available

Causes

systemic crisis

Recession Europe (2011)

Sovereign debt crisis Europe (2010)

World Recession (2010)

boom and collapse of shadow banking system

worldwide banking crisis (October 2008)

incorrect pricing of risk

increased debt burden

Bank crisis US (March 2008)

weak and fraudulent underwriting practice

growth of the housing bubble

housing crisis US (2007)

huge increase of the subprime lending

easy credit conditions

new financial engineering instruments